Group-Think Is Not An Asset Class

Last week ended much like most weeks do these days; with the crowd being pushed along to worry about something.

Any reason will do these days.

We were told Thursday (markets were closed Friday) was a terrible day in the markets due to fears being raised about the Korean peninsula.

The noise makes it seem like we’re back in the Bay of Pigs days, fresh with a new President that few are willing to offer any slack.

As it was, a few things did happen:

- The major averages were down Thursday…by less than 1%.

- Those averages are roughly 2%-4% off the most recent all-time highs.

- North Korea launched a new missile that blew up shortly after take-off.

- They did not perform a nuclear test as feared.

- The Barbell Economy continued to roll forward under the mess.

As for the media? Well, may be what they should have said was:

"After watching 59 Tomahawk missiles rain down on Syria, a MOAB cratering into a hidden terrorist camp killing nearly 100 bad guys and staring out over his coast at the US carrier fleet, Kim took heed and noticed there was a new Sheriff in town - quietly cancelling the threatened and widely-covered/feared nuclear test."

So much for perspective, eh?

And as for market weakness concerns last week? There are many reasons, as always: Chatter about corporate earnings concerns, weak data, robots, China, Trump, defence, Congressional failures, etc., etc.

From a market perspective remember that there’s always a massive amount of wasted talk about weak earnings right before the season starts.

But the history of beating those estimates suggests analysts remain pretty lousy at figuring it all out beforehand (on balance) as one of the charts below illustrates.

And while we can spend a great deal of time worrying about earnings season or North Korea as reasons for market weakness, the more logical answer that (in the US) it’s tax payment week for many of us, is conveniently overlooked.

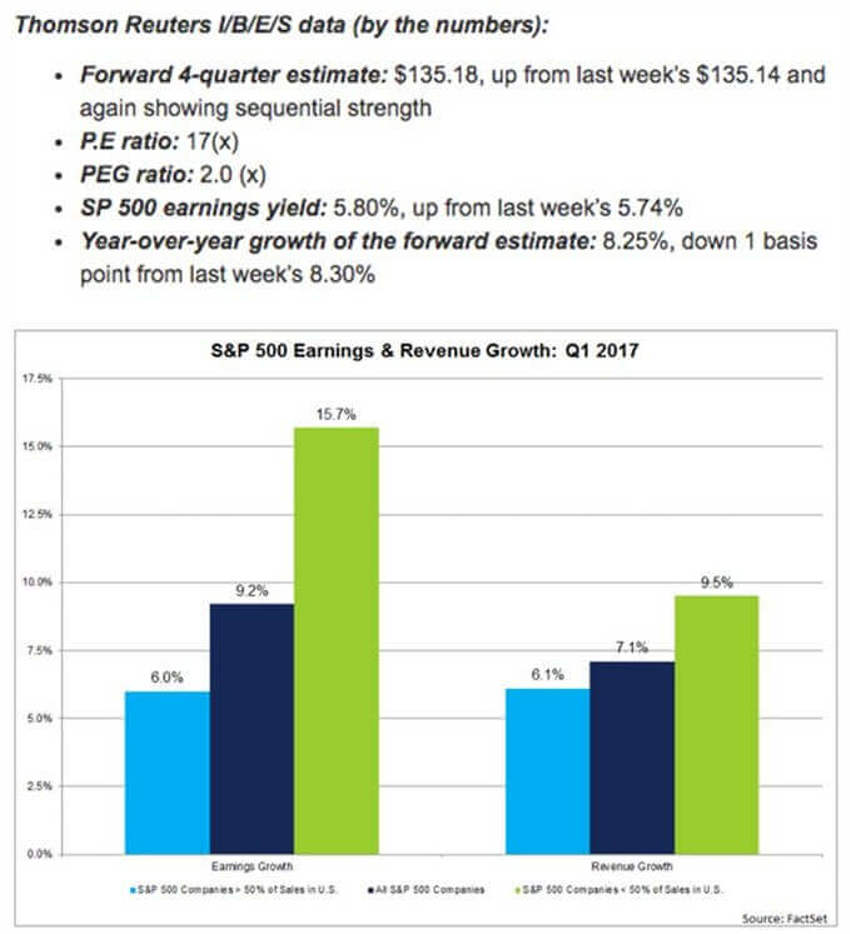

Besides that, here is what the latest in earnings data looks like from 50,000 feet (Factset and Thomson) well above the noise:

The problem with earnings season?

You need to live through the whole thing, and all of its wasted knee-jerk reactions, in order to gain the full value the market has to deliver over time.

The Good News?

No matter how you slice it up the earnings season getting underway should be a solid, and can build from here with some momentum.

Speaking of the market's results, revised projections cause panic. When you review these things from an historic perspective you start to understand just how well Wall Street does when it comes to predicting the future.

No one is good at fortune telling, and convincing yourself that you’ve found one is a clear sign of fear:

At the end of 2016 we covered the wide variety of year-end price targets for Wall Street strategists, as is the normal charade.

As shown above, on average Wall Street strategists predicted the S&P would gain 8.4% for 2016; which ended up being just 1.1 percentage points away from the actual gain of 9.5% seen last year.

As you can see from the actual vs. estimated columns, outside of 2005, it was the closest they've gotten to hitting the mark, ever, with some extremely wide ranges of misses.

The dart-throwing business is easier than the crystal ball business. In other words - stop fretting over Wall Street experts' BS.

Solid Fear Registered (good news again)

Late last week, we provided the latest from AAII investor sentiment. The chart above is from CNN's gadgets.

It too shows that few investors love the stock market.

All of that continues to back-up our "young bull market" thesis. The changes underway are still being significantly misunderstood. And the economy is set to vault forward at a far better clip and for much longer than currently perceived by most.

All this contrary bullish sentiment data is backed up by recent comments from our old friend Mark Hulbert. He follows all newsletter writers with his own sentiment data.

As one may have guessed in this lead-up, it smells like fear as well.

Mark’s comments from the weekend include:

"The U.S. stock market has exhibited a less bullish tone since hitting an all-time high March 1. Could a change in a major trend be imminent?

Most stock market timers I track certainly think so.

Consider the average recommended equity exposure among a subset of timers who focus on the Nasdaq stock market. It has dropped more than 55 percentage points in the past week alone, and is a total of 71 percentage points below its early-March high.

If all we knew was the magnitude of those declines, we’d guess that there must have been a huge amount of stock market carnage.

In fact, there has been only a minor pullback. The Nasdaq Composite Index COMP, +0.52% is only a little more than 1% below its all-time closing high, for example, and the S&P 500 SPX, +0.46% is down only slightly more than 2% from its high.

For guidance when other market timers are running around with their heads cut off, I find it helpful to turn to the oldest stock market timing system that remains in widespread use: the Dow Theory, which was created a century ago by William Peter Hamilton, who at the time was editor of the Wall Street Journal.

For the moment, it says that all you Nervous Nellies can relax: All three of the Dow Theorists who I monitor on a regular basis believe the major trend remains up."

Don't forget that being contrary is a very tough position to hold.

Standing in the storm and refusing to budge in the belief in the US to create wealth is not an easy task.

I suspect that is why so few reach their goals over time.

The toughest ingredients to swallow?

As always, anything with a long-term positive slant demands patience, discipline and the ability to stay on your path while others will fret over every headline.

Let the rest of the crowd got lost in group-think. That negative tilt is like a constant mirage cloaking the horizon.

My hunch is that if we can't see a correction over the next few months with all this noise, terrible Trump ratings and reel-to-reel media head-fakes, then take heed; this market is far stronger than most will accept.

And that’s a good thing.