Market Expectations, Not Reality

Three weeks down and 11 to go - this hazy summer markets process seems set to continue even as some sectors were heavily tossed about last week as “news items.”

Overall, however, the churn is largely under the surface with little else happening above, and it was a fairly uneventful week for markets.

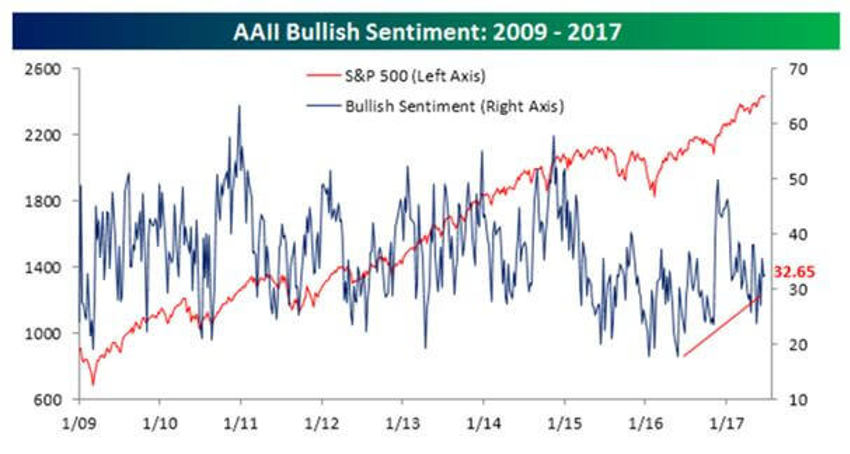

And as you’d expect, bullish sentiment was little changed as well from its long-standing low point.

The latest weekly survey from AAII shows bullish sentiment increased less than one percent from 32.27% up to 32.65%.

This now sets another record, with 129 weeks where readings were below 50%.

In fact, over the last sixteen weeks of pretty steady markets, there have been only four weeks where more than a third of investors were bullish.

If you think the bears are right, then the chart that follows will spook you.

That’s because it’s so often misunderstood.

Have a look:

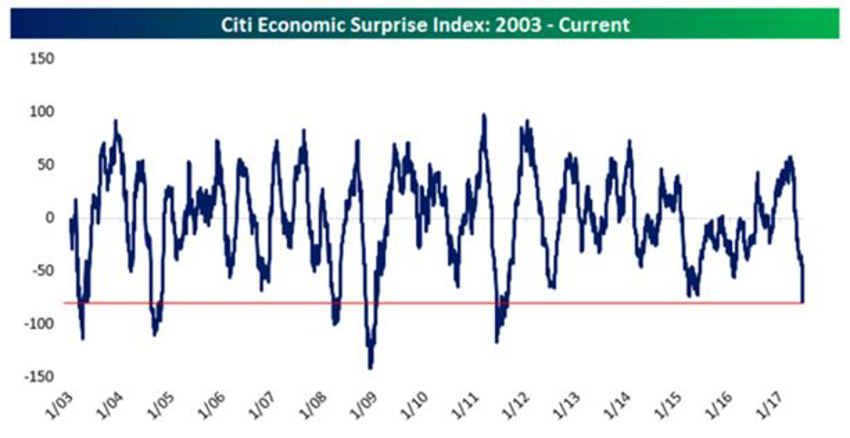

Now, it’s important to understand why and how the Citi Economic Surprise Index (above) works, because if you see if incorrectly you may be doing your investments a disservice.

And that’s exactly what the bears out there are counting on you to do.

First, look at the other times (there haven't been many) when this chart has shown "weak" data.

They were ALL good times to be a long-term investor, and not a scared trader looking for the next shoe to drop.

History helps if we are willing to be patient with it.

This Index is a measure of the pace at which indicators are beating estimates.

In other words, when analysts get on the wrong side of projections / expectations (as they often do), and then it takes longer than expected to get to the anticipated projections, the "indicator starts going down" by the measure of how much they missed said expectations.

It is now at the lowest levels since the summer of 2011. You may remember that was when the economy hit a short-term air pocket, while Washington "debated" raising the debt ceiling. This created far too much unnecessary uncertainty and eventually led to a downgrade from S&P.

Now, we know that recent activity hasn’t been terrible. However, it has been underwhelming from the perspective of economists with higher expectations.

Mind you: That’s not reality. That’s just expectations. And that doesn’t mean the economy is crashing.

Actually, it's really good that they are now out over their skis.

So why the backward view? Well, look at history. Normally, what economists will now start doing is cut estimates just as data is set to be stable or possibly even tick up a bit (might be a little tough during summer), and then suddenly, the surprise index will rebound in the other direction.

Don't Fret, Get Excited

With these economic "surprises" (which should be called “backward economic assumptions) currently coming in worse than all but 5 prior periods of weak data in the history of the Citi index, it’s more likely that these very same chastened economists will soon, in unison, start underestimating economic performance.

The result?

It tends to restart the whole cycle to the upside.

Game thinking, right?

Note to self: Fear remains high and deeply embedded.

And while I have no crystal ball, market tops generally do not arise when everyone is already afraid.

The Bottom Line

The good news?

The choppy, sleepy activity we are trudging through is excellent. In fact, it’s just what the doctor ordered.

And it will probably continue this week.

Just remember that summer tends to uncover short-term reactions that we can then take advantage of as investors. But it demands patience and the ability to fear the headlines.

The theme for the next 11 weeks will remain - a focus on that patience and discipline.

So, pray for a summer swoon, and think demographics not economics.