But This One’s Just Right…

Analysts are rarely satisfied. There just never seems to be that Goldilocks “But this one is just right” moment. This is once again the case with the recent US jobs numbers. Lots of revisions and chatter about ebbing and flowing, losing strength or gaining it.

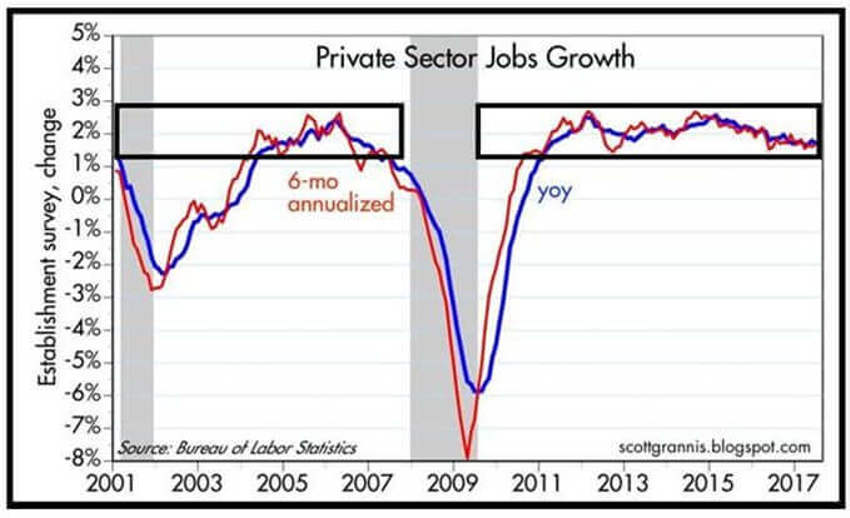

Have a look at the chart below from Scott Grannis of the Calafia Beach Pundit.

It shows jobs growth as a percentage of the overall base. And it helps provide a sense of stability – neither too hot nor too cold.

I’ve also added in the two black boxes to show the pace of growth has been pretty much the same for nearly 18 years…interrupted only by the economic shocks of the tech bubble in 200-2003 and the 2008-2009 debacle:

You can see the best jobs growth over the past 15 years or so was just over 2% per year.

Currently, private sector jobs are growing at a pace of roughly 1.7%.

Nothing to write home about, but not exactly a disaster either.

Keep in mind, we will see this slow process for a bit longer as the baton is passed from one generation to the next – the Baby Boomers to the Millennials of Generation Y.

Politically Speaking

As for the economic drama created by the spending of the previous US administration? We’ll spend years paying back the extreme waste that created massive debt levels in the name of social experiments.

It’s not politically correct to say, but the numbers don't lie.

One huge reason this has been a tepid recovery is that we've had weak jobs growth on top of very weak productivity growth, and both are explained by a dearth of productive investment.

It is the process we have lived under for most of the last 10 years.

Corporations have generated significant profits in the current recovery, but most of those profits ended up funding the federal government's voracious appetite for debt.

So what happened to all the profits?

Scott Grannis writes, “Almost all of the most incredible surge in profits in modern times was squandered by our government, flushed down the Keynesian drain."

But, we will trudge forward and get beyond this "weight around our collective economic neck" in time as companies begin to turn the corner toward more productive investment, and regulatory burdens are rolled back.

What’s Next?

Well, let’s not allow our emotions to destroy wealth-building goals, as they have for so many over the years.

It's summertime now, folks. It's supposed to be boring out there.

And during this hazy part of the year there is a huge reach to make "something" out of what often becomes nothing at all over time.

Because of the thin crowd, low volumes, and lack of interest the media process turns it up a notch to grab your attention.

So, we’ll hear much about the US Fed, Donald Trump, North Korea (a China manufactured event), interest rates, upcoming earnings reports (which should be just fine) and anything else that might work to scare you a bit.

Long-term investors will look beyond all that and focus on the real driving forces of the economy.

Patience and discipline has taught us that every summer swoon before now has been a good deal in the longer term.

As For the ‘Market Top’ Callers

Yes indeed, summer is full of them.

Any sector twitch, any internal churn and every couple of days of red ink stretched together will bring the market top callers out.

Always scary, right? The thing is that these folks never seem to get blamed for calling the top that never arrives.

Being dreadfully wrong is ok…as long as you’re pessimistic about it.

The Bottom Line

The data makes it clear that surprising growth waves are headed towards America’s economy. And those growth waves are being driven by people.

On one end of the Barbell economy, lots of people are starting the last exciting 40 years of their lives.

On the other end, a new record-setting generation of young people are becoming adults.

They will do certain things en masse - and are set to change the world in ways we cannot even imagine yet.

So, pray for that summer swoon - it's happening in the churn.

And, as always, think demographics not economics. We stand by the idea we are in far better shape than the vast majority of investors currently realise.