How Investors Get Paid for Risk

Election confusion is the name of the game; it’s created a record long number of down days (more below on that), decimated a few sectors along the way, run almost all the bulls out of the building and painted cash and bonds as the only value.

While the reactions to whatever unfolds in the election on Tuesday 8 November are a mere guess at this stage, you should embrace the near-term negatives as a positive long-term.

Patience is often Painful

What an ugly week it was in some sectors of the market, with even the Barbell economy not escaping the internal sector attacks.

Late last week, news of Department of Justice subpoenas rolling through the drug sector over some hunt for mispriced insulin took stocks in the sector down 15%, 20% and even 25% or more.

These are crazy reactions that, in some cases, affected stocks that don't even sell insulin.

Generics were also impacted over fears of Clinton attacks.

The funny part?

Given the massive waves flowing into our drug system over the next 20 years, generics will oddly enough be the only way to meet these demands; making these drubbings a valuable opportunity for patient investors.

This also gives you a clue of what algorithm robots, high levels of fear and HFT trading can do by crawling the headlines and then triggering massive ticket orders in seconds - or sooner.

The Shaky Landscape

The game is getting tougher and it requires a higher viewpoint to get beyond the garbage we’ve witnessed in recent weeks.

The internal shellacking stocks are taking is useless in the larger picture, but likely sets the stage for significant value creation over time, once again for properly focused, patient, long-term investors.

New Records?

We have now seen nine sessions down in a row (at the time of writing) – a streak not seen since 1980 – in step with terrible sentiment levels, with markets coming back to almost the exact spot we highlighted in September on this video.

How Bad is Sentiment?

You won't believe how bad.

But I cannot tell you how well this is setting up for the long haul.

And in order to get that long-term benefit we must remain focused for the Barbell, disciplined and patient.

Let's look at a few angles on sentiment:

