How Fear Hurts Wealth

As we prep for the worst of the summer stock market haze in August, the media redoubles its efforts to blanket us in speculative problems.

Interest rates were the latest sure fire nail in the economic coffin, right?

Eh, no. At 2.38%, the 10-year rate has light years to go before it causes the economy any serious issues. And we headed into the weekend, the 10-year was back down to 2.23%!

Boring…

When there’s nothing new to write about…let's summarize for the week. The media is far too focused on dismantling anything related to Trump. Earnings are going great and are at new record highs, as are prices.

Values are still subdued when you consider people are still crowding each other out of line for a bond at nearly 50 times earnings.

If I told you we only buy stocks at 50 times earnings, you'd think I had absolutely lost my mind.

Fear is often so subtle you don't even know when it’s hurting you.

Signs of Growth and Renewal (Green Shoots) Expanding

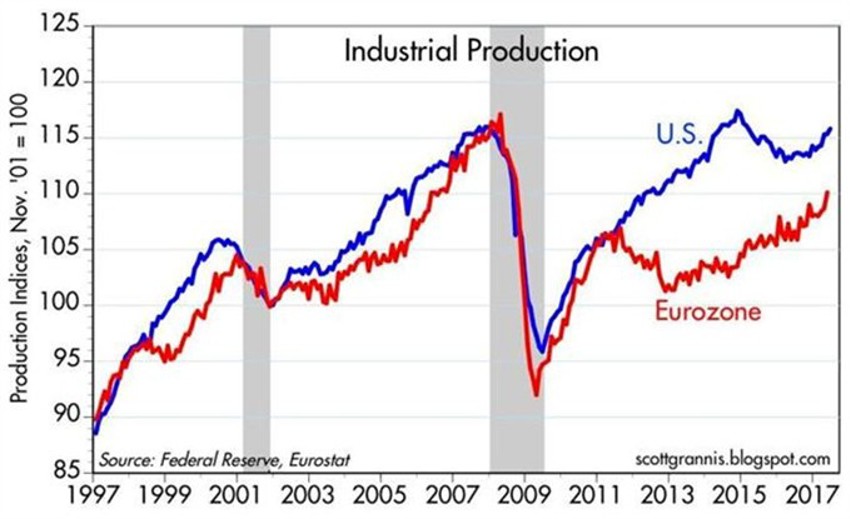

While Washington DC cannot seem to fight its way out of a wet paper bag, green shoots from around the globe are popping up and driving PMI's higher and output to near record levels, both here and abroad:

In both cases, the US and the Eurozone are on upswings, with the US closing in on all-time new highs that are surpassing even the juiced-up times right before the Great Recession, when housing was way overdone.

Make no mistake; the demographic issues unfolding today in the US are being completely misunderstood by most. And the vast majority of the investor herd is looking in the wrong direction.

The oft-referenced Barbell Economy – where the Baby Boomer generation is handing over the economic reins to the Millennials of Generation Y - is a very real event. And we are early in this process in what will prove to be a very long game; one that’s set to be with us for decades.

How About Risk?

There is always risk.

I don't care what you’ve heard about getting away from it, you can’t.

You are always taking a risk if you expect a return. And sometimes, even when you don't expect a return.

Once you accept that you stop being afraid of it. And that achievement leads to fewer emotional errors. That’s when you start to do things differently from the crowd.

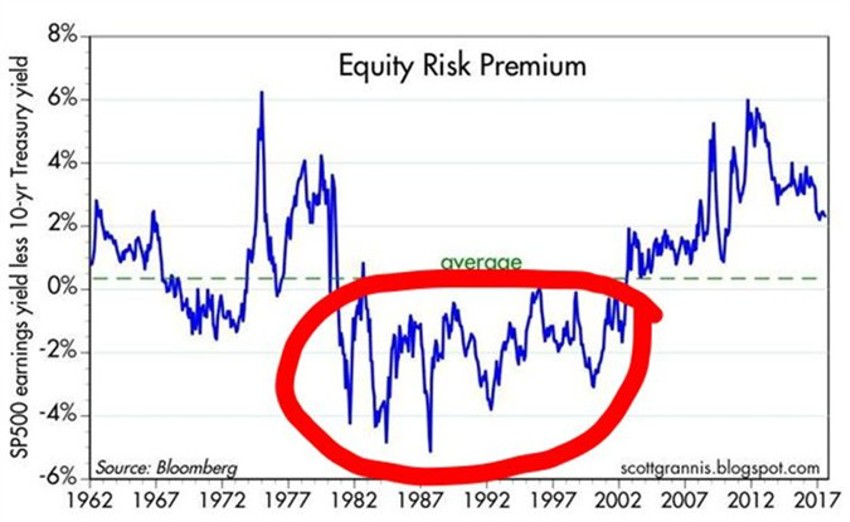

The chart above shows you the equity risk premium currently in the market.

I have added the red circle to highlight something for you. Note that for the entire 20-year secular bull driven by the Baby Boomers in the 1980s and 1990s, the equity risk premium was in the negative zone!

The chart shows specifically that current earnings yields on stocks (the inverse of the P/E ratio) is 4.6%.

That means that if earnings held steady at current levels and if companies paid out all their earnings, the dividend yield on stocks would be 4.6%.

You can see the data compares the earnings yield on stocks to the yield available on risk-free 10-yr Treasuries.

Important: It is unusual for stocks to yield a lot more than risk-free bonds, as they do today.

By this measure stocks look cheap. About as cheap, in fact, as they were all the way back in the late 1970s when the world was once again terrified of stocks.

I would remind you that this was also the last time a MAJOR demographic baton shift was unfolding - as it is now.

The parallels are all very real.

When the stock market is fuelled by optimism, as it was in the 1980s and 1990s, the yield on stocks is typically less than the yield on bonds (circled in red).

People are willing to accept a lower yield on stocks because they expect that stock prices and dividends (and earnings) will rise in the future.

That is the normal process history has taught us over time.

The bottom line in all this is that fear remains an expensive thing to own.