Market Fear Has Always Been Expensive

Where to begin in this sea of confusion?

Could things actually be going well?

Have we forgotten what a wave of growth looked like?

It seems that this old-aged bull market is headed on yet another long leg up, supported by quickening economic data all around.

Must be a dream, eh?

And yet this good news is indeed getting completely and miserably overlooked because of the media Trump Train to Oblivion (TTO).

Think Again....

As each new high is etched into the landscape of market lore, more than half the crowd remains scared of the next fall off a cliff, while the other half seems angry because it hasn’t yet gone over the edge.

What a game. So, grab your popcorn, pray for a correction and settle in for quite a lengthy ride.

It’s easy to mistake what is going on as some sort of market momentum related to Trump, or even politics in general.

And it’s our view these are merely the symptoms. Looking further forward I suspect we will find new lessons have been learned and we will find that when you choke a Golden Goose, it slows down, coughs and in some stages simply stops moving forward.

But when you unleash the machine of creativity we call the US economy it can do things beyond anyone's imagination.

We will find that the experience of the previous eight years was yet another point of proof in history that socialism and its thought process creates only one thing; more people who need government help.

The process to feed that monster (once birthed) creates more debt, which further burdens everyone who gets what they say they want; a chance to succeed.

So, the wonderful news that the market is celebrating - in my humble opinion - is that we are now on the road to healing that wound.

All who believe that will benefit, but risk will still be feared for years to come after the last decade and a half of getting punched in the gut. This is understandable and, in time, we will hear the screams of the rich getting richer.

The secret in that complaint? Wealth tends to only arrive once someone takes a risk. The willingness to be patient and disciplined while sticking to your plan throughout all the storms is key, as is understanding that all things called investments are risks. This bears great weight on the level of success investors reach in their own ‘Promised Land’ of financial goals.

