Market Action vs Correction

The weekend following the 400 point Dow Jones loss was portrayed like Armageddon had suddenly arrived and risk littered every headline.

Then the markets bounced back and the investor herd was thrown back and forth as the storylines changed with the prices.

September is living up to its name so far as a bit more volatile than the August slumber.

The frenzy is borderline ridiculous, as are the comparisons. One of the headlines in particular read, “Markets suffer worst losses since June 24..." Are you joking? I wonder when we’ll start reading lines like, “Last 10 minutes see worst losses since 9:42 yesterday morning...."

Enough Already...

A quarter point rate hikes isn’t going to unravel the world and if you think it will you should probably remove all the equity investments from your portfolio. It is my humble opinion that aligning horrible future event predictions with a rate hike suggests you’re probably standing too close to the flame, so to speak. Step way, way back.

Sure, Friday was an interruption along a very long path. But a look long periods of market history will show you how that type of "interruption" is better characterized as market action and not a "correction." The latter has a sense of finality and separation. The former is a portion of the process that includes all market events.

That 2% drop in the major averages on Friday left no sectors spared, hinting at something different than a bunch of people just hitting the sell button arbitrarily.

That said, if you break down the S&P 500 based on how stocks performed from mini-panic to mini-panic (the 6/27 post-Bruit low through last Thursday's close), you would find that declines were evenly distributed regardless of performance during the post-Brexit rally.

Trust me on this: ETFs will eventually work their way to biting the crowd in ways they currently do not understand. But that is a story for another day.

And don’t assume the market chop is now complete. Volumes did rise quite a bit (see the chart below) so don’t be surprised to see this go on for a bit longer. It’s pretty safe to say that almost no one will be happy with the Fed meeting outcome this week.

Forward Earnings

Forward earnings rose for all three indexes again last week as the energy cloud continues to be purged from comps.

Large Caps rose for an 18th straight week. Mid Caps rose for the eighth week and Small Caps tagged their 15th rise in the last 16 weeks.

So, while too many investors focused on the earnings recession hysteria, all three weightings have risen since mid-March. This signals the best multi-week streak since August 2014.

How does this stand up to records? Well, the only index not sitting at all-time highs after the latest quarterly briefings is Large Caps. Their forward earnings stand just 0.2% below the record highs set in October 2014 (just as the energy cloud was shaping up in earnest).

Mid Caps are well into new highs, as has been the case for 13 of the past 15 weeks. Meanwhile, the Small Caps also stand at record highs for the 11th time in the past 13 weeks.

Remember: "Record highs" in Latin means "it's never been better than this...."

A Brief on “Fed Speak”

The strengthening dollar has already done some of the tightening for the US Federal Reserve.

While most experts assured us that printing money under QE would trash the dollar for good, it’s somewhat comical that dollar strength and lack of inflation is now confounding those same experts.

Here are a few tidbits from the latest Fed chatter and the reasons for same:

“Inflation has been undershooting, and the Phillips Curve has flattened.”

You can admit the jobs market has tightened if you’re trained in the areas of the economy that are seeing massive demand (from things like the Barbell Economy – how the Baby Boomers are handing over the economic baton to the Millennials of Generation Y).

Keep in mind that Generation Y brings with it a surprisingly deflationary tilt.

Old-world econometric models will tell us this is terrible. But it's more like watching a dog chasing its tail; an ineffective and slightly amusing activity.

Rest assured that Gen Y’s talents and abilities infiltrating the corporate world will reveal efficiencies in places no one thought possible; places we cannot even define yet.

Multi-tasking, high-tech savvy and keeping things simple (without the fluff) is coming at us in a giant wave. This helps explain why price inflation remains subdued since labour costs aren’t rising significantly.

Remember also that inflationary expectations remain low, with core PCED inflation rate at 1.6% year-on-year and expected inflation in the 10-year TIPS market is at just 1.5%.

“Foreign markets matter, especially because financial transmission is strong.”

