Magazine Covers versus Market Sentiment

Most folks who are long-in-the-tooth in this business don’t like seeing magazine covers that crow about the next big thing in the markets - especially when it’s bullish.

Why? Well because history shows more often than not that it’s a poor sign of things to come.

That’s why I cringed a bit when I picked up my copy of Barron's this weekend in the lobby of our building as I rolled in for my Saturday morning office work.

And there it was: "Next Stop Dow 30,000" in big giant letters on a pretty blue background.

Ugh!

(Just between you and me, I hope that headline writer now has another job.)

And that’s the “Clash of the Titans that I reference in the above title.

So let's check both ends of the spectrum:

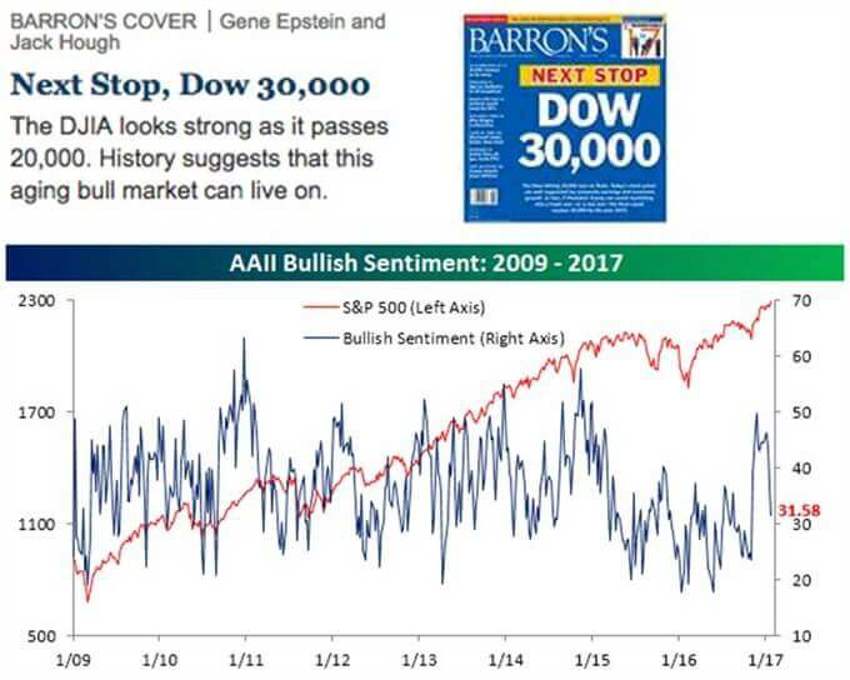

The snapshot at the top is the Barron’s magazine cover that I mentioned.

And the next two charts show you the underlying shift in both Bullish and Bearish sentiment, as reported by the AAII over the last few weeks, as the New Year has begun in earnest.

Note how quickly the market sentiment has pulled back into what I would describe as the "mildly tepid to outright uninterested" zone.

Needless to say, the bullish spike was short-lived; just as I hinted it would be given we’ve reached the all-time new high zone and altitude sickness has quickly set in.

Remember, this is a trick of the mind. Our brain knows nothing about the future. And try as we might, there is no one on Earth who can draw the line of the market average on a chart out into the future; not even for a single minute.

As such, when we hit these new highs we only know how far it can fall back towards zero.

And the moment the market even slows down those feelings of bullishness quickly grow more tepid.

More Details

Note that bullish sentiment dropped from 37.01% down to 31.58%, marking the second straight week where it has declined by five percentage points or more.

That is a pretty rare occurrence that last unfolded back in May of 2016.

The latest data also makes it the 108th straight week where bullish sentiment was below 50%.

On the other hand, while it did not rise by a ton, bearish sentiment now exceeds bullish sentiment for the first time since the election!

Good News Indeed…

We can take this development as good news if we remain focused on the long-term values building under the surface in our economy.

The Dow Jones may be rattling around and toying with 20,000, but we can be confident that individual investors (still) want no part of it.

Another Perspective

The investor herd are getting very confused about valuations that appear elevated just now.

This is primarily because of the anticipated tax changes, regulation shifts and repatriation benefits that are in the pipeline.