The Data in the Cards

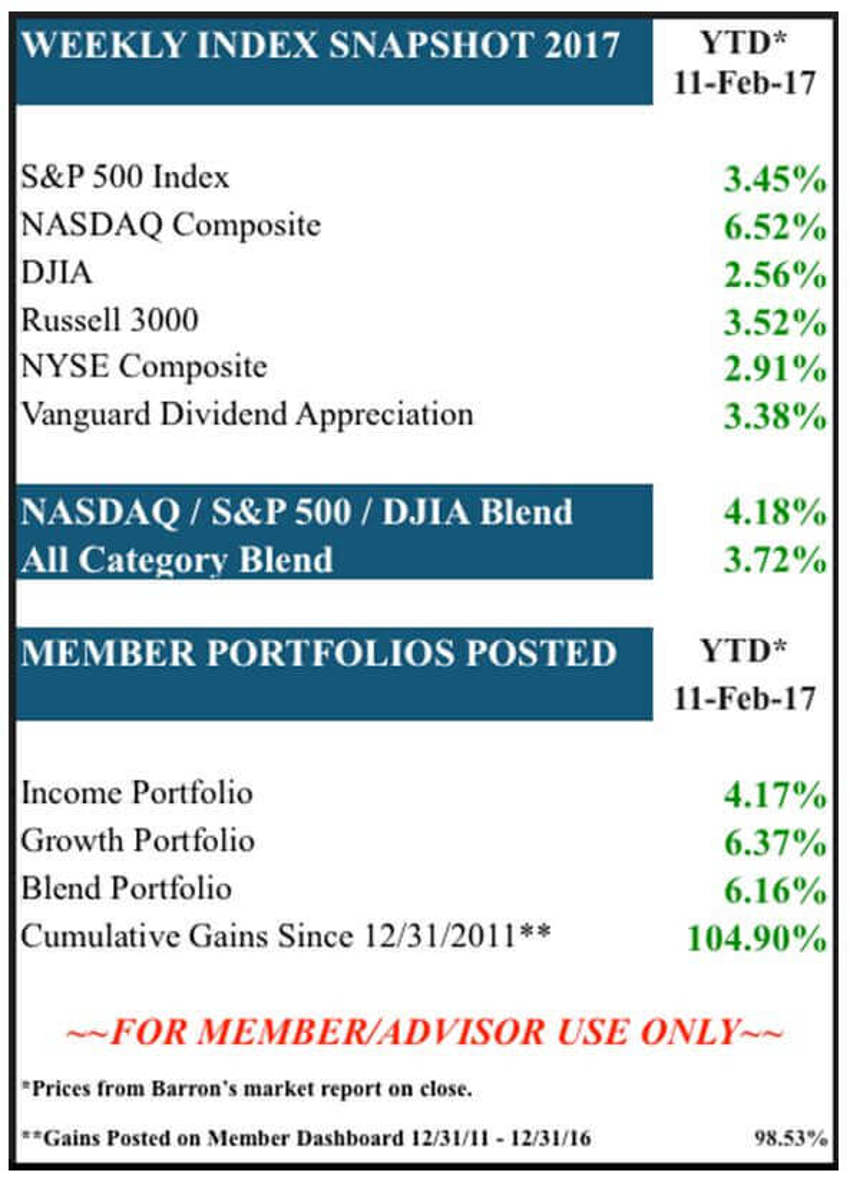

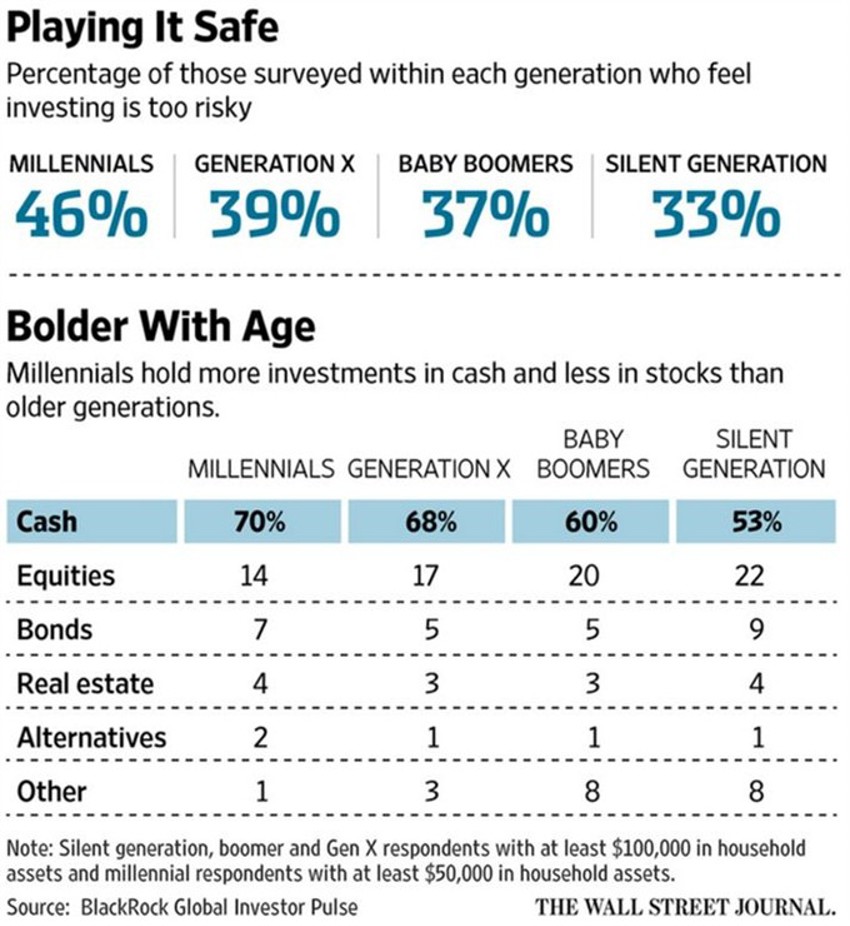

Even as markets hit new highs, a recent Black Rock and WSJ survey shows how many out there still have very little exposure to the greatest wealth building machine (over the long-term) ever created.

