It’s Times Like These You Learn to Think Again…

Just about every summer that I’ve been in this business has been marked by a choppy stock market.

In recent years that choppiness has picked up a bit, and the high frequency traders (HFT) and algorithm guys haven’t helped that issue.

The truth is that most investors tend to overlook that a vast amount of the now dwindling volume is done by exchange traded funds (ETFs) and HFT guys during the summer.

And Wall Street has successfully trained the investor herd into believing that ETFs are their next saviour.

That same crowd cannot seem to understand why the more we see ETFs being used, the more we see wild internal swings in industry sectors and specific stocks, especially in and around the earnings seasons that now feel as if they come about every 72 hours!

(I think they used to be quarterly.)

The Point at Hand

At times like these it’s helpful to remember that emotion stings and logic reigns.

The latter is very tough to focus on when chop and churn is the name of the game.

But, we can rest assured that Warren Buffett and his staff are not rushing out to sell stuff right now.

In fact he looks ready to pull the trigger on another acquisition as we speak.

Think about that for a moment; the most successful investor in history is ready to spend billions while sentiment shows the bulls are dwindling rapidly.

He’s not afraid of the summer swoon. He’s probably looking forward to it, because that’s where the value is created.

A Short Test

Here’s one for you: How many Dow Jones points do you think have passed us by since the end of the dreaded "worst start to a year in the last 83 years" back in Q1 of 2016?

Remember that last year started down 14% by 11th February.

The answer: 5,800 points.

Imagine that nearly 6,000 points of stock market rally have come and gone and yet sentiment is still in the tank, mountains of cash are still in the bank and debt levels are back to where they were in 1982 (as a percentage of income).

And all while we continue to tap away at record levels of GDP and near record ISM readings in manufacturing.

More Records? You Bet...

S&P 500/400/600 Forward earnings rose last week to record highs for all three market-cap indexes!

The yearly change in forward earnings is up from six-year lows in early 2016 (see the aforementioned worst start in 83 years) for all three indexes.

The latest data from Dr Ed Yardeni and his team shows "LargeCap’s forward earnings improved to 9/9% y/y from 9.8% y/y, which compares to a 64-month high of 10.2% eight weeks ago and a six-year low of -1.8% in October 2015; MidCap’s was up to a 65-month high of 13.2% from 13.1%, which compares to a six-year low of -1.3% in December 2015; and SmallCap’s rose to 12.5% from 12.1%, which compares to a 34-month high of 12.8% in mid-March and a six-year low of 0.3% in December 2015."

Further, before the impact of any tax changes, bringing cash back from overseas from regulatory cost savings, consensus growth rates now expected for 2017 and 2018 are: LargeCap 11.4% and 11.8%, MidCap 11.4% and 13.7%, and SmallCap 9.8% and 19.0%.

And yet still investors fret…

The latest “concern” is the interest rate ramp-up as the Fed takes away the punch bowl garbage that seems to be filtering into every headline.

Hey, what happened to Russia stealing America’s election? At least that was interesting. And wasn't there another Ebola outbreak too…somewhere?

My point is let’s use logic and see what interest rates are really doing:

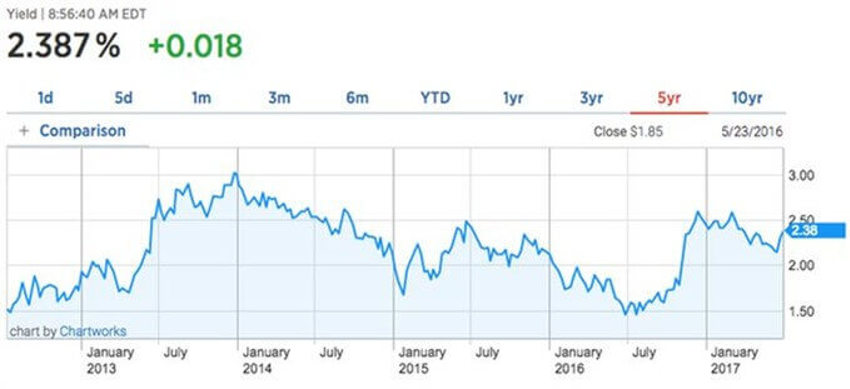

Look at the last five years of interest rates on 10-year treasuries in the US.

