Four Things to Focus on in 2017

We hope you and yours had a wonderful Holiday Season.

For many, the haze of this time of year does not fully wear off until next week. And it’s just about now each year that we get a variety of projections lists; targets are set, prognostications made and everything is judged - comparisons and shortfalls become the highlights…

And it’s a complete waste of your time.

What’s important to keep in mind is that your results are most appropriately measured by your needs.

So all that terminology being weighed and measured, analysed and predicted, like indexes, ETF’s, funds, alpha, beta, hedging…they seem to go on and on to the point of dizziness.

But, for perspective, things like indexes – which we’re all trained to follow – are always changing, and their participants are constantly moving in and out no matter the choice. For some, those changes are made once a year, and for others the door is always open.

So try not to judge your results based on some human-constructed index that’s always open to further manipulation.

Focus instead on:

- Your goals

- Your return needs

- Your time horizon

- Your comfort levels

There is and always will be ebbs and flows no matter what the strategy is, and there are times when it will look great and others when it will not.

Time remains one of your most important allies. And your time perspective not only dynamically changes your perception of risk but your reaction to its constant presence.

So that said, let's not get too swayed by the waves of prognostications we will hear about as the New Year gets rolling.

It's just a calendar, folks.

New Dawn

You could argue that the political ramifications of the latest election will be felt for years to come.

Easy conclusion, right? But that of course will greatly depend on how much President Elect Trump can accomplish once he is actually in the White House.

We can expect that debate to rage on for some time, and I admit to being intrigued by how much coverage he is getting even before he has any power to actually do anything.

But just imagine what that first press conference will look like!

Immediate Signs?

Stocks and bonds, of course.

And we already seem to have forgotten the bearish argument that’s been in place for years now: Stocks are only going up because of easy money...and they will soon crash.

Almost eight years later and we appear to have shifted towards the idea that stocks will only go up because of false tax breaks, which will in turn; explode the budget, only go to the rich and then make stocks crash sooner than later.

But here’s the thing: No estimates have been broken out yet by the Wall Street analysts’ crowd to officially signify the tax changes this administration is likely to create.

This could be the result of fear - the terms "new" and "change" have been confused with "risky" and "perilous." It was risky to move from horses to cars too but I am pretty sure we are all thankful we figured out how to do so.

Even Now, Scepticism...

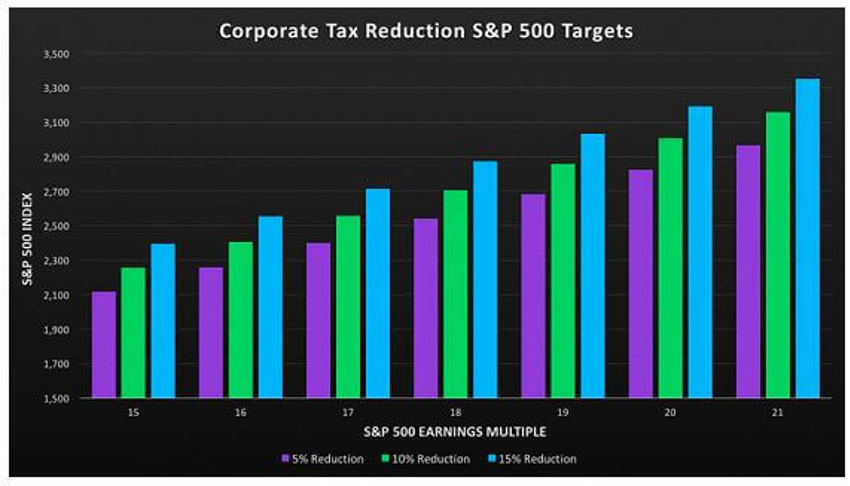

As a reminder to kick the year off, we created the chart above back in mid-December.

It was designed to provide a feeling for where prices may go based on certain levels of (US) tax reduction.

Of course, the chatter is all about when and if it will be retroactive.

And while most have been, this may not be.

In fact, we could find ourselves not really seeing the end result until it becomes real law, maybe closer to summer.

And you might then think, "But Mike, if it won’t happen until summer then earnings will not increase at the pace you note in the chart."

True enough, but by summer 2017, many will be already valuing stocks based on 2018 earnings.

And the hits just keep on coming.

A Comeback?

Could the Old Normal be making a return - maybe Old Normal 3.0 replacing the New Normal that’s been present since 2008?

And could the election result have marked a replay of the Old Normal business process?

This might be why forecasts are rising, and not just for earnings. Stocks, interest rates, GDP and production levels have all seen increased focus.

New fiscal policy may now become the more important focus, leaving the years spent exclusively on monetary policy on the doorstep of time.

And what about the end of the Central Banks focus?

As our previous notes have shown, US Federal Reserve officials have been calling for fiscal stimulus to boost economic growth so that they could proceed to normalize monetary policy.

For almost nine years now, investors have been trained to perceive that economic outlook and the prospect for the stock market were almost entirely based on the ultra-easy monetary policies of the Fed.

It's just a hunch here, but the winds may be changing.

Going forward, monetary policy may matter less, while fiscal policy, which hasn’t played a role at all, could become a more significant lever.

Of course, as always, be on guard.

Anything that moves us forward will be met with a whole new slew of monsters, and they will be presented as bigger, uglier and more perilous than we have ever seen before.

The Bottom Line

It's likely that close to half the population of the U.S. is still fearful of what Donald Trump will do once he becomes the most powerful man on earth.

But let's try to keep that in perspective.

Since November 4th, when expert opinion held that Hillary Clinton was almost sure to win, the following has unfolded:

- The value of the U.S. stock market has increased by just over $2 trillion, according to Bloomberg

- The expected real growth rate of the U.S. economy has increased by roughly 0.5% per year according to the bond market, translating into roughly $1 trillion more per year in national income, and

- The global purchasing power of U.S. residents has increased by about 6%, according to the foreign exchange markets

That's an awful lot of value being moved around, a fact often lost in the shuffle of media coverage.

As the New Year gets its legs and wobbles off the floor and into the future, the question becomes whether the market has gotten ahead of itself.

Yet, as we noted for you before the break, chief economic adviser at Allianz, Mohamed A. El-Erian, has suggested the market has, "Priced in no policy mistakes ... no market accidents ... [and] ignored all sorts of political issues."

We have echoed something of the sorts here but not with such dire tones.

It is clear that the market has priced in good things that have not yet happened. Patient investors will therefore accept that it leaves the market averages vulnerable to near-term disappointments from an implementation point of view.

One can be further assured that most in the media are ready to aggressively pounce on any hurdle Mr Trump hits after he is officially President.

Yes, there is much to accomplish to get that pick-up in corporate profits and the needed actual reduction in tax and regulatory burdens.

That being the case, it points to lots of upside potential as the chart above notes, but not without work and patience.

Time Heals....

Many remain worried by the idea that all these ugly old business guys could really muck things up.

That is highly unlikely but it will be different.

As all of this unfolds, we must instead remain very focused on the long-term benefits baked into the US economic system; the demographic trends from which we are all set to benefit, and keeping in mind they are in place for the next 30++ years.

While the message is designed to remain simple, it should never be confused with easy.

Stay the course, be patient and keep your eye on the long-term horizon. The early 1980s playbook is being dusted off and peppered with a few new twists.

And remember that with the dawn of 2017 we should just expect part of the ride to be ugly; it is part of every historical return.

Until we see you again, may your journey be grand - and your legacy significant.