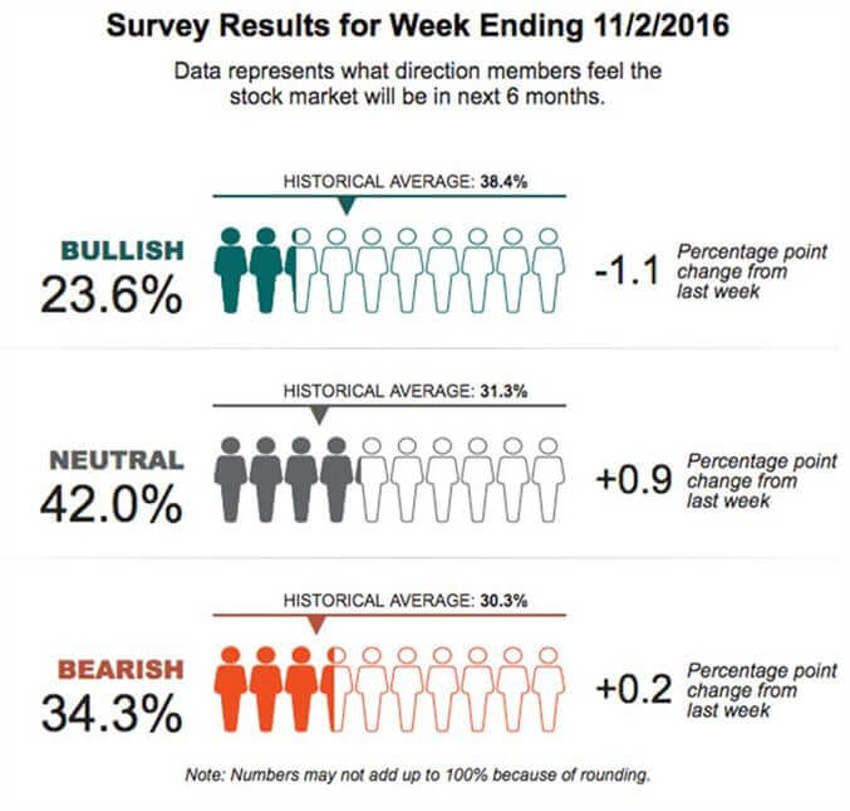

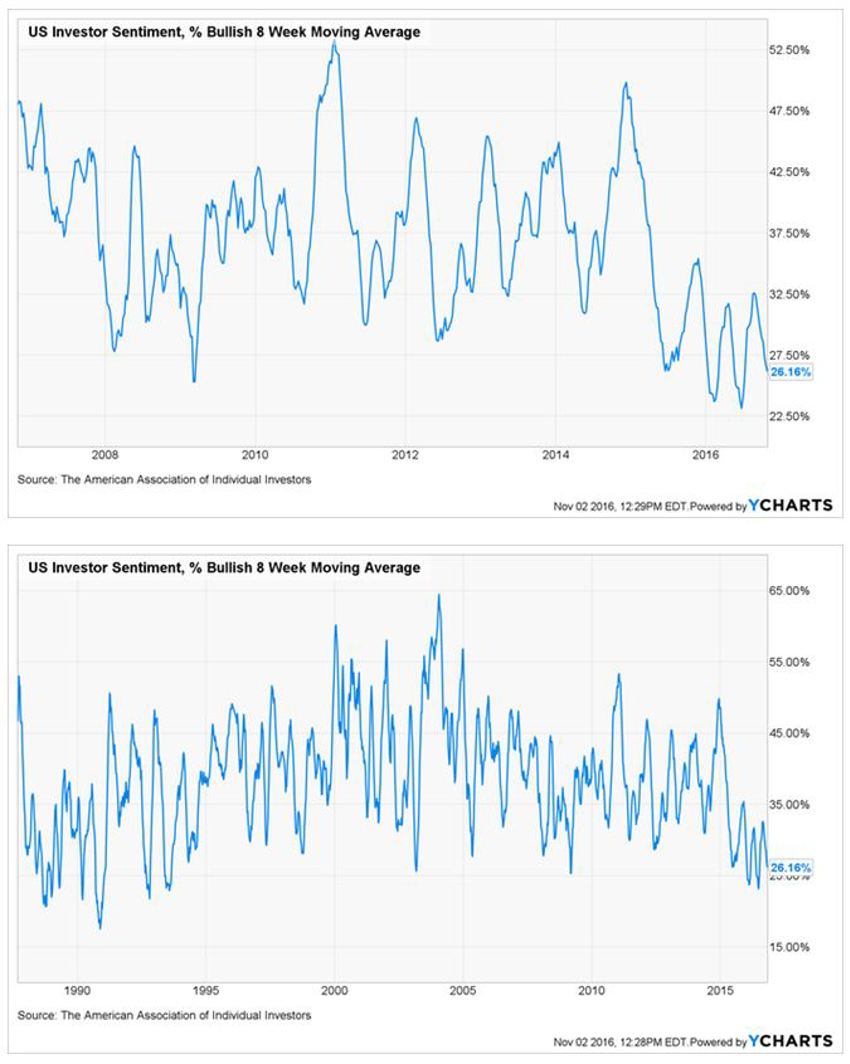

I have included three perspectives on sentiment above.

Sometimes the short-term view on sentiment can throw you off, but this time all three perspective time periods give the same clear read: almost record-setting bearishness, or lack of bullishness.

The top chart shows you the latest week - 23% bulls. And the other 77% don't like the markets.

Let me tell you what it was in March of 2009 (11,000 Dow Jones points ago): 21%.

The other two charts are eight-week moving averages of the same bullish sentiment.

The current reading is lower than 99% of all other readings back to 2008. In fact, it is lower than 97% of all other readings since the data began in 1987.

Remember, the mass audience only feels better about investments after they have risen.

And depending on your perspective you could describe it as either “Stunning” or “Valuable.”

Checking in with Contrary Ideas

It is now pretty much assumed across the board that the world is going to all stay home and get everything it needs shipped in from Amazon.

As nice as this sounds don't bet on it just yet.

