Far From the Maddening Bears

My wishes for a summer swoon thus far appear pretty bogus…

Just about everywhere you look we’re breaking records.

Except of course with sentiment, where the eight-week moving average of bullishness in the latest AAII Survey release is 30.96%. That said, the one-week reading rose all the way to 35%.

Hence, at all-time record highs in every major index, a mere two thirds of the crowd are still either bearish or neutral on the market in the future.

Go figure.

The negative sentiment, the mad rush into bonds on any two-day setback, and the more than $10.7 Trillion sitting in cash in the bank suggest we’re in an extended bear market.

But we’re not. We’re far from it. And historically this suggests continued positive surprises ahead.

Read'em and Weep

America has world-leading demography. And the gears are grinding forward with steady improvements and an expanding economy.

Despite all that most eyeballs are focused on the wrong things: Headlines.

Here’s something to think about.

The very first eight-week moving average of AAII Sentiment was way back on September 11, 1987.

Sure, it’s a spooky date, but that moving average in bullish sentiment was 46.62%.

Back then, the Dow Jones Index stood at 2,576.

Check out the link to the front page of the Business section of the Chicago Tribune on that date here and you’ll find bad news is nothing new.

Now fast forward to today and we’re looking at a Dow Jones that’s nine times higher, with a bullish sentiment reading that’s 35% lower.

Find me the logic in that.

Just a smattering of records:

Earnings are at all-time highs.

LEI's for the month just hit another new high with a 0.6% rise - the largest monthly rise of the year on top of that!

Japan will keep rates low

Europe will keep rates low

The 10-year rates here were expected to "crush the recovery" just last week, when it rose from 2.10% to - gasp - 2.38%. Not.

Two things on the interest rate fears:

- 1. The 10-year is back to 2.24%, and

- 2. If there is anyone concerned that a rise from 2.10% to 2.38% in the 10-year yield will somehow dismantle a $20 trillion economy then please do not invest in the markets.

Washington DC Lost

In the larger picture there is a positive as it relates to the complete incompetence in DC: The market is telling you clearly that something else is more important.

Just a Heads-Up

I am certain somewhere in the next 48 hours, we will hear something terrible is to come from the multi-day winning streak the Nasdaq has set.

