Mayday! Mayday! Everything is Fine...

It’s tough to offer up helpful data during the summer haze when not much is new.

The chop and concerns continue to keep the investor herd on its back hoofs - solidly in cash and throwing their waves of capital into bonds.

And the new market highs slowly keep coming.

Last Friday’s “Market Mayday” call arrived in the form of Amazon’s purchase of Whole Foods.

A shocker, indeed.

Funny, though, how all the expert talking heads immediately arrived like a car dashboard littered with lolling heads, bobbing up and down at the news and telling us what the future would now bring to any listed retail stock, all within moments of the announcement.

How exactly do they know what’s going to happen next? They sure missed spotting the Amazon purchase - not a single one foretold that little event.

Hey, if you claim to know how the future tea leaves lie…

I can tell you what didn’t help all of this - a low volume Friday in the heat of summer with more people traveling to the beach than were there to fight back against the internal churn that followed.

As such, A few companies got shellacked, and many others felt some stress without any really good reason for it.

That’s what happens as part of the now normal knee-jerk, algorithm-driven, HFT minefield we must endure for the remainder of summer.

Speaking of Investing…

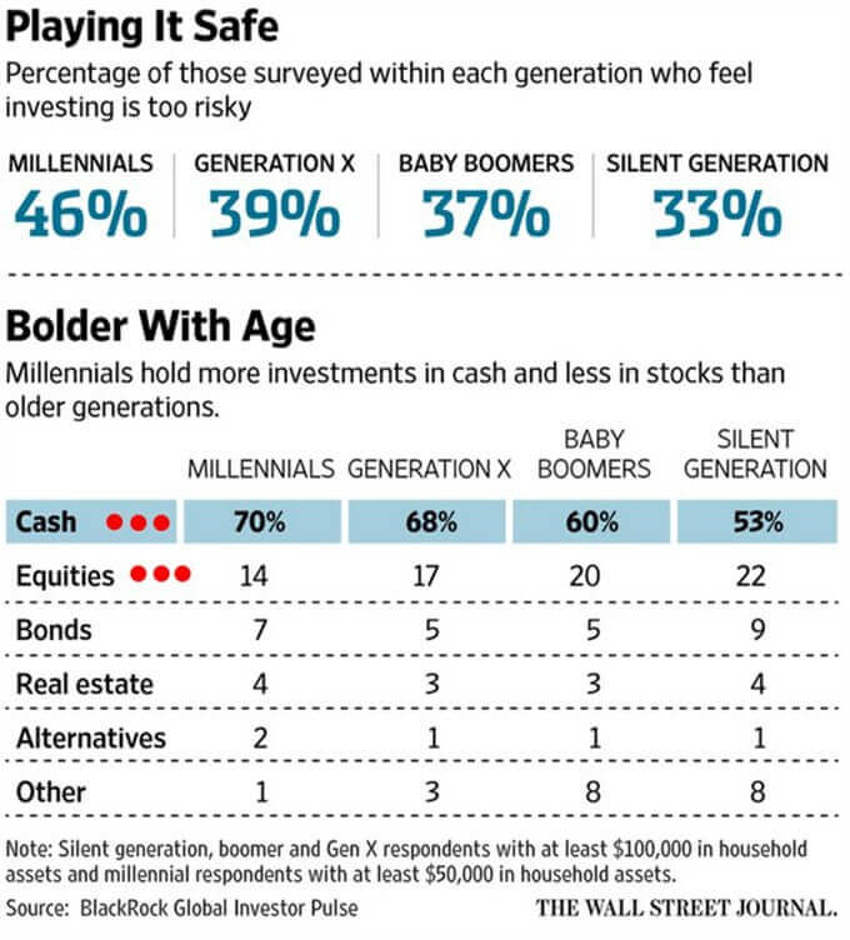

See the chart below.

It shows the result of a survey covering current feelings about investing - posted in the WSJ and done in conjunction with Blackrock.

No wonder the mood remains punk as it relates to the bright opportunities ahead.

The pain of the past - some recent, some not so recent - will continue to drive the "cost" of the 2008-2009 recession even higher for too many investors:

My Hunch?

Here’s two cents to suggest that something else could be afoot.

Think about this: If you were a house builder who got crushed, foreclosed on or eliminated during the collapse of 2008-2009, how would you operate going forward?

Probably with great caution.

Instead of loading the market with inventory you would welcome a surge in buying with a slow dose of inventory.

In other words, like airlines controlling seats available on certain routes, we can be somewhat confident that builders will take their time delivering new inventory into a very tight marketplace.

And by the way, the strong demand-side in the US market for this housing equation needs to be measured in decades, not weeks or months.

Meanwhile...

The small business world is pumped up about business:

- The PMI's are great.

- Costs pressures are falling, and

- Exports are setting records - along with industrial output.

What's not to like?

The US Federal Reserve

Obviously, there was more chatter about how risky it is for the US Fed to be raising interest rates.

Yet people still talk about QE, and that ended nearly three years ago now.

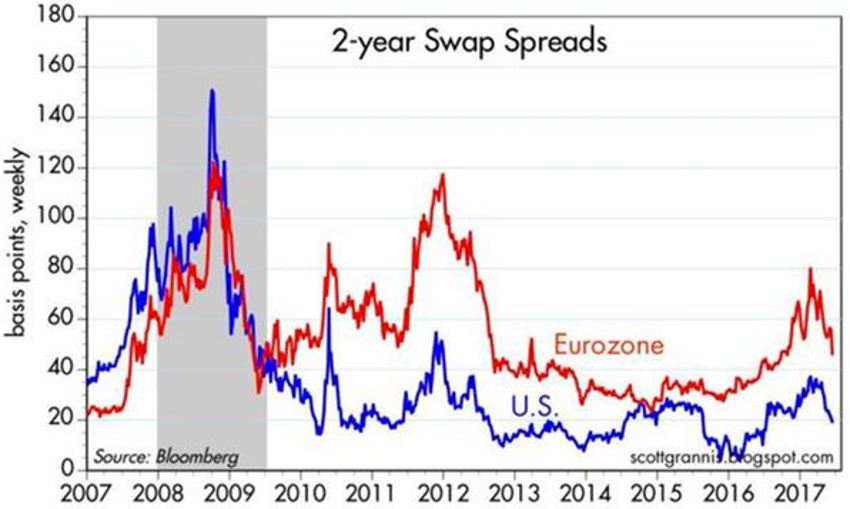

See the chart below to help you with this argument from Scott Grannis at the Calafia Beach Pundit:

The chart above shows a helpful spot to look at if you are concerned about liquidity.

Remember that the consumer part of the market set records in the last two government auctions - so the demand for bonds is very dynamic.

As the chart above shows, 2-year swap spreads are at very reasonable levels.

This tells us that liquidity is abundant and systemic risk is low.

Oddly, while every is worried about the miniscule 0.25% notch up by the Fed last week, if anything the recent decline in swap spreads both here and abroad is a harbinger of better things to come.

If the Federal Reserve were really causing any sort of pressure or "squeeze on the banking system" and/or the economy, these spreads would be a lot higher and rising, not falling and nearing record lows.

Note to Self

Fear remains high.

Market tops generally do not appear when everyone is already afraid.

The market volatility that we’re seeing is excellent news. Just what the doctor ordered.

Summer is almost always boring. It tends to uncover short-term reactions we can then take advantage of as investors...just like last week.

So, the theme for the next 10 weeks or so is to focus on being patient and disciplined.

And pray for a summer swoon.