Two years ago malls were going to be dead for the 500th time this century. But they learned how to make malls entertaining again.

Now, I have a hunch that retailers will figure this out over time and become more effective at competing with Amazon.

Remember, when something becomes "obvious" that’s when it definitely is not.

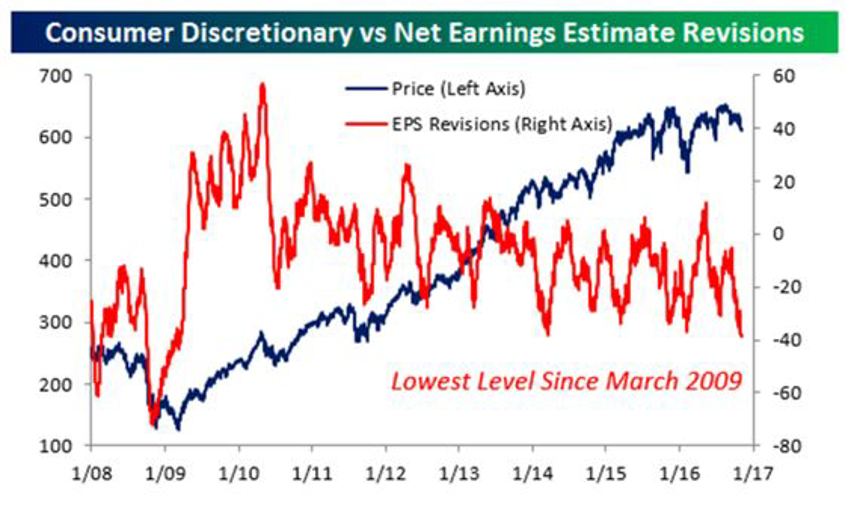

Sure, the Consumer Discretionary sector is facing a number of headwinds. Not surprisingly, there has been a steady flow of negative revisions coming from the analyst community.

After hitting its highest level in nearly three years earlier this year, data now shows us that the spread between the number of upward and downward revisions for companies in the sector just broke down to its most negative level since March 2009

Some Things Sound Smart.....

Sure, some things sound smart, but in real life practice they’re really not.

Many in the field of finance tend to perpetuate myths, rules of thumb and assumptions that just aren’t true. And it’s a very long list....but here are a few thoughts to close out today's note:

"Investing is about finding new opportunities and security selection."

In reality, portfolio management is really about risk management and portfolio construction.

If you can’t get these things right it won’t matter how many new opportunities or stock picks you come across - those are just tactics, not a portfolio.

Keep things simple. Sticking to a plan is already hard enough when the storms arise…and they will.

Making it more confusing just makes it easier to get off track.

"Clients want to be impressed."

Not really.

Most really just need a better understanding of the complexities involved with the markets and their own investments.

It’s far more impressive when you can communicate your message in a way that anyone can understand.

"Intelligence is all that matters."

One of the finance industry’s biggest failings is many blindly assume absolute brilliance is all they need when it’s really a relative game.

There are plenty of smart people who are terrible investors because they can’t get out of their own way.

Intelligence is never in short supply on Wall Street, but the correct temperament - and a lack of ego - often is.

"Complex markets require complex solutions."

In my decades of work, this one is probably the most damaging for a majority of investors.

The simpler, the better (with the understanding that simple does not mean easy).

This ain't the Olympics: There are no extra points for degree of difficulty.

"Clients need more products, more portfolio changes, more everything."

This statement (above) could not be farther from the truth.

Less is more: The best in this business know how to pay attention to fewer and fewer things, and focus on the ones that matter most over the very long-term.

People Drive Markets

Understand where demand is building and or falling and you have 80% of the problem solved if you are focused on being a long-term investor.

The other 20% is being patient enough to let it unfold over time.

Change will pick up pace. Dramatic opportunity will be mixed with much angst as the baton changes hands.

This election mess will soon clear up, so use the ugly market action to your advantage, hold your breath, grab some TUMS (not those, they're mine) and stay focused on the long horizon.

That’s how investors get paid for risk.