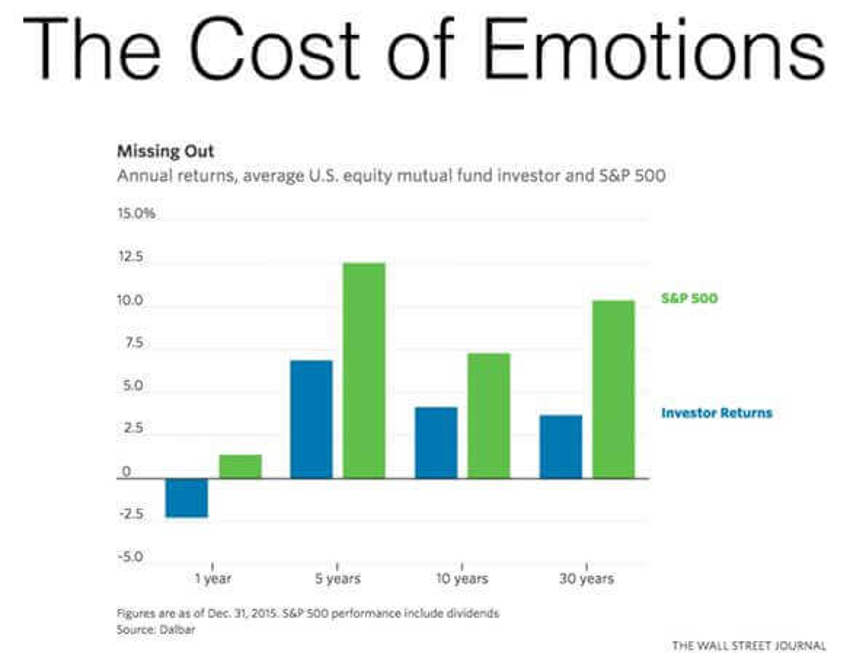

Not-So-Sweet Emotion

Just remember this: If investing, building wealth over a lifetime or preparing for and/or managing a pleasant, fun-filled, relaxing retirement income stream was meant to be easy, it would have been called "fun", not "investing."

Don’t confuse the two.

If you do then things start to look like this:

Speaking of Confusing

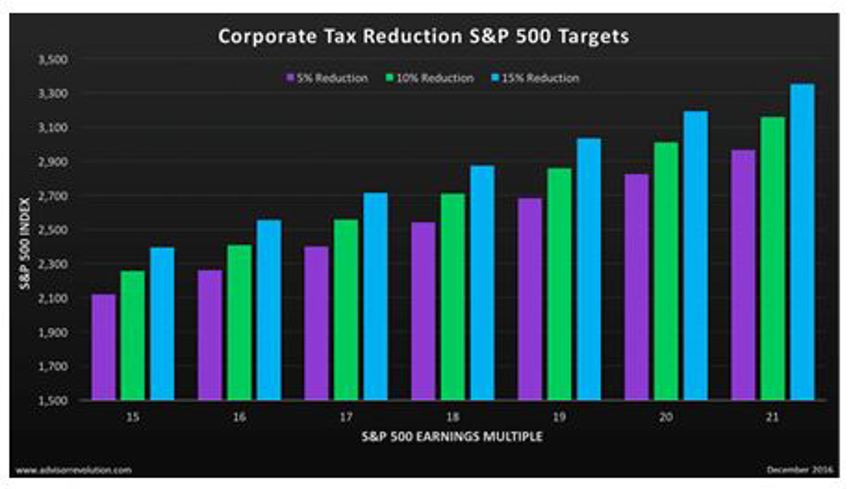

While far too many investors remain locked in a trance over what is happening in the Washington DC political swamp, many forget that history shows markets perform best when DC does nothing.

It's an old tale, but I'd like to remind you of the chart we prepped at the end of 2016, as we were looking forward to the benefits to earnings of less regulation, few taxes and a better "business productive" environment.

The surprises remain to the upside as uncomfortable as that has become:

Secular Stagnation?

We’ve heard that term for years now.

It’s the assumption that slow growth means we’re stuck in some nightmarish world that will never grow again.

But all that type of thinking does is throw you off track.

The truth is that slow, steady growth makes it very hard to get a recession. Yet the types of actions most people take when they are afraid (hint- pile cash up in the bank) are what drives the "secular stagnation" that we’re witnessing.

Investors have taken $10 Trillion out of circulation and put it into deposit accounts.

And it’s doing nothing good or productive there; it’s building no new ideas, hiring no new people, and earning little if any interest.

My suggestion?

Take the healthier view of this "stagnation" fear – it’s more like secular stability.

Two Quick Questions

Question: In the last 50 years, how many years has our GDP output gone down from the year before?

Answer: Two

Question: How many years did it take to get back to new record high GDP outputs after those "setbacks"?

Answer: One (in both cases).

Patient investors understand that you have to take the good with the bad to get up the mountain.

I’ll leave you with one thought about the last 30 years plus: