Investors Swinging at Fever Pitches

Finally, the markets cracked.

That cookie had to crumble at some point, eh?

So after a direct media attack, and wave after wave of implied yet rarely factual headlines, Trump and politics are the subject of the blame-game for the latest market events.

Let me just say that nowhere in recent history have we seen the type of political mayhem - right out of the box – that we’ve witnessed in the first 110 days of this administration.

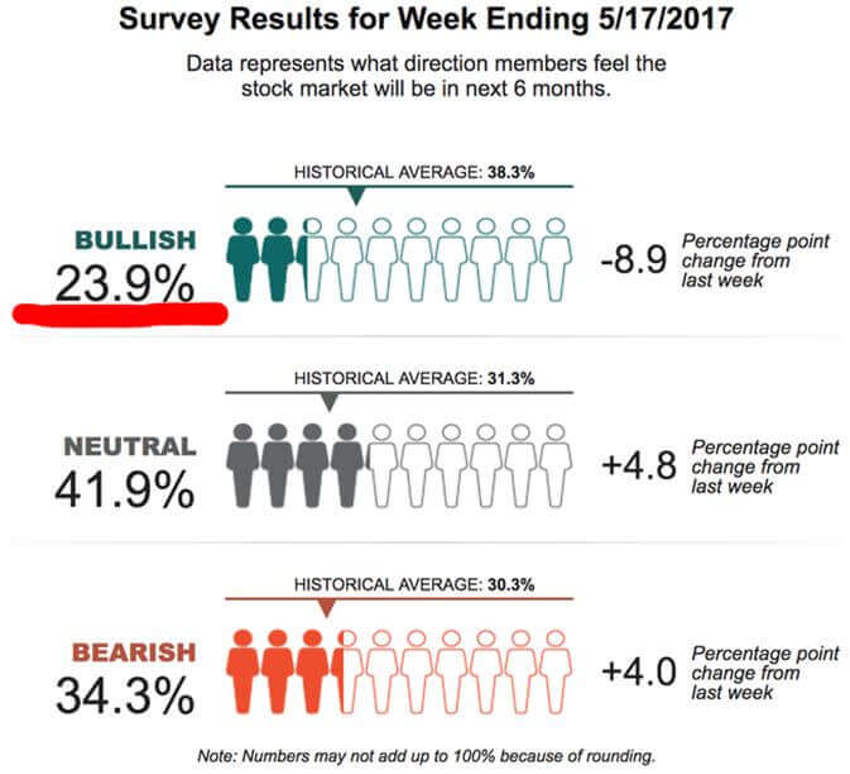

And here’s the impact on investor sentiment from the latest AAII data:

Now, call me crazy but I have a strong hunch that, had the AAII survey been open throughout the course of this entire week the retreat we’re seeing above (as of Wednesday night) into the bearish camp would have been even more severe.

As it is, only with the hindsight of nearly 35 years in this industry, I find it completely stunning that we have a bullish reading of just 23% right now.

That’s how positive investors feel about record breaking major indexes.

Remember, at the lows of March 2009 - some 14,000 Dow Jones points ago - this reading reached down to just 19.7% bullish – that’s one-in-five participants.

Over eight years later we’re still just a few points higher.

The Larger Picture?

Last week North Korea was all anyone talked about. This week it’s Trump (well, he seems to fall into every week, really) and Kim Jong-un has fallen by the wayside – what a ridiculous media game.

It just goes to show you that are never as good as they feel or as bad as they look.

Do you think Warren Buffett is selling today?

"Same old fears and same old crimes, we haven't changed since ancient times"

That line (above) is credited to Dire Straits, from their song "Iron Hand." And it's worth a listen to keep your mind and focus off the noise that has once again reached fever pitch.

But like the other fevers peppered across our historic pathway, this one will break too.

The only bad news is this: Like Italy, China, Brexit, crude oil, North Korea and the all the rest of the headline concerns, this latest Trump turmoil will pass. And when it does more new monsters will appear.

The only thing we can do in times like these is stay the course.

This is part of the deal.

And it's a required step as we trudge up this mountain while building toward our long-term wealth accumulation goals.

Another One Bites the Dust

As the New Year dawned there was much chatter amongst experts that a strong dollar was a terrible thing for the markets.

Strange then how just a year ago the idea of a weak dollar negatively impacting the markets was all the rage.

As 2017 arrived, we said, "Now that the experts expect a strong dollar to be bad - look for the dollar rally to pause and allow multi-nationals to shine nicely by summer or fall in their quarterly stats..."

So, here’s the dollar over the last 5 months:

Why Bad Sentiment Is Good News

Overall, poor investor sentiment is a substantial positive for long-term investors - even though it always feels pretty crappy watching gains go up in smoke here and there.

Long-term investors who know their history realise that those losses come back just fine.

Meanwhile, the Barbell Economy continues to move along nicely - even though we have much internal interruption, chop and short-term reactions.

And don't forget that summer and all its haze is dead ahead.

One Last Item

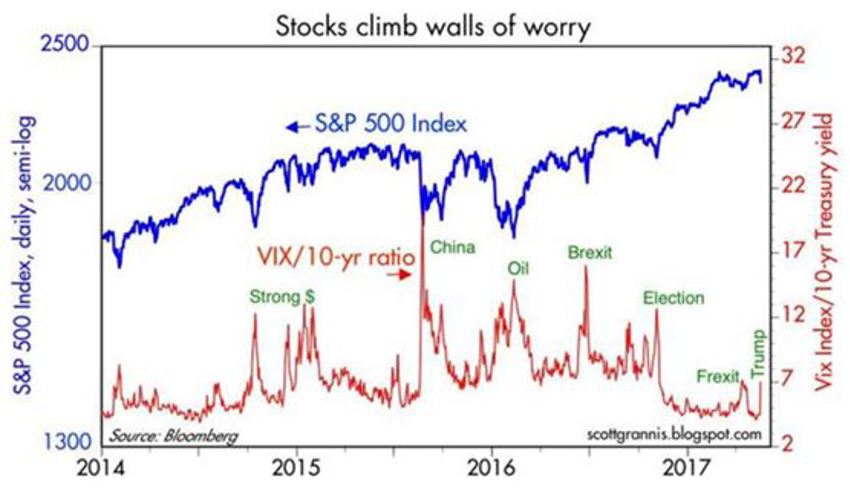

The chart below from Scott Grannis over at the Calafia Beach Pundit shows all of the mini-panics over the last three years.

And it’s been overlaid on the VIX, and implies the "wall of worry" that you’ll hear and read many experts make reference to.

The press are now panting with hopes of disaster in the White House and the “disruption" in Washington, alongside the chants for Trump's impeachment.

That’s causing the market to fret, and with that new worry comes a correction, yes?

Surprised?

Come on....you shouldn't be.

The chart above allows you to judge the magnitude of the "Trump concerns" and compare them to the other numerous "panics" that have popped up over the past few years.

So far it's just a blip.

Here’s a thought: Let’s stop calling it the "wall of worry" and rename it the "foundation of opportunity."

Not only does it sound better but it’s far more accurate.

Until we see you again, may your journey be grand and your legacy significant.