Market Make-Believe on All Hallows’ Eve

Nonsensical: Having no meaning; making no sense; ridiculously impractical or ill-advised.

Synonyms: Foolish, insane, stupid, idiotic, illogical, irrational, senseless, absurd, silly, inane, hare-brained, ridiculous, ludicrous, preposterous, meaningless, senseless, illogical.

Here on All Hallows’ Eve it’s clear by price action (and reactions), sentiment and by capital flows that investors on average are already completely and deeply spooked.

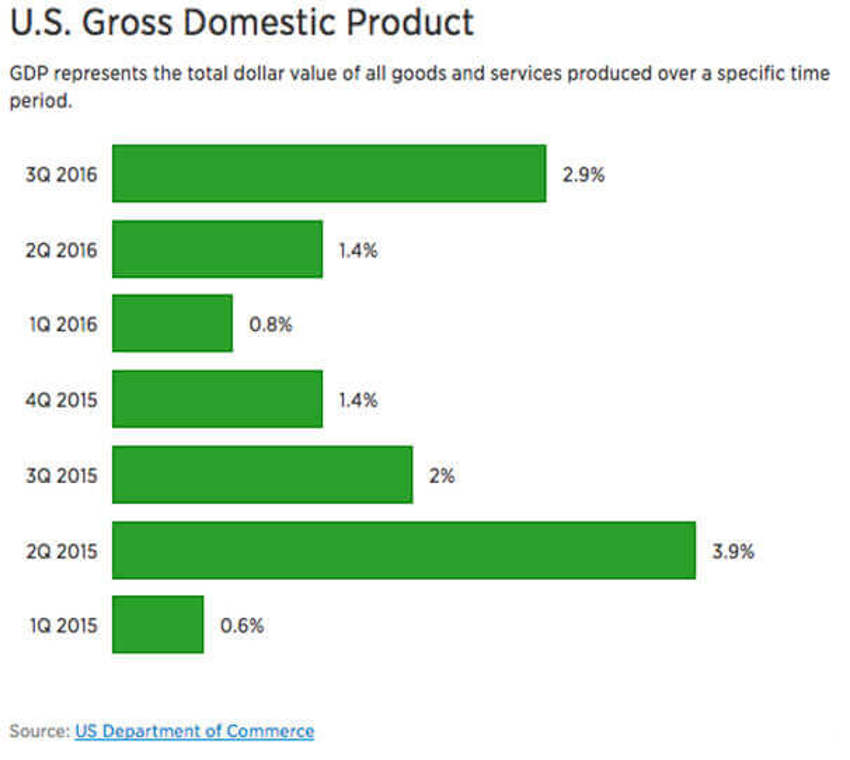

Even as US GDP comes in hot at +2.9%, which is better than expected, it’s already being downplayed for an alleged "myriad of lurking economic problems."

So I’m becoming more and more convinced that something has dynamically shifted in the masses ability to understand opportunity (and reality).

It seems the investor herd has become so addicted to the need to be afraid that it has begun to succumb to the enticements of any financial mirage offering some semblance of security.

And anything that might be reported as a good is twisted into an excuse for more bad news.

Worse still, anything bad that’s going on is aggressively weaved into a mind-altering, drastic setback; one sure to last for ages and to only ever end in global bankruptcy. Sell the furniture now, folks, our currency will soon turn from trading dollars to broken biscuits.

Excuse me if I sound frustrated. I am.

What really grinds me is the media’s efforts to beat each other “the scare.” The damage it’s doing is what’s truly scary, and yet that perspective is going wholly unnoticed.

Some Stats: (halfway through the season)

- EPS: up 2.6% year-on-year (it was supposed to be down)

- Revenues: up 2.7% year-on-year (it was supposed to be down)