In her latest, US Federal Reserve Board member Lael Brainard noted, “Headwinds from abroad should matter to U.S. policymakers because recent experience suggests global financial markets are tightly integrated, such that disturbances emanating from Chinese or euro-area financial markets quickly spill over to U.S. financial markets. The fallout from adverse foreign shocks appears to be more powerfully transmitted to the U.S. than previously.”

She went on to state: “In particular, estimates from the FRB/US model suggest that the nearly 20 per cent appreciation of the dollar from June 2014 to January of this year could be having an effect on U.S. economic activity roughly equivalent to a 200 basis point increase in the federal funds rate.”

Let's Keep This Simple

The Fed is struggling because they are underestimating the cost of fear in their forecasts. They are also not making a big enough point that the buffoons in Washington DC have done an absolutely horrible job of fiscal policy implementation for years. If it did not have something to do with a new tax to provide for more giveaways, President Obama has simply not been interested.

The expansion investment strike from corporations is also a compelling stand against terrible administration policies.

That noted, we should in fact be extremely pleased that our economy has been able to expand at all with all these chains around our neck. It's all in the barbell.

When fear subsides, rates will rise and the Fed Speak can and will shift.

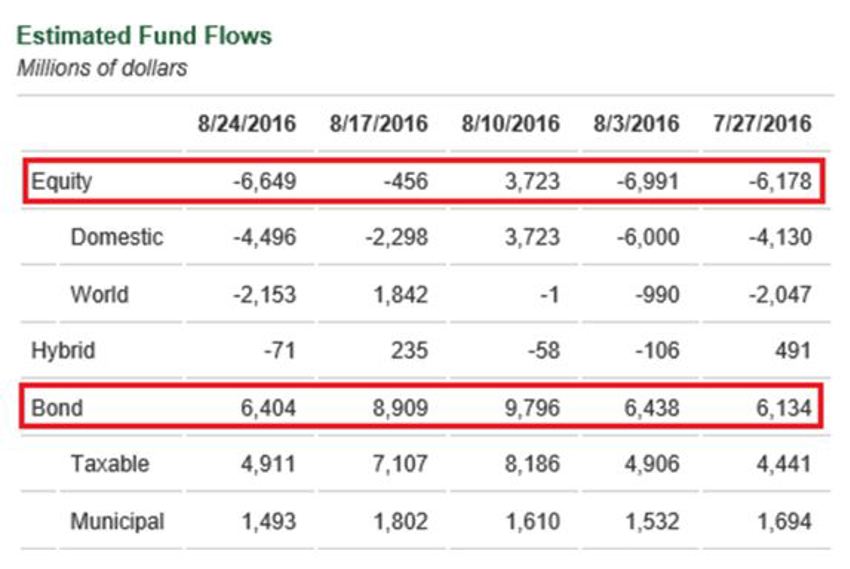

But if you think fear is fading just now, think again. Check the last four weeks of specific fund flows data - every week shows a big flow into bond funds even at near record low rates (60+ times earnings):

Yep, fear remains. If you need any further indication then just wait for the latest sentiment data.

