Good News Gone Bad

How to turn good news bad:

- There’s been solid US jobs growth…but the doomsayers are saying, "But it's all in services."

- There’s been new highs in forward earnings and revenues, but “It's all driven by free money from the Fed."

- Margins overall stayed steady during the energy setback and are now recovering, "But it's all AI they say - jobs are being lost…"

- There are trillions in cash on the side lines, "But the markets are priced too high and there are not enough bonds to buy."

- Demand is building in the pipeline for many parts of our economy, “But Gen Y started too late and will be overwhelmed by the aging of the US."

- After all the headwinds, fears and angst, markets are just under all-time highs, "But it's all just corporate buybacks on cheap money and debt."

"They" have been saying stuff like this since I started back when the Dow Jones was at 970.

Seriously?

Of course, there are many, many things that could be implemented to make things better. But that’s going to take time…and new occupants in Washington DC.

And you’d think that, after the first six weeks of this year, we’d see at least a little bit of excitement. Does no one remember how we went through the worst start to a year in eight decades! Wow, that was a tough headline to read 137 times each day and 39 times on Sunday - right?

It’s almost like the kid who finally got all but one thing on his Christmas and manages to be depressed all day about it.

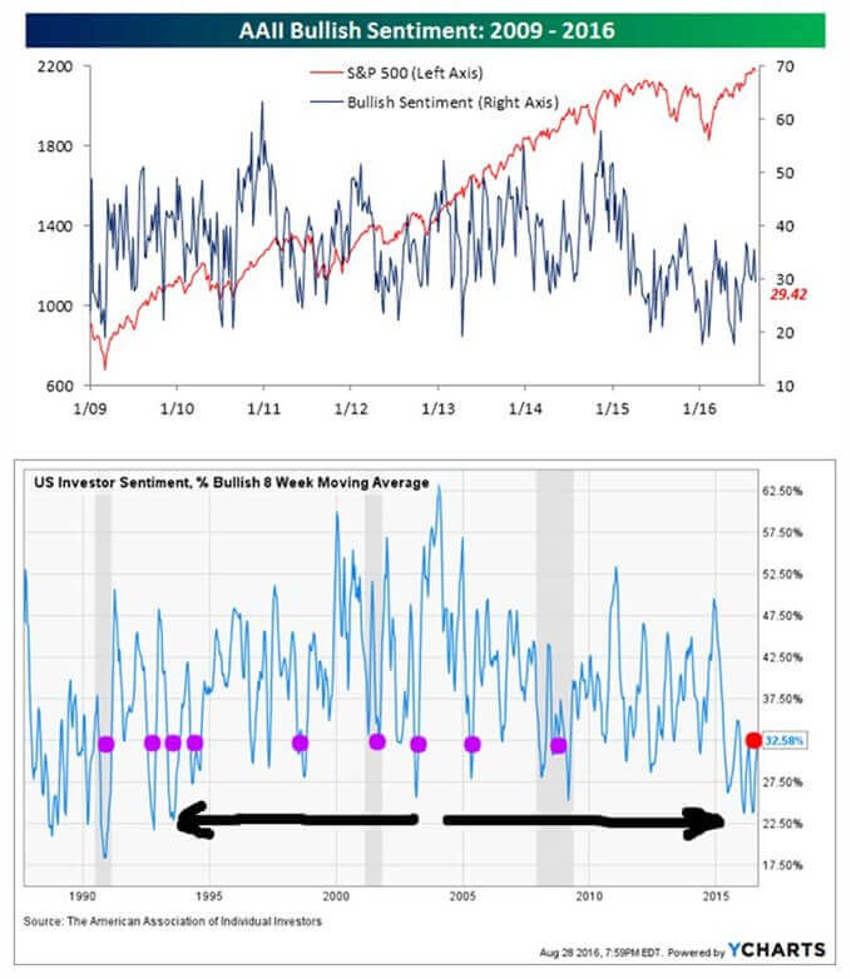

Both the current week and 8-week moving averages of bullish sentiment in the wide population is as tepid as it was after major bear markets of the past. And yet, even as sloppy as August has been, the major indices are hovering just below all-time highs.

