Investing on Assumptions Instead of Facts

Another monotonous week, eh?

Sometimes this can all seem a bit repetitive.

But rest assured that the calendar will fix that for us shortly as those who "Sell in May" return to the market at higher prices.

For now, what we have are:

Solid PMI's. √

Very few Q3 warnings so far. √

Excellent Manufacturing data. √

Steady markets despite “Rocket Man” riding the airwaves. √

More and more "smart" hedge fund guys saying there is trouble. √

Falling AAII sentiment again. √

The Bond market reverts back to fear levels AFTER the Fed meeting. √

And even President Trump is getting higher marks. √

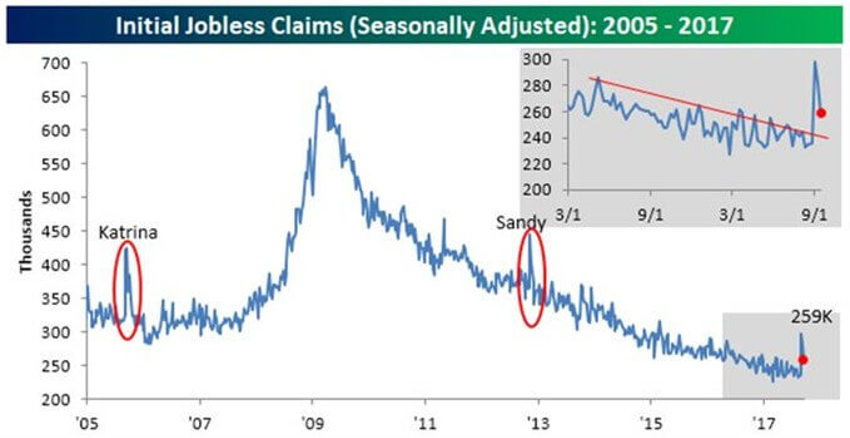

Oh yes, and about those jobless claims...

Remember back when everyone was saying they would explode due to the storms?

And they did…for about a week.

Check it out:

Look at the red dot above and note how quickly those numbers are falling, which hints at a continuing solid jobs market out there even as many folks worry about the storm-driven losses.

This week the US saw the second straight decline in claims as first-time claims fell to 259K from last week's reading of 282K.

With claims coming in 43K below consensus expectations, this week's reading was further below expectations than for any other weekly print since April 2009.

In fact, the streak of sub-300K readings now stands at 133 weeks!

And according to the latest data release, first-time claims in Florida rose by a tiny 5,133.

With the damages from Hurricane Irma that number seems pretty darn low.

Hence, let's not be too surprised if we see these readings increase in the coming weeks for a short window.

The US Fed’s Bottom Line?

It felt like shivers ran through the markets as Ms. Yellen spoke about sorting out QE.

Strange too, as $10 billion more per quarter being siphoned off the Fed balance sheet looks more like a drop in a large ocean than anything close to an event that will be making waves.

The Bond folks appear to agree.

After a tiny spike of 5 basis points in the 24 hours after the announcement bond rates are right back to where fear puts them:

Now Wrap Your Brain Around This…

I have a suggestion as we burn through the last months of 2017.

Let’s try and move away from market assumptions to the negative when there’s no data to support that conclusion.

We already know about all the allegations of bad stuff on the horizon – we read about it every day.

But history tells us that the investor herd missed the importance of the economic Baby Boomer wave for many, many years after it arrived in the 1980s and 1990s.

The bigger picture was clear back then. And it’s the same case now with Generation Y.

So don't make the same mistake as the next chapter of our powerful demographic waves unfold.

Focus on demographics, not economics. The former creates the latter.

And while the world around you worries just remember that we are at record highs because we overcame all that we feared before right this moment.

That's just the way it works.