Retail Death Reports

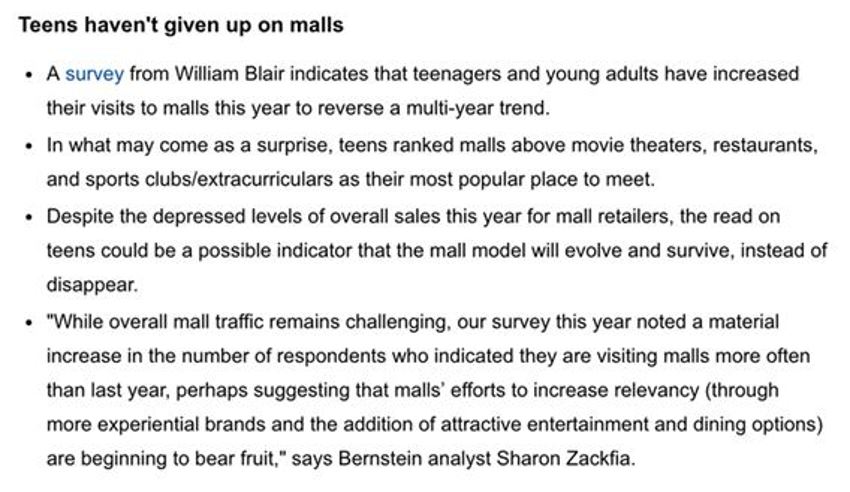

I always think it is kind of comical when we see lots of certainty in a specific opinion; like how retail is dead unless you’re Amazon.

Not so fast, folks.

My hunch is that a couple years from now, we’ll find some of the hard hit retailers will have adjusted and their stock returns will have set the stage for improvements.

Survey data shows that the kids aren’t done with trips to the mall just yet, hinting that mall owners are doing a pretty good job of creating "experiences" and concepts along with the shopping and retail services:

A Note on the Bear

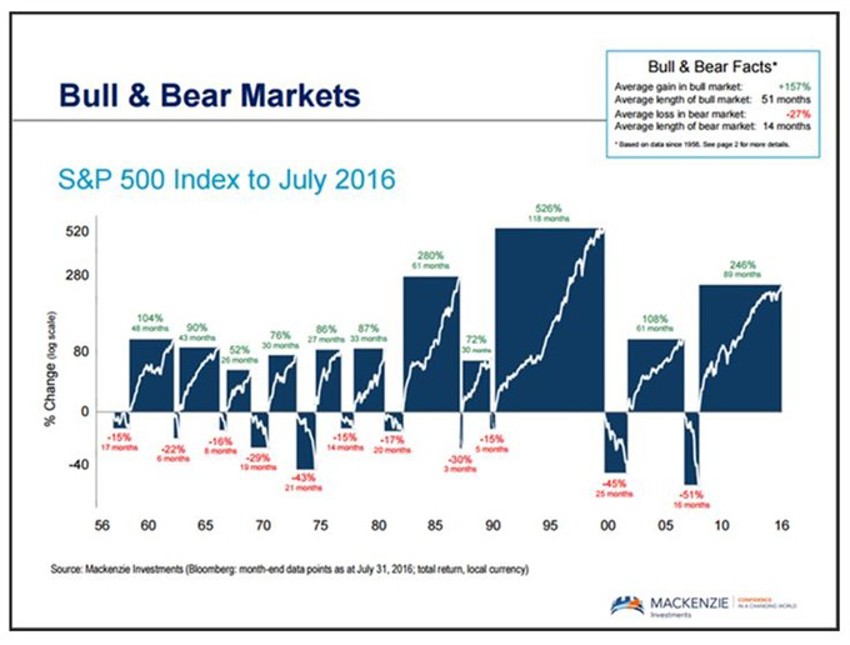

We hear so much about the constant bear market risk that we seem to have never really left the topic from over 11,000 Dow Jones points ago.

After all, the entire theme of investing since the March 2009 lows has been "Yeah, but just wait until you see the next shoe drop...."

My point here is that it is easy to overlook how little time we actually spend in bear markets: 85% of the time in market history has been spent in a bull market.

Here’s a graphic to make it more real for you. It should encourage you to spend time thinking strategically about where risk should be taken during the 85% of the time when things tend to be just fine:

It certainly does drive home the point that we seem to focus on the bad when in reality it’s a relatively minor piece of the puzzle. And by the way, that history covers every single thing that we’re terrified of, and have been, all along the way up the mountain.

In Summary

The news cycle is all about strife, stress and negatives. Meanwhile, the markets get sloppy in September. The investor herd is back, trade desks are full again and the “Sell in May” crowd missed the rally. And of course elections are on tap; and each one seems to get a bit crazier.

The better part of valour here is to let all this stuff unfold, finding pockets to take advantage of as fear rises again.

Remain focused on the Barbell Economy. It’s real and expanding, and demand is growing like a weed.