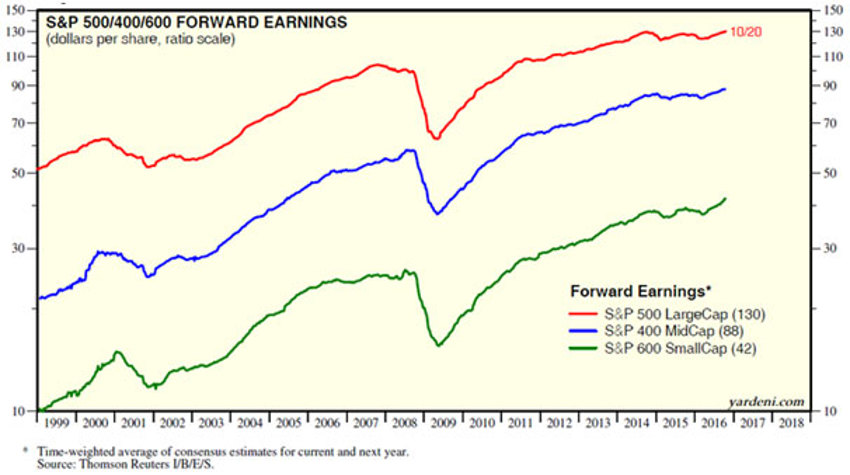

- Forward Earnings: at new record highs (see below)

- GDP: up 2.9% (see below)

Records being set in:

- Cash flows

- Cash balances (corporate and personal)

- GDP output (the US has never done more - on track for $19 Trillion in another quarter)

And Yet?

Despite all that the dark under-belly of market fear has seen mutual fund investors flood stock-pickers with redemption orders during the latest week, cashing out the most money in five years, as the Investment Company Institute data last week.

Investors yanked $16.9 billion from stock mutual funds in the seven days through October 19th. This is an important marker: it's more money being withdrawn than in any other week since August 2011!

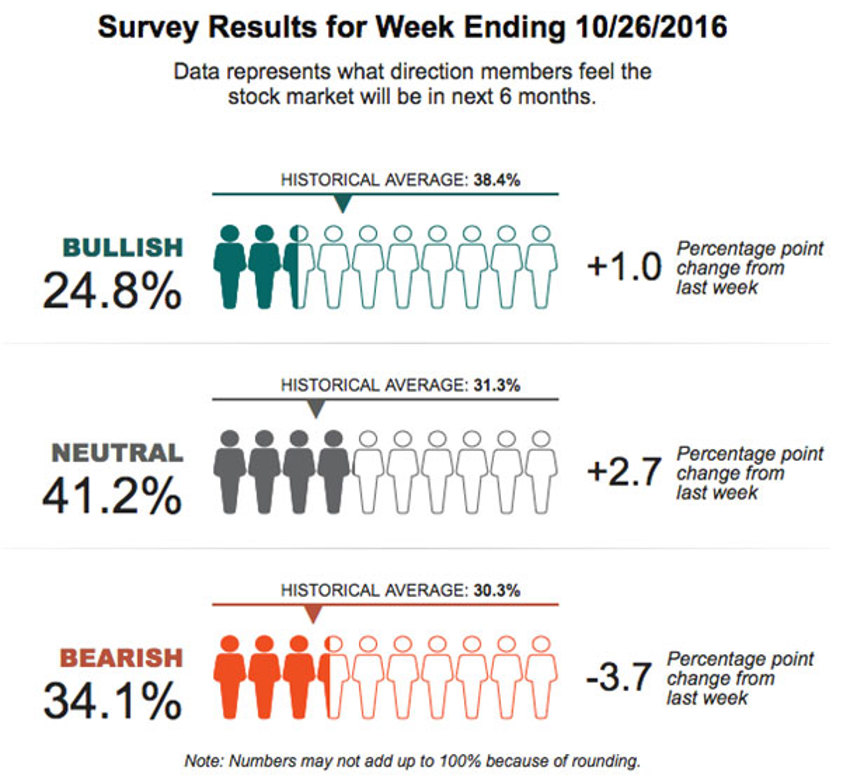

The latest AAII (investor sentiment) data is in:

- 10 weeks straight of sub-30 readings on bullish sentiment

- 51 weeks straight of sub-40 (long-term average) readings on bullish sentiment

- 85 of the last 86 weeks of sub-40 readings (all records)

I repeat: it has been a struggle to remain focused on the long-term with so much garbage reported in the press. Driving angst and fear is the new focus. This may explain the extraordinary number of double-digit responses I am seeing in terms of earnings moves; both good and bad.

All of this unnecessarily spooks investors. The sentiment, no matter where you look, is paralyzing for many.

And as sad as this is and as much damage that’s being done to plans through fear, this environment creates a wonderful opportunity for long-term investors.

Charts for back-up:

- First - GDP stats

- Second - new record highs in the S&P 400/500/600

- Third - record setting string of low bullish readings

Note the sentiment chart above: A full 75.2% of investors do not like the current level of the market.

This is further shown in the money flows; little to no stocks and all bonds and a ton of cash.

My question is this: What level would they like?

