Dampening the Fuse to Market Euphoria

I say it all the time: Pray for the things that we fear because they create long-term opportunity.

Thankfully, we’re seeing it every week; the markets rise, trip momentarily, and then rise again. And with every trip the investor herd panics and scatters.

That action continues to keep the powder dry on this market’s future boom potential and dampens the fuse to market euphoria.

So, in this pundit’s view the current market boom is just getting started.

And all of the negative chatter about Generation Y being lazy, unmotivated and happier to eat out of mom and dad’s refrigerator than go out and build something for themselves is like another ice cold bucket of water being spilled onto that reaction.

Sure, the Millennials are late in getting started. And instead of joining the workforce right away some got multiple degrees in order to begin with six-figure incomes.

Late for them means more market investment time for us.

But maybe it’s time we wake up and smell the holiday-spiced coffee:

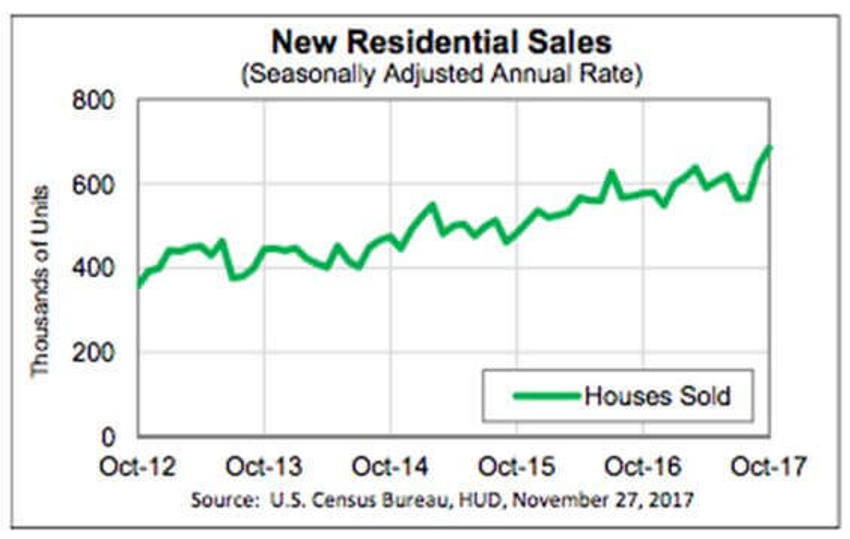

Yep, that’s right; 685,000 annualized US home sales have created a 10-year high in the residential market.

The even better thing is that we are miles and miles and miles away from where America needs to be in this area, as the latest release this shows only about a 4-month supply on hand.

Over the next 5 to 10 years, over 60,000,000 Gen Y kids will be moving out. There’s only so much refrigerator space at mom and dad’s once the next generation of marriages and children begin to arrive.

So, as I said above, pray for more corrections.

About that Yield Curve Thing…

You can’t avoid the ongoing Armageddon theme in the financial press.

The latest of the popular Black Swan candidates is the yield curve. The issue is that it’s “flattening” and the so-called experts are saying it will soon invert.

That means the world is going to end…again.

Can we stop fretting over this please?

As "millions" are apparently worrying about this flattening of the Treasury yield curve, breathless stories continue about our nation's malls are emptying, surging subprime auto loan defaults and students defaulting on loans by the truckload.

And yes, these are all disturbing developments. But a great many more things need to unfold, at the same time, before the economy is at risk of falling into another recession.

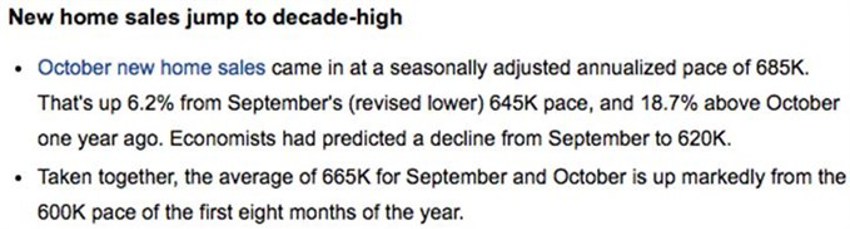

On the flip-side we can see that credit spreads are still relatively low (even as GDP and earnings hit record highs), swap spreads are very low, real yields are very low, inflation and inflation expectations are right where they should be, and the financial system has tons of liquidity.

The following charts can help to put you at some ease the next time you see these blaring headlines:

Remember as well that Bond market players are not nice. Rest assured, if the world was coming to an end or liquidity was drying up or the curve was inverting, they would be the first to charge you for it.

And a rate of 2.34% over 10 years is not what I would call charging you for it.

The above chart shows 2-year swap spreads are among the most widely-followed and favoured indicators, because historically they have been good leading indicators of economic conditions.

In normal times, swap spreads are 10-30 basis points.

Today they are at 18 bps.

That’s just about perfect, and it means that liquidity is abundant and systemic risk is low. In other words, the financial markets are not worried at all about widespread defaults or a liquidity squeeze.

And by that measure the markets are telling us that, in today’s world the US Federal Reserve hasn't tightened up at all.

So, if you want to hear someone tell you that we’re living in an economy like we were back in the 60's, 70's or 80's then I’m not your Huckleberry.

