Don’t Fall for the Short Term Falls

Sometimes things sneak up on us.

And it’s an unfortunate characteristic of human nature that we often immediately assume that whatever is doing the sneaking is a bad thing.

That attitude can keep us on edge - even if you’re not aware of how it’s affecting you – kind of like white noise; you don't know it’s there until it isn't.

And that trail of fear is like breadcrumbs forming a path from the moment the surprise arrived to where we are now.

That’s certainly the case now. Think about it in terms of the investor herd response in the following ways:

-

There’s $9.3 trillion in cash sitting in consumer bank/savings accounts

-

Less than 10 days ago, the 10-year bond auction had the highest number of personal consumer bids in the history of bond auctions at 2.12% (that's what I call fear)

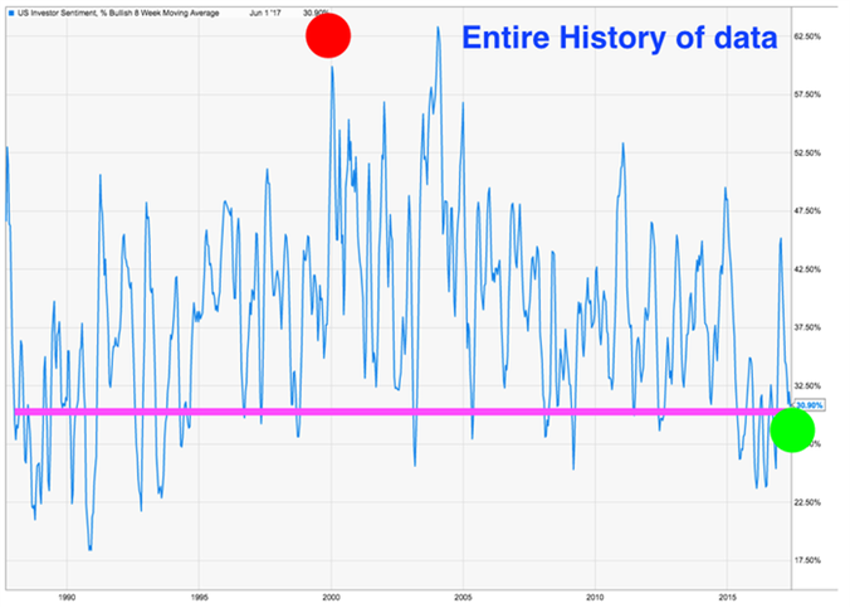

And then there’s the investor sentiment measures. Let’s kick that dead horse again:

Now, the above is probably going to take a few minutes to sink in....

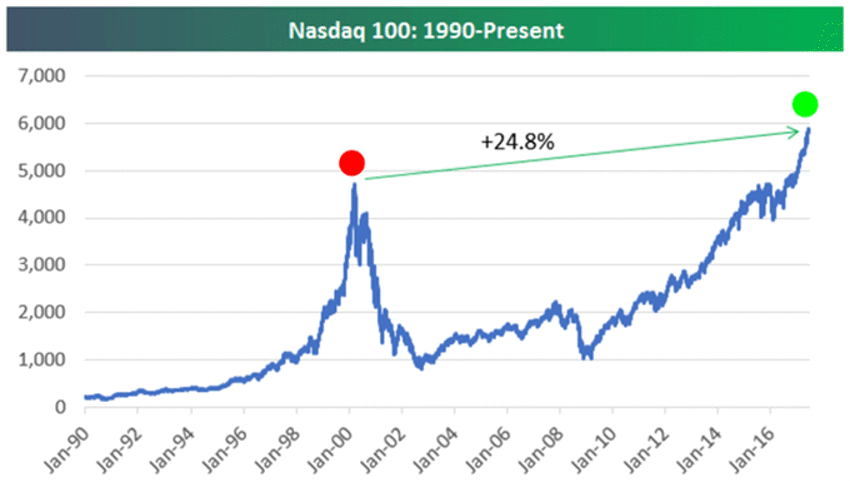

The top chart is the Nasdaq 100 going back to 1990. The bottom chart shows sentiment going back to 1986.

