Overpriced? You Tell Me…

Just about all aspects of the still young earnings season are coming in pretty nicely.

Expectations were dragged down again as analysts tried to calibrate for the hurricane impact, but so far it appears these concerns are overweight negative.

Let's take a look:

- S&P 500 consensus forward revenues and earnings rose to new record highs again last week.

- The forward profit margin forecast were steady at a record high of 11.1%, the first time since September 2015.

- That forecast is up from the 24-month low of 10.4% that was expected back in March 2016, as many tried to get beyond what was then "the worst start for markets in 80+ years.”

The Bigger Picture

2017 results are becoming more and more irrelevant as forward earnings per share is rapidly converging to the consensus earnings estimate for next year, which currently stands at $145.55 for the S&P 500.

Note also that the 2018 consensus will become increasingly irrelevant next year as forward earnings converge with the estimate for 2019, which is now at $159.09.

And as an aside based on earnings one year out, you average those two numbers together and we see the S&P's overall P/E is somewhere around 16.8 at current levels.

Is that overpriced?

You tell me.

The 10-year bond is selling at 42.7 times earnings - guaranteed to never improve once purchased.

But like Yogi Berra said: “It's tough to make predictions, especially about the future.”

Go figure

Here are some more Insights for Q3:

- There is an accelerating growth trend after accounting for the big boost in Q2 and the lapping of previous ugly quarters last year from the energy pit.

- 52 Members of the S&P 500 have reported (at the time of writing) and earnings are up 13+% YOY, while revenues have increased more than 6.8%. Not too shabby.

- Just over 76% have beaten earnings expectations, while 73% have topped revenue forecasts. Of course, all these will change as the season continues.

Meanwhile...

Don't be surprised to see some lacklustre responses in the market action while we get through the earnings parade.

There was a solid push upward leading into the season so, in the near-term at least, chop may be the name of the game.

A run to the finish for the Holiday Season should be very solid.

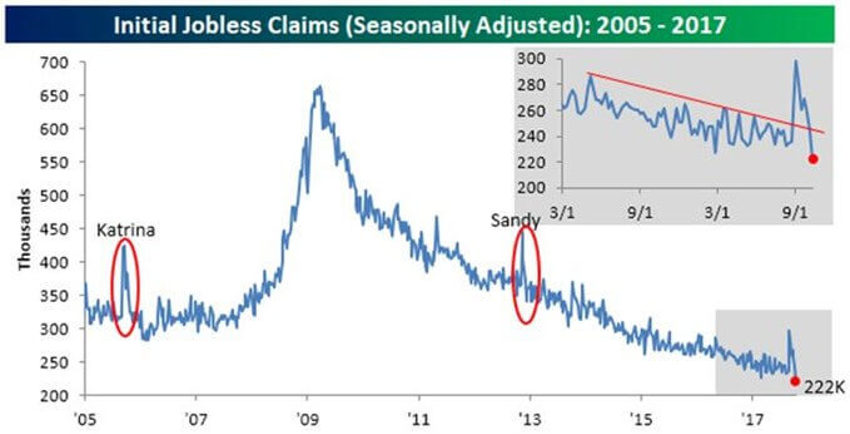

Now check out the latest US jobless claims:

Folks, that’s a new low!

Just weeks after two major hurricanes, the US economy is humming along so well that we have completely erased the blip upward during the storms - and then some.

Note the differences between now, and Katrina and Sandy from previous storm seasons.

With a record high number of jobs still open for the taking, and a solid trajectory in consumer earnings, where the heck is the problem?

Have we reached a point in investor psyche where the crowd literally is unable to see the good, or worse, must have some kind of problem to fret over?

More Support

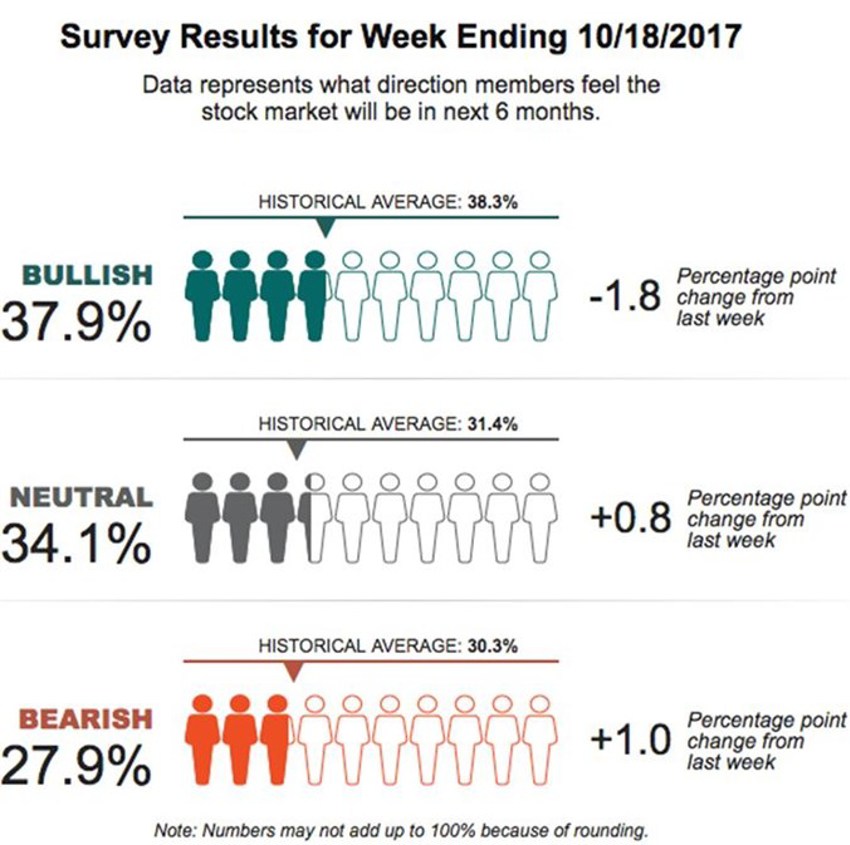

Some more good news: Little has changed on the sentiment end of the puzzle.

Just over a third of the audience feels good about the market. And the rest, well, not so much.

Sure, this figure is higher than two weeks ago by 3%, but we are at record highs in the markets and two-thirds still see "economic uncertainty" and feel better on the side lines:

Make no mistake about it – given a week or two of red ink and those bullish numbers will be in the 20's before you can say "Black Swan."

Also....

Keeping up with the Joneses and the other US Federal Reserve regional surveys, manufacturing activity in the Philadelphia region continues to chug along - manufacturing activity came in "higher than expected" for October.

Surprise, right?

It rose to 27.9 compared to forecasts for a reading of 20!

Imagine missing the projection on one thing you are supposed to know by just 40% or so!

By the way, lost in the shuffle was that October’s reading represents the 15th straight month that manufacturing activity showed growth - the strongest monthly reading since May.

Remember, it's the long-term current we need to invest in, not the short-term waves that make all the noise crashing against the beach.