It’s Not Just The US That’s Seeing Economic Improvement…

There is plenty of good economic news in the US to focus on; solid jobs, solid sales, excellent data on manufacturing, solid PMI's….

In the UK and Europe, Theresa May got the vote she needed and now Brexit can officially begin - wonderful to see all of that happen without Europe being swallowed up by the black hole so many had feared.

In fact, the latest GDP and ISM data from that region suggest nothing even remotely close to what was once considered apocalyptic certainty.

And the improving earnings season is getting almost zero attention while the news is focused on Trump.

Have a look at our market review video of the S&P 500 It takes a few minutes but well worth the time

How About Those Output Numbers?

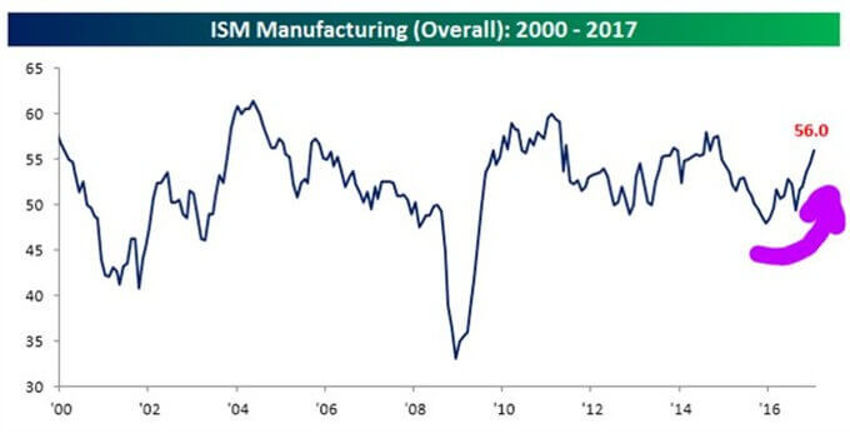

The latest ISM manufacturing report shows activity for January 2017 hit its highest level in over two years.

The reading came in at 56.0 while the experts expected 55. But the more impressive part is that level is the highest monthly read since November 2014, and represents the fifth straight month where we’ve seen a month over month increase.

And in case you are wondering, over almost the last 70 years the longest consecutive streak of monthly increases was from mid-1993 to mid-1994, when we saw ISM manufacturing numbers increase for 12 straight months.

Here’s a snapshot:

Now for Something Else...

It’s not just the US that’s seeing improvement.

While it wasn’t too many moons ago that the end of Europe was nigh (over Brexit) you can see the more positive responses since in the below chart from Scott Grannis over at the Calafia Beach Pundit blog:

It’s OK to Think it’s OK

I’m of the strong opinion that it will be years before the masses begin to understand that it’s OK to feel positive about the future again.

I would also say that we may see a strong parallel unfold over the next year or so.

Now, right now lots of folks are trembling every time Trump says he’s going to cut new deals for trade and take a better position for America.

Now think about how comical it must be from another country’s perspective how America’s population is screaming about how terrible it is that their leader is trying to negotiate better deals.

Wouldn't we be laughing at them?

Beyond the overblown fears, these new trade deals will set the stage for a real shot in the arm for the US economy.

More investment will be made here as companies selling us things will look to protect their market share. And we’ll also likely see a helpful improvement in our trade deficits, instead of funding everyone else's improvements.

(And this is something to be angry about?)

It’s utter nonsense.

Now back to the chart above, which shows that manufacturing output in both the Eurozone and the U.S. has been improving.

The tepid confidence in the system so far may make it feel like a coordinated recovery in manufacturing conditions in Europe and the U.S. would be too much to expect.

But that’s what the data is telling us. Slowly but surely the constant fear-mongering is set to once again be left in a heap on the side of the road....dust in wind.

Meanwhile, the American Association of Individual Investors (AAII) shows sentiment is wilting. The AAII Bull Ratio fell for the third week last week to 48.5% after climbing the prior three weeks from 58.0% to 64.7%.

And bullish sentiment fell from 46.2% to 31.6% over the three-week span, while bearish sentiment rose from 25.2% to 33.5% over the same period.

Once again there are more bears than bulls, which should continue to be a surprise considering we’re at or near record highs across the major indexes.

More Industrial Support

With the energy sector decimation generally now in the rear view mirror, rail data is beginning to show improvement too. As fracking activity picks up, so does the need to transport sand, pipes, and new well equipment.

On the flipside, low natural gas prices have prompted utilities to use natural gas instead of coal, which hits the rails share of transporting that commodity.

And that tenuous balancing act has become more supportive as frackers emerge from hibernation, and losses in coal loadings appear to be bottoming.

As such, railroad earnings have begun to turn the corner as well.

Construction Spending

We had noted earlier that we would likely see a few small pauses in some spending areas as the new administration was getting ready to hit the ground running; making major changes along the way.

It’s not abnormal to see some await those changes in order to get a better read.

So it was no real surprise to see that after hitting its best level since April 2006 in November, construction spending retreated a bit in December.

Dr Ed Yardeni points this out a bit more detail for us here:

"Public construction spending sank 1.7% on widespread weakness. Total spending dipped 0.2% after advancing six of the prior seven months by a total of 3.7%. Private construction spending rose for the seventh time in eight months, to a new cyclical high, up 0.2% m/m and 5.0% over the period. Residential investment advanced for the third straight month, up 0.5% in December and 3.5% over the time span, while non-residential investment was flat after increasing six of the prior seven months by 5.1%."

Private Business Revving Up?

The ADP data was a nice surprise showing private industries added 246,000 to January payrolls, which is considerably above the average monthly gain of 179,000 during the final half of last year.

Of Note: There was also a small bumped up revision for November’s numbers from 215K to 226K.

January’s advance was driven by a 201,000 increase in service-providing jobs; goods-producing companies added 46,000 jobs, a two-year high. Within service-providers, trade, professional and business services (71,000) hired the most workers, followed by trade, transportation & utilities (63,000) and health care and social assistance (49,000).

Parting Thoughts for the Day

We’ve found in the past that the less one pays attention to daily emotionally-driven events, the more productive their results tend to be.

So let's not make this tougher than it already is....

We are building the foundation for a repeating and very significant cycle.

It is a long cycle driven by a record-setting, brilliant demographic generation coming of age in the US.

The breakthroughs we will accelerate through over the next decade will be shocking.

But they demand patience, the discipline to stay the course, and an understanding that corrective waves in markets are not only positive over time.