Have a look at the matching red and green circles. Logically speaking - you would expect these to match. The red dots mark the top of what became known as "the tech bubble." The markets were at record highs - and sentiment (also marked in red) - had also reached record highs.

In essence, the masses were certain stocks would grow up to the sky, which can be seen in the record levels of bullishness at the time.

Now here is the eerie part. As the top chart shows us, prices today are almost 25% higher than they were when the masses were clearly in love with stocks!

Yet, as both spots are marked in green we are now near record lows in blended AAII bullish readings.

Logically, there’s no reason for this.

It is all emotions. And those, historically, have been very expensive for most investors. Look for a repeat of that mistake again, because there will be a time when the lower chart reaches the same levels we saw in 2000 (marked in red).

History teaches us that is unlikely to be based on lower prices. Indeed, we have seen a rally of 15,000 Dow Jones points since the lows of 2009.

And sentiment? Well, the 8-week MA chart shows you we are barely above the reading seen in all of 2009.

Based on the underlying fears still solidly in place many years into recovery, the data suggests it will be thousands more Dow Jones points before people feel "good" about stocks again.

There will be a price. But as stated before, that is unlikely to be a lower price from here.

The lesson: Pay attention to the underlying current, not the waves.

S&P 500 Earnings, Revenues & Values

Q1 earnings season is behind us. In another seven weeks the next season will begin for Q2 data.

S&P 500 consensus forward revenues rose to a second straight weekly record high. At the same time, forward earnings was at a record high for a ninth straight week!

As the Millennials of Generation Y move into the marketplace we can soon expect margins to expand as their deflationary force brings costs down.

The good news?

Forward profit margins rose week-on-week to a record high of 11.0% from a long-standing 10.9%.

The profit margin’s record high is its first since September 2015, and up from a 24-month low of 10.4% in March 2016 - right after the "the worst start to markets in over 80 years."

Dr Ed Yardeni tells us that forward revenue growth for the S&P 500 was steady week-on-week at 5.4%, but that’s down from 5.8% in late January, which was the highest since May 2012 and compares to a cyclical low of 2.7% in February 2016.

Dr Ed and his team also tell us that, "Forward earnings growth improved to an 18-week high of 11.3% from 11.2%, which is down from 11.7% in January; that was the highest since October 2011 and compares to a cyclical low of 4.8% in February 2016."

Beat or Ignore?

Where is it written that as an investor I should have the singular goal of "beating" the overall stock market on a total return basis?

What if my goal instead needs to be more focused on compounding income in ways that the S&P 500 index is not capable of generating for me?

Let’s say you build a stock portfolio that produces significantly more dividend income (even better, if it compounds each year) than the S&P 500.

Has the investor somehow "failed" because partial capital appreciation components may be lower during certain periods of time?

Personally, I think that's an error in an investor’s mental framework. That’s because sometimes judging success or failure based on outperforming a benchmark such as the S&P 500 could really prove problematic to other important client goals and objectives.

The problem arises because many folks misunderstand the vagaries of short-term price action. And through that misunderstanding, the error can be compounded by actually assuming something "must" be wrong, and then a change takes place when nothing was really wrong at all.

Sure, at times as an income investor there is the risk that you could be forced to "harvest" shares during a bad market in order to meet income needs. In doing so you invade your principal at a time when it might be better to simply hold on.

But the flip-side of that decision begins first with better planning for the pathway ahead and allowing room for those risks.

And if you build a dividend growth portfolio that is producing an adequate amount of dividend income to meet income needs, short-term price volatility can become far less consequential.

Remember that the compounding dividend income stream is based on the number of shares you own and as such tends to be more predictable and reliable, regardless of what the market may be doing on a short-term price action basis.

History shows us that even when the market price of a stock is falling dividend incomes can actually be rising, assuming you picked the right dividend growth stocks.

The Bottom Line

Slowdowns and hiccups in the monthly data are dead ahead because everyone will be at the beach and spending time with kids now.

And as far as the annual fear of a summer market swoon, expect it don't fear it.

Why? If you look at every other summer swoon in history they were all at lower prices than where we are now.