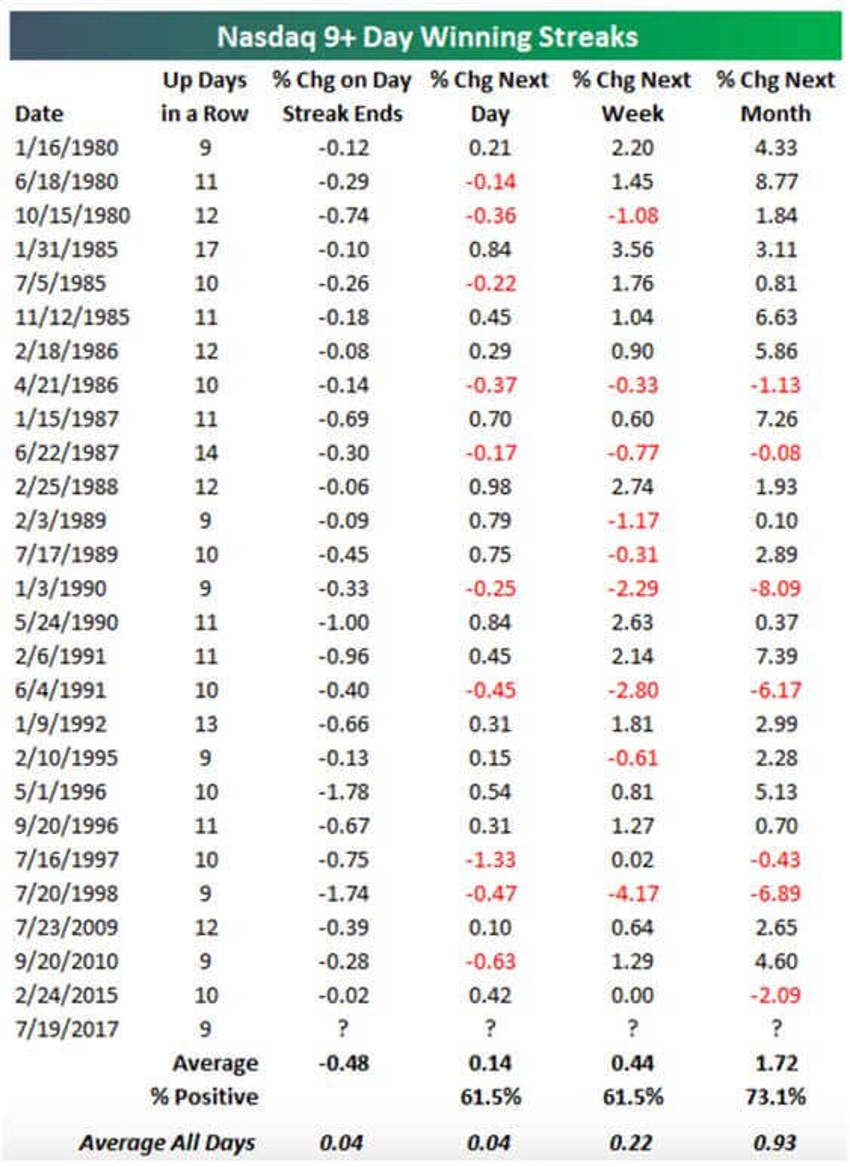

Here is a chart of that data - and all previous 9-day+ winning streaks:

Note in the chart above how the Index performed in the days and weeks following the end of the streak.

The summary at the bottom of the table hints overall that the Index has done slightly better than average in the week and month after these long winning streaks have ended.

As such, conventional wisdom suggests we might be due for a pause or pullback after a long winning streak doesn’t really hold water.

Hoarding Money

When we started the year, I noted the US had record levels of savings - a tidy $9.2 Trillion in consumer savings accounts earning zilch.

The goal was simple: Keep it safe from that ugly old volatile stock market which, sadly for those in the bank, has once again proven scared money loses long-term.

But guess what? Fear is still expanding, and so is that mountain of cash. Care to hear what that tidy little sum has grown to as of June 30?

$10.7 Trillion! That’s from the latest FDIC data.

You can always smell fear. It has footprints. It leaves a mark. And it singes the brain so badly sometimes that the economic bogeyman seems real to even the most sane amongst us.

The Great Recession will reverberate in the psyche of America for decades to come. It changed everything related to investing.

And the really, really sad part about investing - is the market does not care. We are enjoying the best job market we have ever seen in the history of the country, yet the consumer is frozen in time and reluctant to spend freely due to…exactly…what?

That's not all.

Liquidity remains the key.

Of that $10.7 Trillion in the bank, a full $2 trillion of it is sitting in checking accounts.

A Lesson on Movement

Make no mistake, we are the cause of our "slow economy." Our collective fears about a slow economy are indeed causing the slow economy. The average dollar spent moves roughly six times in the US Economy - meaning you spend a dollar today and it moves around to six other spots and produces a result; an impact.

The point here is that money moves. It does not sit idle. Think of it as a little robot that keeps moving through the economic landscape.

And purely because of our fear of "economic uncertainty", we have removed 10.7 trillion of those little robots out of our economic machine.

But if we all collectively decided tomorrow that we were going to be only $9.7 Trillion worth of "scared to death" versus the current $10.7 Trillion worth of fear, America’s GDP would expand by roughly 5% - 6% a quarter for the next 18-24 months minimum.

That’s an explosion. A good explosion.

When you release a trillion dollars of new capital for investment, small business, technology, corporate expansion, jobs and non-scared spending into our economy and it will grow.

And when it finally does happen, someone will be there to tell you a) what's wrong with it and b) why you should be terrified of it.

Up Next?

As we meander into the end of July next week, we will enter the last stage of the summer haze, and the already thin crowd will get thinner. Volume will fall, choppiness will likely increase further and people will worry.

But long-term investors should look beyond all this and focus on the real driving forces of the economy - the Barbell Economy is working just fine thanks. And the good news is that these driving forces are in place for decades to come.