Good News? You Can’t Handle The Truth…

The data stream, along with manic headlines seems to be getting grim again.

No matter what the announcement is the information is always deemed to be not good enough.

And when you add in all of the annual October crash fears from decades gone by you can start to wonder how anything actually gets done.

Markets are choppy and churning, and while this is not new though it admittedly weighs on anyone paying too much attention to it.

It’s the headline game that’s been at work in earnest for the last 20 years.

But before we get to that the key factors to focus on for the long-term are:

- Earnings are turning higher

- Forward earnings and revenues are edging into new record high territory

- The page is turning on the oil driven earnings recession

And yes, it's ugly, choppy and frustrating out there, but this too shall pass

Endless Confusion?

Here are some examples of the fear-mongering themes:

- Goldman: It's looking like a 'wave' for Democrats, and that could be bad for stocks

- Stock Prices Under Threat as Global Trade Becomes a Pariah

- The Dying Business of Picking Stocks

- Government Bonds Pounded by Inflation Fears

- What OPEC’s Oil U-Turn Missed: Peak Demand Keeps Getting Closer (Hey, remember how just a couple years ago these same experts warned us of peak oil instead)

- Manufacturers Struggle - Looking for Answers

- In China, Property Frenzy, Fake Divorces and a Bloating Bubble

- U.S. State Dept official 'pressured' FBI to declassify Clinton email -FBI documents

- Trump alienates many wealthy donors in a most unusual US election

- Russia slams 'unprecedented' US threats over cyber attacks

- Restaurants: Restaurant Chains Get Burned by Overexpansion, New Rivals

- Punk Profit Growth Could Kill This Bull Market

- Why the Economy Doesn’t Roar Anymore

- U.S. Budget Deficit Rose in Fiscal Year 2016, First Time in Five Years

- The Next Recession Is Coming

- UK looks at paying billions into EU budget after Brexit

- U.S. and U.K. Consider New Sanctions on Russia Over Syria

- U.S., Britain call for immediate ceasefire in Yemen

- Industrials: How Caterpillar’s Big Bet Backfired

- Stocks, dollar rebound but Yellen rattles markets

- U.K. Bond Plunge Pushes 10-Year Yield to Highest Since Brexit

- U.S. Dollar Rally Isn’t All It Seems

Is It Any Wonder Sentiment Stinks?

I cringe each time I see these waves of misdirection. Sadly, they create a self-fulfilling picture that tends to confuse far more investors than it helps.

And this should not be expected to change anytime soon. Your last bullish sentiment chart update marked nearly a year of weekly readings well below the long-term average even as markets have spent more time chopping around than anything else.

Notice as well that nowhere in these headline streams above do you ever see the more important guiding principal of future growth potential, like demographics showing how your ideal customer audience is growing or shrinking.

Earnings Turn Continues

The grudging turn towards positive earnings growth is continuing.

While it’s still early on the stats are looking pretty solid even if the market is not reacting just yet.

Including the bank earnings reports to date, Q3 results from 34 S&P 500 members have been released.

Total earnings for this group are up +1.3% from the same period last year on +2.9% higher revenues, with 79.4% beating EPS estimates and 64.7% coming ahead of revenue estimates.

Like I said; it’s early doors but things are improving.

From Dr Ed Yardeni we also note that forward earnings rose to record highs for MidCaps and SmallCaps last week.

LargeCaps (at the time of writing), however, fell slightly (0.1%) from their first record high in 24 months from just a week earlier.

All three indexes have been on solid uptrends since March, and MidCaps and SmallCaps have been at record highs since June.

The yearly change in forward earnings for all three indexes has been edging higher from six-year lows in early 2016 as year-on-year comparisons have eased.

And forward valuations are slowly backing down as price and market churn continues, even as earnings slowly climb the wall of improvement.

Valuations dropped to four-month lows for all three indexes last week:

"LargeCaps forward P/E dropped to 16.4 from 16.6. MidCaps fell to 17.3 from 17.5; that’s down from a 14-month high of 18.1 in early September. SmallCaps was down to 17.5 from 17.9, compared to a 14-month high of 18.8 in early September and a 13-year high of 19.6 in March, but is up from a three-year low of 15.5 in mid-February."

Hidden in the Noise

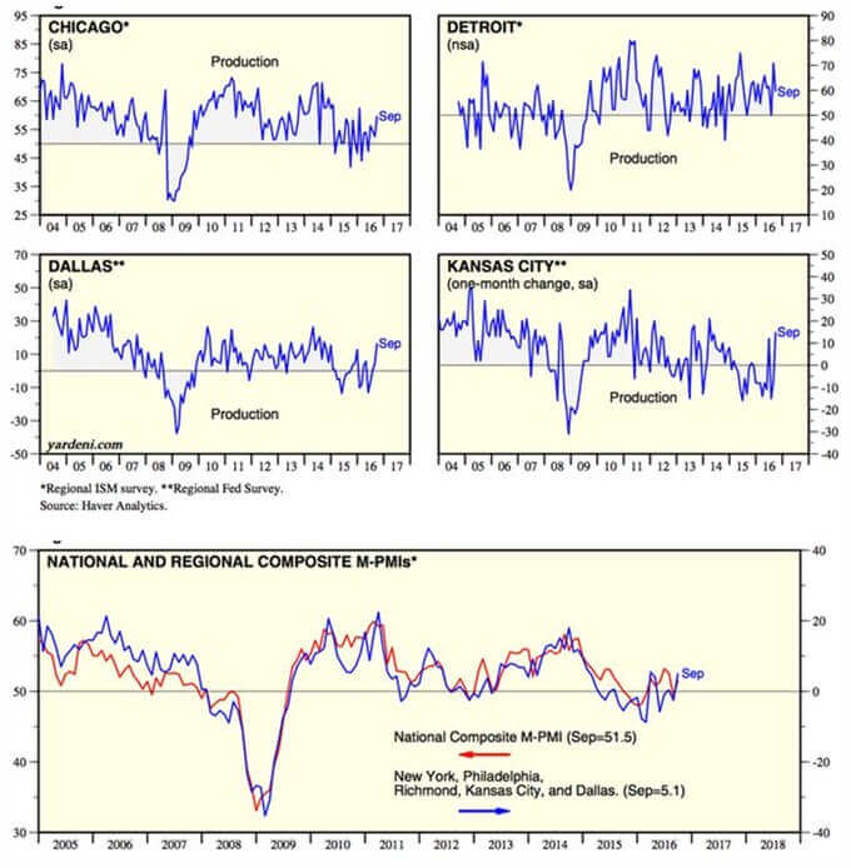

As politics overrun the airwaves and should do battle with earnings fretting over the next several weeks into the finish line, regional production reports are generally showing a solid bounce out of lacklustre (at best) summer data.

Let's take a quick look:

We would argue that these data streams are still showing the lag effect of production order losses from lower energy, drilling and fracking equipment, etc. demand.

As that burns off in future numbers the pace of improvement should return to more normal standards.

In Summary

Knowing in advance it is never fun. My hunch remains that we cannot expect much of a shift while we edge to the finish line on the nasty election front.

It could even get uglier, and far too many investors are likely to overlook the positive elements in earnings reports and focus instead on the bad or fearful concerns.

Remember, investors are paid to focus on the long-term aspects of their overall financial plan.

Straying off course due to emotional strain has been a glaring and historically very expensive misstep.

We are in great shape with a solid future ahead but as always there are plenty of potholes that will always be out there to work around.