Note the levels of cash (read: measurement of fear):

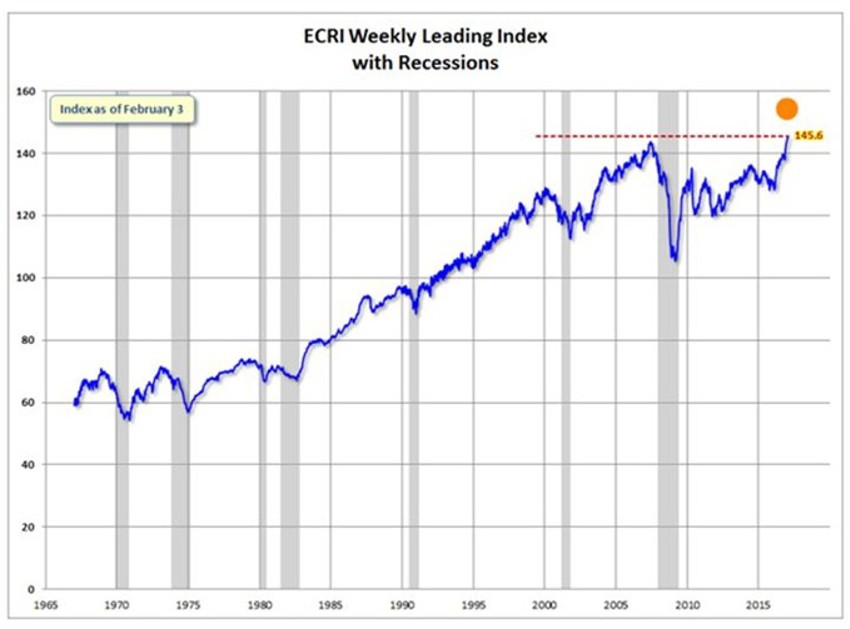

And as you let that backdrop settle in, note the latest in the ECRI Leading Indicators data from last week.

The above chart shows almost 50 year of the data available.

It also highlights that we have reached a new all-time high in that data, which hints that a feared recession is often a ways off after new highs are reached.

Thought of another way; the current economic data suggests it’s at its highest level of strength…ever.

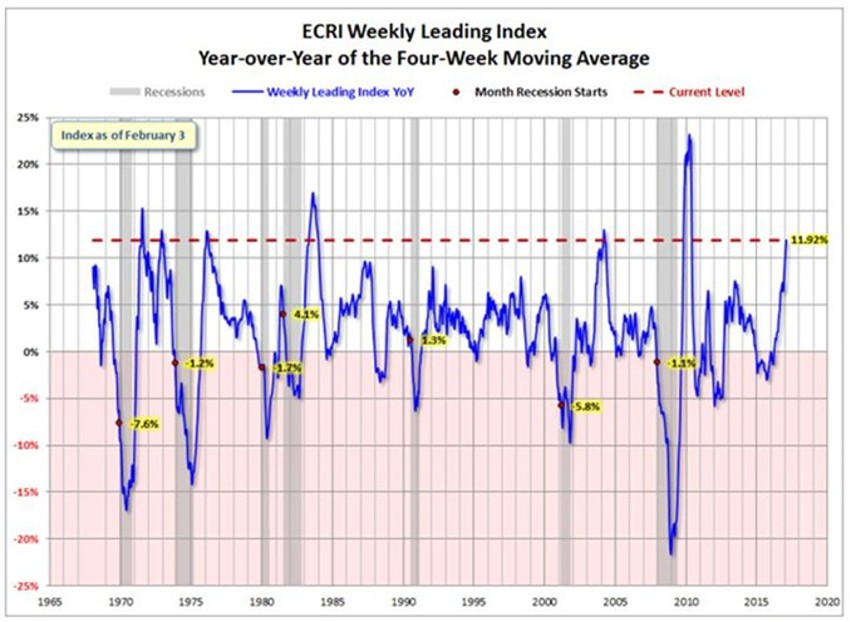

Or how about this view:

The chart from Doug Short above provides a snapshot of the year-over-year growth of the ‘Leading Index.’

More specifically, this is the year-over-year change in the four-week moving average of the WLI.

Those tiny red dots highlight the year-over-year (YoY) value for the month right before recessions began.

The key issue to be aware of as the scare-mongering continues unabated is that the YoY comps have been in positive territory now for 46 consecutive weeks.

The latest reading you will note is up 11.92% YoY, an increase from the 11.50% reading last week.

The growth factor is now at its highest level since 2010.

And of greatest important is that the latest level is higher than at the start of all of the last seven recessions.

So like I said, pray for a correction.

And Q4 Earnings?

Lost in the media hype over Trump, the earnings season has been a solid one, despite many who are still working hard trying to poke holes in it.

The analyst world remains well behind the 8-ball, which is a good thing.

