Market Storms in a Teacup

Funny how the calendar can shape your perspective on the financial markets.

Right now we’re in that odd spot of the year between the summer haze wearing off and the fears about September and October crashing over us.

We get lost in YOY (year over year) and MOM (month over month) comparisons, CAGR (compound annual growth rate) assumptions and the same tapes playing again each month; almost robotic in nature.

Wasted Energy

There has been heightened chatter about interest rate fears of late, as every meeting with a prospect for the US Federal Reserve Chair role is now over-analyzed and used to frighten the crowd.

Sorry, folks, interest rates are fine and the US Fed is also fine.

In fact, the economy is strolling along at a very steady pace with more than enough jobs available for those who want to work.

Inflation is tamed, oil is broken, tech is now slowly turning its attack on medical costs and education, and the deflationary effect of Generation Y continues to seep into the system.

It’s a very slow process that we can’t escape. It’s also a good thing.

On top of that, earnings continue to remain impressive and in record territory, and the fears about the impact of storms may indeed have been overblown as we’re rolling through a very light warnings season.

Q3 reports will begin in earnest in another week or so.

And Speaking of Storms…

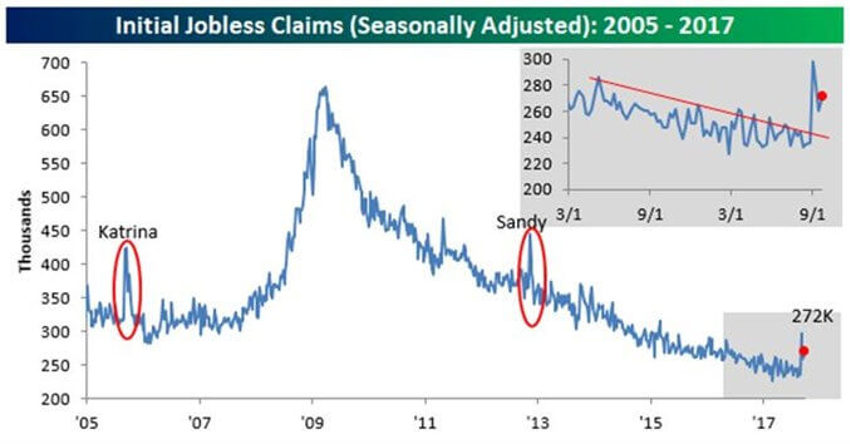

Harvey and Irma were set to demolish the great run we had on jobless claims, as many records there have been set in recent quarters, but this never came to pass:

According to the latest Department of Labor (DoL) release, this is how Harvey, Irma and Maria have impacted claims.

Now, it’s likely we’ll see several more weeks pass before we get back to the lows, but note the differences in these three latest storms as opposed to Sandy and Katrina in earlier years.

When you consider the impact they had on claims (highlighted above) the fact that claims have not gotten above 300K this storm season is very impressive.

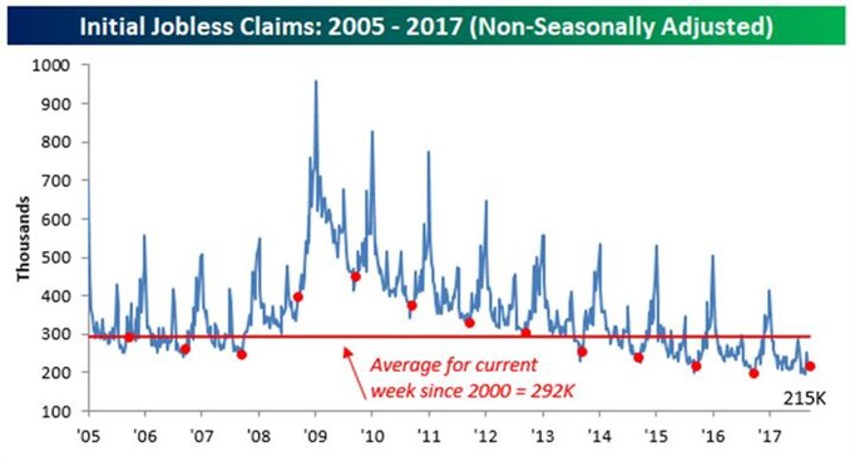

Above is another perspective. It shows no seasonal adjustments and the strength there has also been solid, despite the storms (see above).

The latest print increased slightly to 215K from 213K, but is a huge 77K below the average for the current week of the year going back 2000.

Looking further back to 1967, claims have only been lower in the current week of the year six other times and only once since 1973!

And while the impact on individuals, property and livelihoods has in many case been completely devastating, from the overall claims and market impact perspective, these are little more than storms in a teacup.