Did You Miss the Market Correction?

For the final few weeks of August here are a couple of thoughts:

- It’s slow

- There’s no volume

- There are no buyers, and

- The 3rd string team is manning the trading desks.

The bad headlines hit and the selling happens.

Reality Break

That said, Q2 just ended with record-setting elements across the board.

And let’s keep in mind that Donald Trump did not cause this to happen any more than he "caused" the rallies.

That’s not me being politically-minded. Business is simply better than it was, here in America and across the world.

Sure, there will be something terrible that happens in the future, but it will have nothing to do with 2008-2009 - so stop thinking about it.

Let Me Remind You...

Here in the US at the official start to summer the SPY hit a high of 241.90.

This week the SPY closed at 243.09.

Now, for all of you math geniuses in the crowd that's a move of 49 basis points or less than 1/2 of one percent.

So you tell me if more good or bad has happened since the start of summer?

Better yet, here’s what I wrote in the week prior to the start of summer:

"Let me warn you ahead of time, this summer is likely to be like most every summer. Ghosts will appear around every corner - each being a culprit for the assured, all-too-feared summer swoon. There will be so many of them, your head will spin.

I tell myself every summer that I am going to simply ignore it all and enjoy the summer because it is most likely make little to no real headway - with lots of chop in between.

And as for that summer swoon - bring it on. History teaches us they are valuable in time - not something to run from as so many do. My hunch is, if we are lucky enough to get one, the latter stages of August - the haziest of the summer doldrums - would be your best bet."

Just another summertime performance.

The Good and the Bad

The correction everyone is terrified of has already been unfolding for the last six weeks or so.

The major averages have masked the event due to the moves of the top 10 cap-weighted stocks, which now account for roughly 2.50 full percentage points of the S&P 500's YTD gain.

The same goes for the Dow Jones where there is overlap.

It's called “big-cap disease.”

And do you know what’s causing it?

That flood of money into the "easy" ETF stuff.

That’s because every time you buy one those same stocks go up - whether they should or not.

Now let me give you a sense of where the broad market is in terms of YTD gains as of last evening - for all those who do not have all 10 of the top stocks:

NYSE Composite: +5.94%

Equally-weighted S&P 500: +5.83%

Russell 3000: +7.70%

DJ Total Stock Market: +7.75%

My point is that the markets have been chewing each other up internally for weeks now.

When the frustration builds for too many investors they just buy an ETF.

And as I’ve warned here before: “When the student is ready, the teacher arrives. And sometimes that happens even when the student isn't ready.”

More to Back That Up

There are two snapshots below.

They show you the number of NYSE stocks trading above their 50 and 200-day moving averages.

Look at how low these numbers are. In both cases they are nearing (or already exceeding) lows that have often correlated with major bottoms, and yet they’ve been falling for many weeks now.

This explains both the numbers above, and the spread between the real, broad market and the major indices with all the tech-heavy cap weightings:

OK, so the first chart above shows the number of NYSE stocks currently above their 50-day averages.

It’s only 39%.

Ouch!

The second chart shows the number of NYSE stocks above their 200-day moving average.

Both are pretty ugly. And both of have been happening behind the scenes while the major indexes kind of hid that process with their odd-tech weightings.

Now, the other thing you might want to note are the dots that I’ve placed on the chart.

When compared to the last two major periods of fear: Election Day Eve and "the worst start to markets in 83 years" with lows back in February of 2016.

This data suggests to me that many have already sold.

Want to know what’s even stranger?

This is all being driven by the fear of a coming correction that’s already been unfolding.

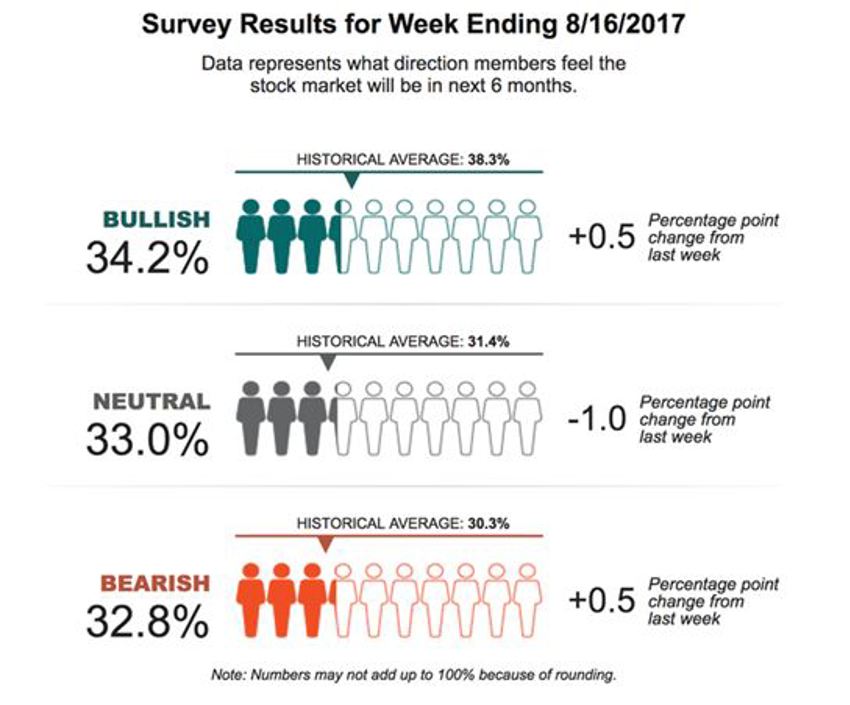

Sentimentally Speaking…

Investor sentiment once again show bulls are nearly hibernating, maybe even for good.

They make up just one-third of the crowd now in the very same week when records are being set.

The peril here is, as always, in buying into the short-term, emotional news that forsakes the benefits of thinking in a long-term structure.

These are the trying times of each year. And it rarely changes.

The media headline spin will reach whatever fever pitch it takes you to keep you reacting and clicking.

Expect pure nonsense.

And when the dust settles and everyone is back to full force, all sorts of "bargains" will be unearthed and the process will go on.

Focus on demographics and not economics.

The former drives the latter.