(And if you think the answer is a lower level, you’re missing the point.)

One More Thing

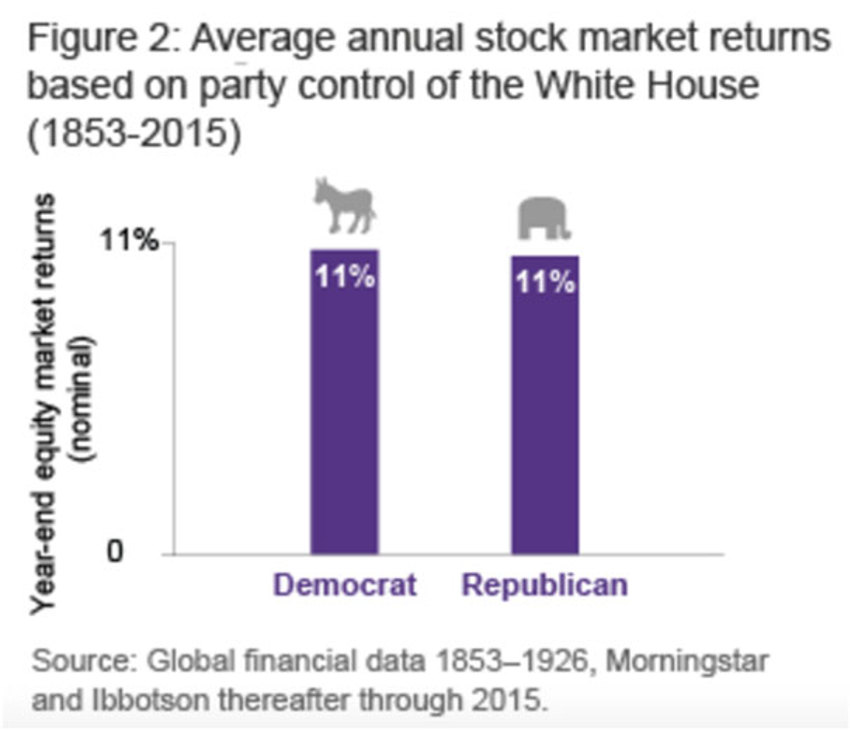

As much as it is easy for anyone to get wrapped up in the passion of politics, and then worse, having some media person tell you it has some dynamic impact on the future of the market, it's time to ignore that.

It makes no difference whatsoever.

After all the hand-wringing and broken promises made in order to get the votes they need to get into power, the markets go their own way; and usually up over the long-term.

Here is Vanguard's take:

Vanguard research going back to 1853 shows that stock market returns are virtually identical no matter which party controls the White House.

“Once you take into account volatility, the returns of the stock market under Democratic and Republican administrations are virtually indistinguishable. This is one more reason why investors should focus on more meaningful factors when it comes to their portfolios.”

In Summary

Look, as much as I would love to suggest there is a bunch of new stuff here, I can't.

It’s the same mush we’ve been traveling through for going on two years now.

Sentiment stinks, earnings have struggled but are improving and the US GDP, like it or not, keeps chugging forward.

After all of this, we stand at record highs in GDP output, even if that’s just slow and steady.

We are seeing the economy feel great stress over healthcare. Anyone can see that Obamacare is a failed effort - or will it take all of the remaining companies providing policies to the system to leave as well?

The election angst admittedly makes it all feel a bit worse. October's market action is living up to its charm - taking out the crash part - so far anyway.

In a nutshell, it’s just more of the same mess we’ve watched for 23 months now...

This takes us back to the same point: The Barbell Economy remains where we need to focus – the handing over of the economic baton from the Baby Boomers to the Millennials of Generation Y.

That doesn’t mean it all works perfectly all the time. There are ugly months, quarters and years ahead no matter the choices made.

Plant seeds for future growth in the channels that are seeing long-term, expanding demand.

Be patient and disciplined, ignore short-term garbage and focus on the long-term trend of populations.

Nonsensical: Having no meaning; making no sense; ridiculously impractical or ill-advised.

Synonyms: Foolish, insane, stupid, idiotic, illogical, irrational, senseless, absurd, silly, inane, hare-brained, ridiculous, ludicrous, preposterous, meaningless, senseless, illogical.

Here on All Hallows’ Eve it’s clear by price action (and reactions), sentiment and by capital flows that investors on average are already completely and deeply spooked.

