“Big Decisions” That Mean Little to Nothing

Ok, so now we "know" what the US Federal Reserve will do as regards interest rates, which is, uhm, well, nothing really?

After 2.8 seconds, the slicing and dicing began as machine traders were programmed for trades for both the words "raise" and "no change." -The average John Doe investor out there had no chance.

So what does it all mean for you and me; those of us focused on the long-term structures in place that are driving our economic growth ahead?

Little to nothing.

And as forewarned is forearmed…the media is already warming up the "Now we need to prep for a December rate hike" headlines.

The next time the world tells you to fret over a 25-basis point rise in rates please just stop and think about it for a moment.

Your portfolio and your blood pressure with both thank you.

Step Back for Review

It’s imperative that we consider the whole interest rate cycle – deemed a monster on everyone’s doorstep – for what it really is; a pitch in the dirt.

Rates will eventually rise for good reasons. When they do it will be because the economic might of the US is slowly but surely healing from the deep emotional scars left by the Great Recession.

And as we stated at the time, "The emotional scars to our economy will last decades longer than the financial damage."

The Larger Point

By example, when the Fed raises rates by 25 basis points, do you really think that matters to a well-run company?

Does it matter if they raise rates when companies continue to refinance bond debts at lower and lower costs for very lengthy periods of time?

Will a rate hike - no matter when it comes - actually change anything for most companies?

The answer is: Very, very little.

What about those who are worried that a rise will crush their dividend stocks?

Complete nonsense. Sure, dips and corrections will come but make sure you focus on that instead of the fear surrounding it. If the Fed raises rates by 25 basis points in a year and your dividend producing stock does the same - are you really any worse off?

Now here’s a real life example that took place just this week: One company, one set of bonds and one small debt refinancing in a sea of corporate debt refinancings:

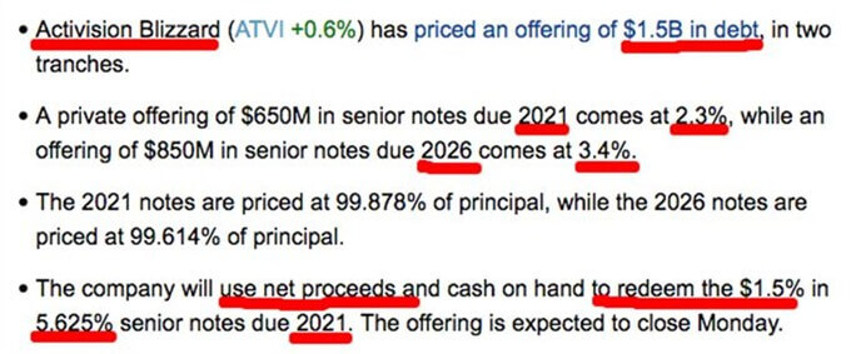

I’ve underlined a few items above to help you review the bullet points.

- ATVI took action in a bond market filled mountains of fear-driven capital.

- It refinanced $1,500,000,000 in bonds.

- They were previously paying 5.625% on that tranche of money.

- They will now be paying a blended rate of 2.85% on the same level of debt - further extending 55% of that debt for another 5 years!

What Does That All Mean?

ATVI saves $42,000,000 every year in interest going forward.

Make sure you don't read over that point too quickly: $42,000,000 each and every year which previously went to bondholders will now stay with shareholders.

And what about the savings that fall to the bottom line in the next five years alone? There’s a staggering $210,000,000 - nearly a quarter of a billion dollars

This represents just one company, one debt tranche and one refinance episode, and this is being repeated by CFOs across the land

So now do you really think ATVI cares whether or not the Fed raises rates by a quarter point?

Your Best Actions?

Instead of fearing rate hikes do as corporate America does: if you want debt then go get it.

Bigger house? Simply put, you’ve never been able to buy more house with less money on a monthly costs basis than right now.

Leave the fear-mongering to others, and out of your future thinking and planning process.

The blessings of a slow and steady economy are numerous. One of these is that all needs are being satisfied by the investments already being made.

That’s because technology falls in price every quarter as every new 2.0, 3.0 or 4.0 model does more with less.

The change is geometric.

The cloud - apps and software tools are doing things today that require far less expense and investment and their output is rising.

"But Mike, manufacturing has been gutted…"

Baloney. We just got better at it. We have record output and we lost nothing.

Those that used to work at plants and facilities got better jobs with more pay and our output went up!

“So, what about all those things I’m being told I should be afraid of?”

In a 2014 article from the MIT Technology Review, Erik Brynjolfsson, co-author of a prominent 2014 book on the subject, is quoted as stating that “technology is the main driver of the recent increases.”

Supporting evidence for that theory, highlighted by Cato, was found in a 2015 Ball State University study in which economists attributed nearly 90% of the US manufacturing job losses in recent years to productivity gains.

They observed that: “Had we kept 2000-levels of productivity and applied them to 2010-levels of production, we would have required 20.9 million manufacturing workers. Instead, we employed only 12.1 million.”

There is no ghost in the machine. It's fabricated like a movie set on a stage.

Do you really want to live in the world that would have required the 20.9 million factory workers of 2000 levels?

Think about that the next time you read about how the end of life as we know it is coming soon.

So What's Next?

As we layer on the analyses of the latest US Fed statement, every syllable will be sliced and diced, and every subsequent report will be measured against it for weeks.

Political analysis will tell you how the world will change ahead based on every sound-bite coming from either candidate.

Expect chop to be the norm as we go through the usual testing process that’s now unfolding in markets which we have covered for weeks - and included in this simple video review for you.

Closing Thought for the Day

Take a deep breath. Yet another monster has been vanquished. There are many more to come.

Remain focused on the long-term data at hand. Short of an extinction-level event, in which case your account balance won’t matter to anyone - tens of millions of new households will form in the US over the next 3, 5, 7 and 10 year periods.

Assuming birth rates remain stable, we will have Generation Z backing up Generation Y with back-to-back record breaking generations of demand.

And remember that people make markets. Those touting a 0.25% interest rate rise as a “big decision” just don’t realise how little it actually means.