Fascinated by Fear & Greed

So here we are, approaching the tail-end of the latest earnings season, and I think too many folks out there will make the mistake of moving into that short-term, mental process that asks: "What have you done for me lately...?"

That would be an error.

If you look back on years of returns you’ll find that it’s not abnormal to see a couple good years in market indices followed by one that feels more like a pause.

The logic backing up that theory for the structure of this current market resides in the simple idea that; as increases in market values finally sink in after the terror of 2008-2009, rates will feel some upward pressure.

That’s not a bad thing, but it does cause an equilibrium problem on a short-term basis.

We have had periods in the past where strong earnings growth arrives, but P/Es actually fall off as prices "stall-out" in order to essentially digest the previous year's gains.

But instead of causing concern, despite how ugly the headlines get, you would be better served by focusing on "what's next...?"

History shows that those years of "pauses" are followed a vast majority of the time by years where the markets accelerate to the upside again, and do so from a better value base as earnings move upward.

So, if we end 2018 with smaller than hoped for gains, be confident that the stage is then set for a significant valuation reset in 2019, as solid earnings will only serve to make the numbers look even better.

Speaking of Earnings

Here is the latest update from Thomson Reuters I/B/E/S data (by the numbers):

• Forward 4-quarter estimate: $158.07 vs. last week's $157.78

• P/E ratio: 17.4x

• PEG ratio: 0.86x

• S&P 500 earnings yield: 5.75%

• Year-over-year growth of the forward estimate: +20.27% vs. last week's +20%

Once again this week the Thomson Reuters data showed a sequential increase in the S&P 500 "forward 4-quarter estimate" to $158.07 and a y/y growth rate of over 20%, which continues to indicate that the positive story around S&P 500 earnings flowing unabated.

But I have a hunch most folks are still just ignoring it.

As per the above, boredom may once again step in given we’re nearing end of the latest earnings parade.

So, it’s important to keep in mind the PEG ratio (above).

It’s fascinating that we have risen this far from the 2008-2009 panic lows and are still below a 1.00 level for valuation.

The "bad news" remains centred around the apoplectic perception of the rise in rates as the fear bubble has only slightly burned off.

(Have a look at the bond market video we put together back in January - please review it here again - the password is: BondReview0118).

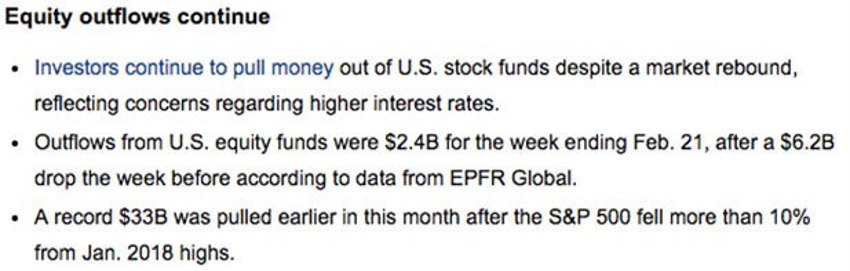

We saw how quickly that bubble can refill, as the passive SPY saw record outflows 10 days ago.

And the good news for long-term investors is that those outflows continued last week, even as stocks worked to find a stable footing while panic subsided…slightly.

Better Yet?

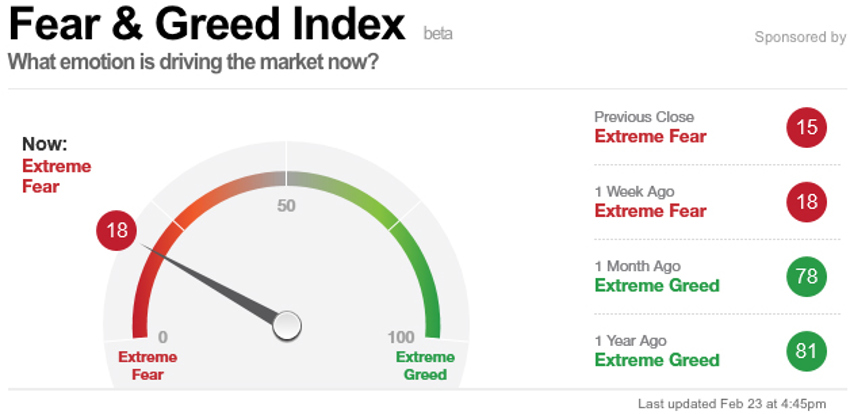

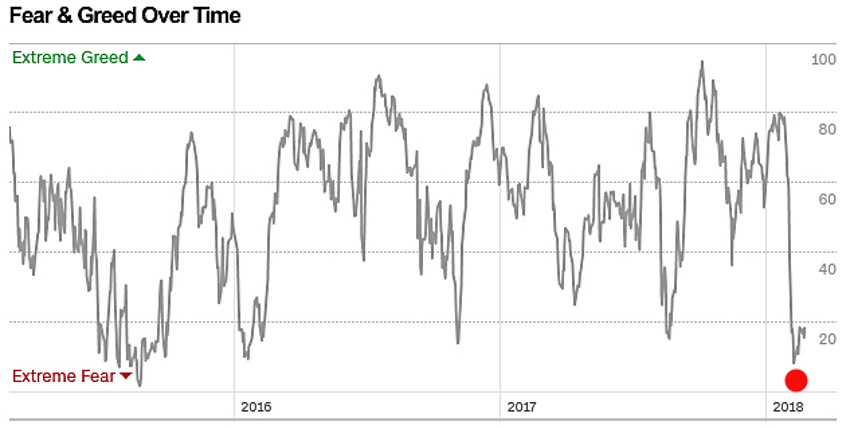

Fear remains nicely embedded again in the CNN Fear and Greed Index.

Both charts below suggest continued chop and churn should provide solid values for the long-term investor who is patient enough to look beyond this latest panic attack:

Folks, the point here is pretty basic: As we moved 17,000 points up it was kind of "ho-hum" all the way. Then as we drop a few thousand points it’s become "get me outta here now....!!"

I don't mean to be repetitive - but this is almost exactly what you would want to happen as a long-term investor.

In fact the only way it would be better is if it lasts a little longer than a week or two.