The chart above shows we are still below the highs of the last five years – as seen back at the end of 2013 / the first week of 2014.

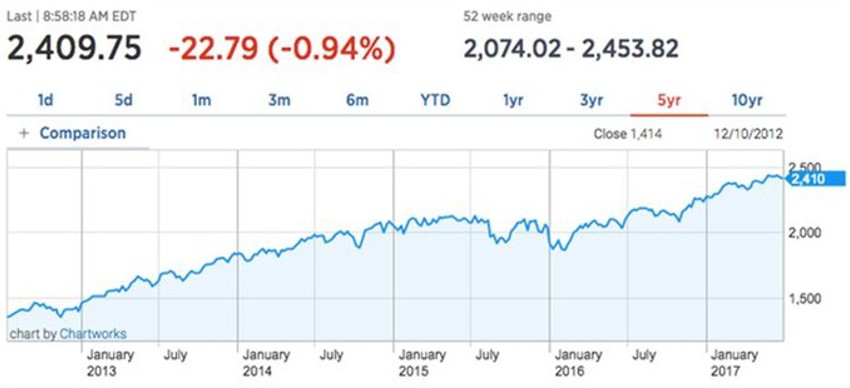

Now, to help you see the real impact of interest rate fears let's take a quick look at the SPX over that same period:

Now, in case you were wondering the S&P was about 28% lower back then.

And that little factoid kind of throws cold water on the idea of being terrified of rates which may, finally, actually get back to say, umm, 3%?

We’ve said repeatedly over the last five years that buying bonds at 30-50 times earnings because they feel better than those ugly old stocks does not make it the right thing to do.

But, it sure does show the cost of emotion.

By the Way, About That Jobs Thing…

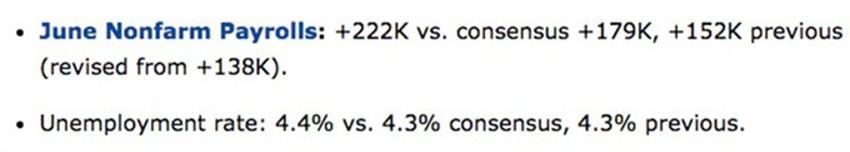

Just a month ago the consensus was that jobs growth was slowing.

There were reams of type reported and gallons of ink spilled over the idea that jobs were thinning last month.

It was all bad news.

So you might now find it funny to see that we have revisions - the upward moving kind - for each of the last two months - and a beat on the latest jobs data:

Running the Race

The economic baton is being passed from the Baby Boomers to the Millennials.

We are running out of homes as the younger generation is taking over and a record number of jobs are going unfilled - the kind of jobs that will catapult us ahead on the technology, productivity and creative side of the world.

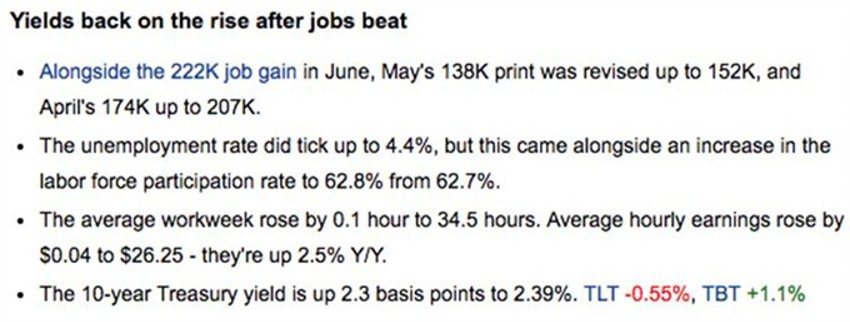

Here’s a bit more on the jobs data report:

The Barbell Economy

On one end of the Barbell, lots of people are starting the last exciting 40 years of their lives.

On the other end, a new, record-setting generation of young people are becoming adults.

They will do certain things en masse and are set to change the world in ways we cannot even imagine at this time.

Now, we can disagree and we can worry about how others interpret the data. And we can fret over minute-by-minute headlines, or we can simply get on our surfboard, paddle out into the break and ride the waves.

Our focus remains the same; pray for a summer swoon, and think demographics not economics.

We are in far better shape than the vast majority of investors currently realise.