Market Apocalypse or Badly Needed Pause?

This is the question on everyone’s lips after our nigh on nine year bull market shuffle:

Is this "it"?

Has the apocalyptic “other shoe” now dropped?

(Hmmm…come to think of it I’m not sure I heard the first one hit the deck…)

Back into the water

A lot of people have waited a long time to wade back into the stock market waters.

Only in recent weeks have we seen the end of majority bearish sentiment.

But I suspect that will not be the case after the recent drop.

We’ll wait for Wednesday night's data to see how quickly the bullish rose petals fade and fall off.

Methinks those happy-faced sentiments only run skin deep.

So why the panic?

Well, it wasn’t because of any specific bad news.

Nope, once again the drama has been brewed up by a debate over non-existent news that would actually be good news if it happens: Wage growth inflation.

The crowd has been told for so long that it’s wise to fear wage growth that we’ve apparently lost our ability to dissect the issue with logic, and not emotion.

A whiff of inflation would be a good thing. And you certainly don't want deflation.

Earnings are surging and we have not even had a quarter or two of that to build on itself after the tax cuts and repatriation flows.

What’s next?

Now think about it for a moment; with a few trillion new dollars to spend, what do you think companies will do with as stocks fall?

I have two likely answers for you:

1) Buy back more of their own stock on the cheap during the panic, and

2) Go hunting in the M&A world. Just look at Broadcom adding a few billion more to the offer for QCOM as a hint.

The outcome?

Who knows if there’s a Black Swan to follow.

Probably not.

But for many who have just arrived on the idea that stocks are ok again, it will feel as if there is.

Just remember that we got a good glimpse of what happens when everyone and their brother thinks ETFs are the new "easy route."

And then found out that they work just like everything else does, only worse when the crowd panics. And they will always panic eventually.

Earnings reboot

It’s hard to believe but forward earnings have surged even more than bulls expected, even as the results and impact of the tax changes drip into the Q4 conference calls and reports.

Thomson Reuters' data shows forward earnings exceeding $155 a share. Note the 2018 "estimated" S&P 500 earnings growth rate is now 17.7% (rounded off to 18% for this note).

This is a real step up from last week's 16%, which in turn was a giant leap from just last November 2017 when it bumped above 10% for the first time in a decade.

But with the drop in the key indices this week folks will likely overlook that the P/E for the S&P 500 as a whole is now 17.8(x) - almost a direct hit for a 1X the market's expected growth rate this year.

This suggests the entire S&P 500 Index is now priced at roughly 1 times growth - a PEG ratio of 1.0 – and that’s not an unreasonably-valued market at all.

Keep in mind that the latest Thomson reports also show that 80% of the S&P 500 companies already reporting Q4, 2017 financial results have beaten revenue estimates; that’s well ahead of the more normal 60% (or so) beat rate.

Finally, the S&P 500 earnings yield actually rose as the market took a beating.

It jumped from 5.35% in last week's note to over 5.60% this week.

The bottom line here?

A pause was badly needed and shouldn’t be feared.

It’s perfectly normal for this to happen.

In fact, what’s not been normal is the absence of a setback as we climb this bull market mountain.

So here are the expected S&P 500 earnings growth rates for the next two years:

-

2019: +10%

-

2018: +17.8%

And it’s not just earnings that are positive; the underlying data is sound and steady:

Factory orders were revised upward in November, and the subsequent December data matched that bump, which was also ahead of estimates.

This is a long game, folks.

The short-term ugly must be weighed up against the long-term trends.

Speaking of Fear

I stand by the idea that the largest bubble since 2008-2009 had nothing to do with stocks.

Instead, it grew out of the too often overlooked emotion channel where the culprit is fear.

And the recent bullish converts after a rally of over 16,000 points were quick to retreat during a week of ugliness.

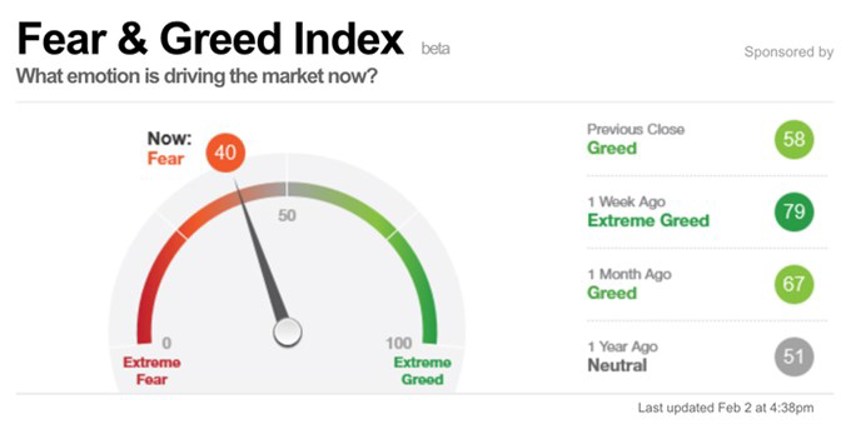

Here’s the latest from CNN's Money Sentiment:

As I’ve noted for months: “If you are afraid that the crowd is too bullish, just wait for an ugly week (or three) and watch them move right back out.”

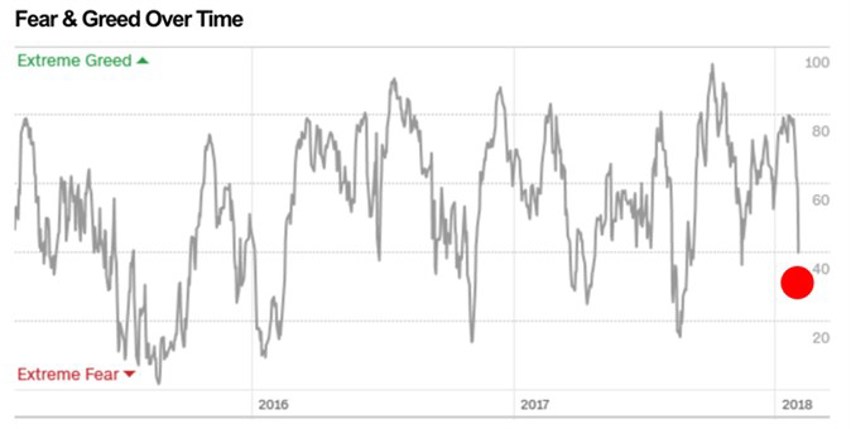

The second chart above is just a few years of the data shown in the colourful dials above it.

After big annual surges it is not abnormal to go for months and months without making a lot of headway.

As much as it might not feel good watching that happen, I would not be at all surprised if we find ourselves in a neutral-zone for a bit.

Let patience and discipline be your guide.