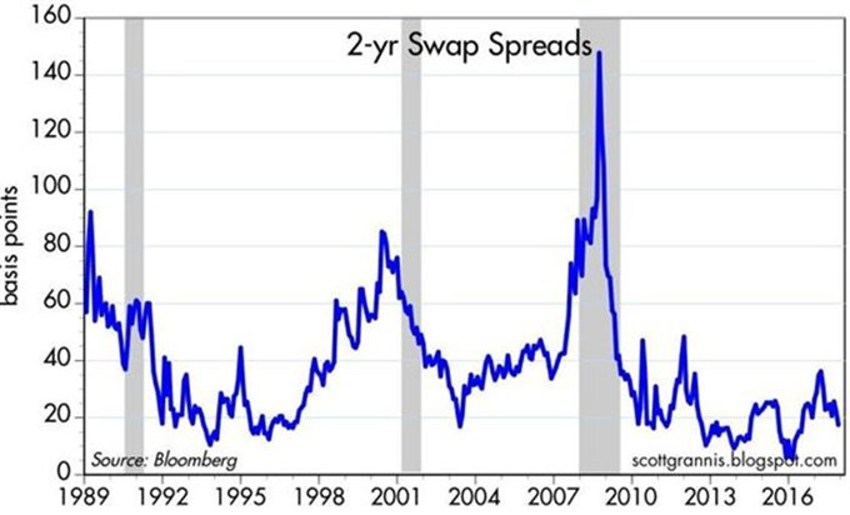

The chart above from Scott Grannis of the Calafia Beach Pundit shows us the real yield curve in action.

Real yields are the true measure of how high or low interest rates are when we assume the current rate of inflationary pressure.

We’ve often noted this is the current fly in the ointment - and it will get even more forceful (in a good way) as Generation Y moves deeper into the business world and corporate structure.

They are the most deflationary business force we have witnessed to date.

Putting that in a slightly different way, a 10% yield in a 10% inflation environment is not a big deal, but a 10% yield in a 2% inflation environment is a killer.

The blue line on the chart above is the Fed's real short-term interest rate target.

It currently sits at about zero - well, it will do in December when the Fed will almost surely announce that rates will rise another quarter point to 1.5% (US).

Now, that's just below the current underlying rate of inflation (1.6%) according to the PCE core deflator, which is the Fed's preferred measure of inflation.

(PCE Core inflation is typically about 30 to 40 bps less than CPI inflation.)

As the chart also shows, the front end of the real yield curve is pretty flat.

What that means is that the bond market does not currently expect the Fed to tighten much more after their December meeting - keep in mind that if growth picks up and fears fall, rates will rise a little further and the Fed will follow it upward.

The 5-year real yield on TIPS (the red line) is effectively the market's expectation for what the real Fed funds rate will average over the next 5 years.

Note that prior to the last two recessions the real yield curve inverted: the blue line rose above the red line.

That meant that the market expected the Fed to start lowering interest rates in the foreseeable future, because the market sensed that monetary conditions were beginning to undermine the economy's fundamentals.

That's not the case today.

So, until we collectively see the yield curve actually invert, real yields move substantially higher, swap and credit spreads moving significantly higher, and inflation expectations rise, a recession is very unlikely for the foreseeable future.

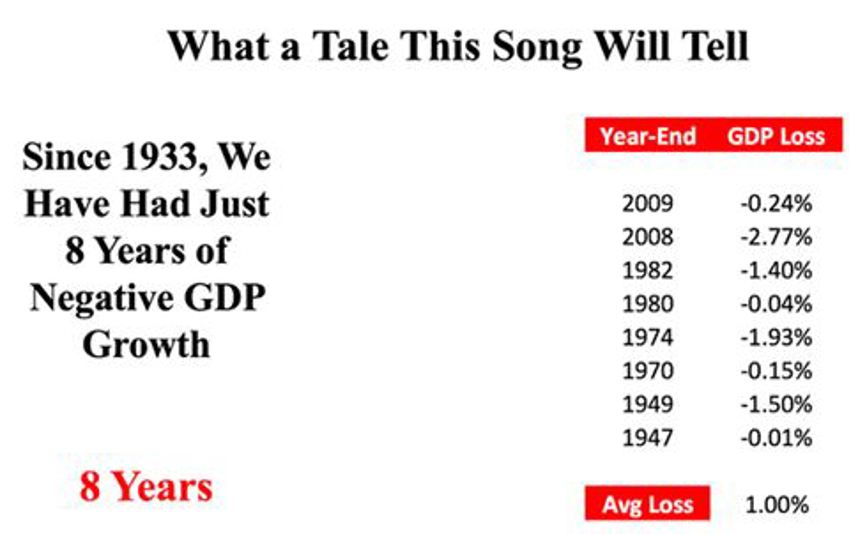

I provide you this snapshot again to remind you we have seen only 8 years since 1933 where GDP growth has fallen, and each year this was followed by new gains:

In Summary

Keep these things in mind in amongst all the headline insanity to come.

The dirty little secret of successful, long-term investing is that, “he who moves less, wins.”

Folks, long-term thinking always wins out over short-term trading. And worrying about the next setback sells lots of ads but makes almost no money for you.

History proves that.