Let's close out today with a few earnings updates from FactSet:

"For Q4 2016, the blended earnings growth rate for the S&P 500 has moved up to 5.0%. On December 31, the estimated earnings growth rate for Q4 2016 was 3.1%"

Their comment on valuation:

"The forward 12-month P/E ratio for the S&P 500 is 17.3. This P/E ratio is based on Thursday's closing price (2307.87) and forward 12-month EPS estimate ($133.34)."

So, if history is any indicator analysts will still be coming up short.

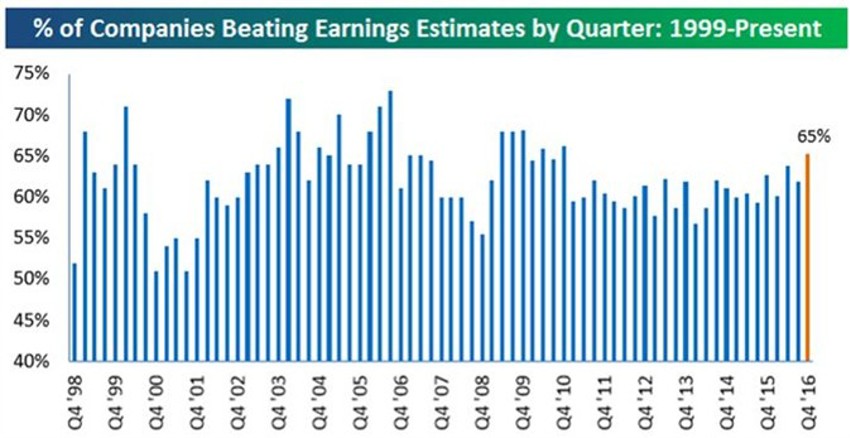

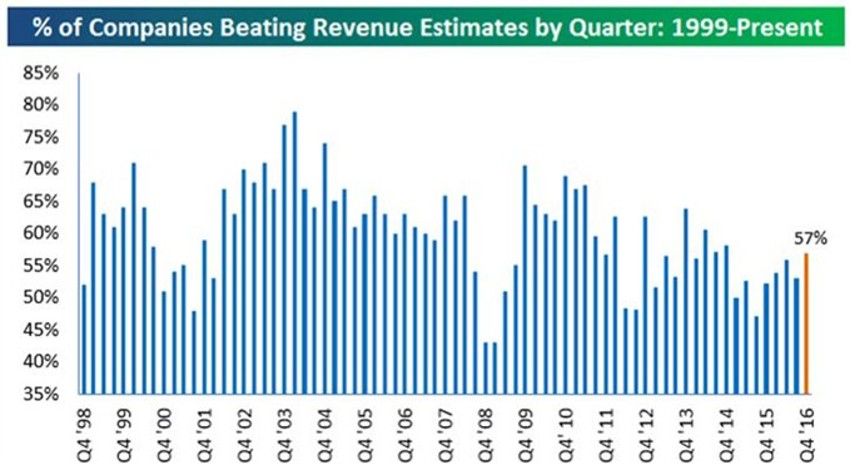

For more key stats, here is the latest on beat ratios (though they got even better in the last 24 hours):

We should surely expect that many will find it tough to navigate expectations in the near-term given the massive shift ahead based on tax, regulatory and repatriation benefits to come, the current earnings, and revenue beat rates that continue to come in strong.

So far, as the first snapshot shows, 65% of reporting companies have beaten consensus analyst earnings estimates.

Note that the 65% beat rate would be the strongest reading seen since Q3 2010, if it holds through to the end of earnings season (that’s February 21st, when Wal-Mart marks its unofficial end).

For revenue beat ratios, we see 57% of those reporting have beaten estimates this season.

This is not as strong as we saw in the early aftermath of the Great Recession, but a revenue beat rate of 57% would be good enough for the strongest reading since Q4 2014.

Yes, A World of Uncertainty...

As long-term investors, there are several very uneasy thoughts (facts) we must accept over time.

And I suppose these only become more comforting as time goes on.

Fact:

- The world is always based on uncertainty

- Nothing is assured

- For investors, the future is always cloudy

- Projection is a fancy term for guessing

So, what makes these rather disquieting facts seem more reasonable?

Well, these same facts have existed in the investing world since data began being kept.

It has always been this way.

And fear? Well, fear has always been expensive.