Even as US GDP comes in hot at +2.9%, which is better than expected, it’s already being downplayed for an alleged "myriad of lurking economic problems."

So I’m becoming more and more convinced that something has dynamically shifted in the masses ability to understand opportunity (and reality).

It seems the investor herd has become so addicted to the need to be afraid that it has begun to succumb to the enticements of any financial mirage offering some semblance of security.

And anything that might be reported as a good is twisted into an excuse for more bad news.

Worse still, anything bad that’s going on is aggressively weaved into a mind-altering, drastic setback; one sure to last for ages and to only ever end in global bankruptcy. Sell the furniture now, folks, our currency will soon turn from trading dollars to broken biscuits.

Excuse me if I sound frustrated. I am.

What really grinds me is the media’s efforts to beat each other “the scare.” The damage it’s doing is what’s truly scary, and yet that perspective is going wholly unnoticed.

Some Stats: (halfway through the season)

•EPS: up 2.6% year-on-year (it was supposed to be down)

•Revenues: up 2.7% year-on-year (it was supposed to be down)

•Forward Earnings: at new record highs (see below)

•GDP: up 2.9% (see below)

Records being set in:

•Cash flows

•Cash balances (corporate and personal)

•GDP output (the US has never done more - on track for $19 Trillion in another quarter)

And Yet?

Despite all that the dark under-belly of market fear has seen mutual fund investors flood stock-pickers with redemption orders during the latest week, cashing out the most money in five years, as the Investment Company Institute data last week.

Investors yanked $16.9 billion from stock mutual funds in the seven days through October 19th. This is an important marker: it's more money being withdrawn than in any other week since August 2011!

The latest AAII (investor sentiment) data is in:

•10 weeks straight of sub-30 readings on bullish sentiment

•51 weeks straight of sub-40 (long-term average) readings on bullish sentiment

•85 of the last 86 weeks of sub-40 readings (all records)

I repeat: it has been a struggle to remain focused on the long-term with so much garbage reported in the press. Driving angst and fear is the new focus. This may explain the extraordinary number of double-digit responses I am seeing in terms of earnings moves; both good and bad.

All of this unnecessarily spooks investors. The sentiment, no matter where you look, is paralyzing for many.

And as sad as this is and as much damage that’s being done to plans through fear, this environment creates a wonderful opportunity for long-term investors.

Charts for back-up:

•First - GDP stats

•Second - new record highs in the S&P 400/500/600

•Third - record setting string of low bullish readings

Note the sentiment chart above: A full 75.2% of investors do not like the current level of the market.

This is further shown in the money flows; little to no stocks and all bonds and a ton of cash.

My question is this: What level would they like?

(And if you think the answer is a lower level, you’re missing the point.)

One More Thing

As much as it is easy for anyone to get wrapped up in the passion of politics, and then worse, having some media person tell you it has some dynamic impact on the future of the market, it's time to ignore that.

It makes no difference whatsoever.

After all the hand-wringing and broken promises made in order to get the votes they need to get into power, the markets go their own way; and usually up over the long-term.

Here is Vanguard's take:

Vanguard research going back to 1853 shows that stock market returns are virtually identical no matter which party controls the White House.

“Once you take into account volatility, the returns of the stock market under Democratic and Republican administrations are virtually indistinguishable. This is one more reason why investors should focus on more meaningful factors when it comes to their portfolios.”

In Summary

Look, as much as I would love to suggest there is a bunch of new stuff here, I can't.

It’s the same mush we’ve been traveling through for going on two years now.

Sentiment stinks, earnings have struggled but are improving and the US GDP, like it or not, keeps chugging forward.

After all of this, we stand at record highs in GDP output, even if that’s just slow and steady.

We are seeing the economy feel great stress over healthcare. Anyone can see that Obamacare is a failed effort - or will it take all of the remaining companies providing policies to the system to leave as well?

The election angst admittedly makes it all feel a bit worse. October's market action is living up to its charm - taking out the crash part - so far anyway.

In a nutshell, it’s just more of the same mess we’ve watched for 23 months now...

This takes us back to the same point: The Barbell Economy remains where we need to focus – the handing over of the economic baton from the Baby Boomers to the Millennials of Generation Y.

That doesn’t mean it all works perfectly all the time. There are ugly months, quarters and years ahead no matter the choices made.

Plant seeds for future growth in the channels that are seeing long-term, expanding demand.

Be patient and disciplined, ignore short-term garbage and focus on the long-term trend of populations.