We have warned not to expect the first 100 days of the Trump presidency to be smooth sailing. They rarely are, and in fact usually make for especially choppy waters when this type of political shift unfolds.

Yes, Trump is a new kind of sheriff and is doing things in a new way - and we will all need to become accustomed to that.

But returning to valuations; once the aforementioned tax and capital flow benefits are realized, rest assured that the valuation question will be set to resolve itself.

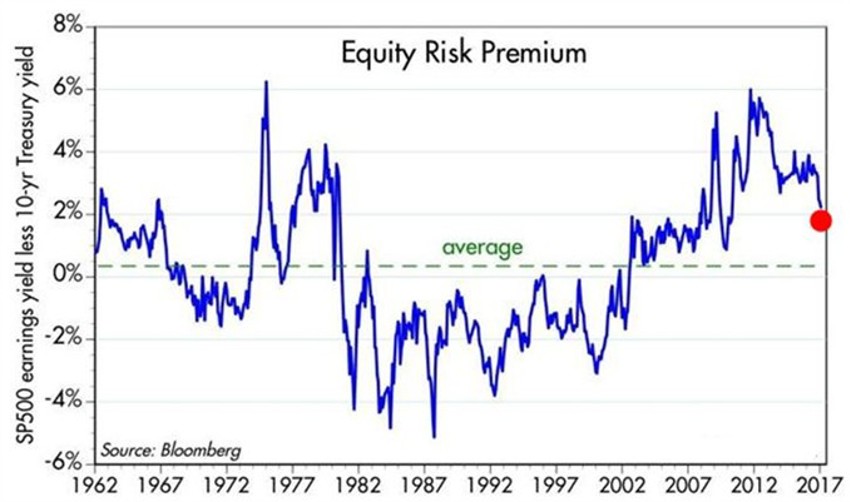

Have a look at the chart below:

Slowly but surely the capital strike is ending.

This will become clearer when we get the repatriation deals worked out for lower tax rates recapturing that capital.

And let’s remember that we cannot view PE ratios in a vacuum.

The chart from Scott Grannis of The Calafia Beach Pundit (above) does a great job of comparing the earnings yield on stocks (EPS divided by price, or the inverse of PE ratios) with the yield on 10-year Treasuries; a proxy for long-term risk-free rates.

Further highlighting the fear of risk remaining in the audience is how the greater the difference between these two factors grows, the less optimistic the market becomes.

And when that difference is negative, as it was in the 1980s and 1990s, the market was quite optimistic as investors were willing to accept a very low yield on stocks relative to their risk-free alternative.

It’s no mistake that history taught us both of those lows ran parallel to periods where the public was "very confident that stocks would appreciate" in the future.

Today, even at or near record market highs, we find it's almost the opposite.

Investors by the boatload continue to express their unwillingness to take on the risk of stocks even though their yield is still bouncing around 200 bps higher than the yield on 10-year Treasuries.

The Bottom Line Here?

It’s pretty clear now that many feel the market is about to suffer setbacks.

Sentiment is rolling over, charts are ugly, nerves are shot and the excitement period is wearing off.

After all, it must end badly, right?

The Fears Now?

Many are confident again that the market is vulnerable to a decline because a lot of the optimism shared over Trump's business-friendly policies is believed to have already been “priced in."

The Good News?

That doesn't square with the fact that real interest rates remain very low, sentiment is starting to stink again and risk aversion is still the name of the game.

We stand where we were at year-end; a correction is a good thing for long-term investors.

Closing Thoughts

Our thoughts as we ended the year were that the period between late January and into the first few weeks of February could present a period of chop and angst as the real administration shift took hold.

The media attacks are blistering and clearly weighted on the side of perceived harm.

So, take this as fact: Ugliness sells better than positivity.

With everyone waiting on a correction we are unlikely to see what’s expected.

Instead, we may be in for some real chop and churn in a fairly thin trading range, and bouncing back some on the closes.

The end result will be that it does not satisfy anyone, which is another good sign for the trek higher up the mountain afterward.

Is there risk? Sure there is. There always has been and there always will be.

Remain patient and stay focused on your long-term financial planning goals.