In a word: stunning.

Face it - Bulls are Ugly

Investing in a bull market is an ugly process.

Bulls leave you feeling like they’re in the driver's seat; like riding along an old dirt trail, dust kicking up everywhere, almost out of control and at high speed and with your hands tied behind your back.

And you never really know with any certainty where the edge of the cliff is.

It seems every little nick off perfection, every penny missed in a 90-day analyst window, is somehow couched as "this is it" - the trigger to hell.

How else can a long-running business – or any good business - be suddenly deemed as worth 18% - 25% less at 9:00 tomorrow morning and just seconds after an earnings report goes something like this:

"XYZ beats by 14 cents, but reduces Q3 estimates by 3 cents."

Now to the untrained eye that looks like a net 11-cent beat over the two quarters, right?

But not on Wall Street, folks.

Nope. In a millisecond that company went from knocking the lights out, to having peaked, management who can't fight their way out of a wet paper bag, out-dated products and all that’s left is to sell off the furniture and server farm.

Madness....

Bull markets upset everyone, especially after the years of the crap we’ve been sailing through.

And as I speak to lots of people, rare is the conversation about any part of the market that doesn’t eventually bottom out at:

"We should not be here. My gosh, earnings are in a recession, growth is down or slowing, demand is slowing, we have the upcoming election mess, the Fed has no tools left to solve the problem, debt is up to our ears and no one can see where the next growth wave is going to come from, right Mike?"

Sentiment is that bad

Humans are Funny Things

In the end, many never get to the point of actually being happy.

In a rally we wonder why we didn’t earn more. In a sell-off, it's a question of why we didn't have more cash. Or hedging, that new triple-weighted ETF thingie that Bob in the tech department got from his broker…it’s always the same.

The longer a bull market goes, the dumber the "responsible" investor looks. But does our definition of responsible also change as we go?

What is the "right price level" for the market?

5,000 points lower? 2,000? 3,000 points higher?

The only reason I ask is because the current price always seems to be wrong. Check the chart above; 71% of surveyed investors felt it was wrong.

And Now…

Here we are, as summer 2016 comes to a slow and steady close with lots of churn, and more than enough ridiculous valuation reactions being taken while no volume is around.

Nerves are shot, fear is elevated and almost everyone is walking on egg shells, terrified of the next news headline and the next presumed cliff.

It's got to be out there somewhere, right?

Yet, positives abound, though hidden in all the outright disgust. Pretty soon your cab will arrive at the curb with no driver. So too will your pizza and groceries. Just today it was noted that shipping lines are minimizing crews for cargo as GPS, satellites and the cloud take over, dropping shipping costs by some 20%.

The iPhone 7, 8, 9 and 10 will all have many times more technology than men went to the moon on.

We marvelled at that and it drew worldwide attention. Now we shrug if our handheld smartphone can’t hover like a drone and follow us around like a puppy.

Technology is advancing, and we can thank Gen Y for that.

But hold on and take note; this is the first pitch in the first inning of a very, very long game, my friends.

Stocks are near record highs, the US labour market is tightening as millions more jobs open looking for even higher-tech educations. Wages are moving up - also at record highs in the US – as is net worth, cash levels, GDP, and profits across most sectors of the economy stayed high even as energy was routed.

All that, and guess what? We’re still mostly in a funk.

Don't Fret

Long-term investors have to take this in as we come to a summer close: The gloom is a good thing.

It keeps everything in order.

I’ve argued for years that 2008/09 will turn the miserable feeling the mass carries around into a near-permanent condition, much like it was for many after the Great Depression.

Until the economy/markets give us something to really be brutally unhappy about - and they will eventually - we’ll keep manufacturing new fears on our own.

Like it or not. It’s all part and parcel of the bull, and the long-term trek up the mountain.