Beneath the Cloak of Market Fear

Maybe it’s me, but it feels like there’s a set of important jobs number about every four days now and an earnings season just about every week and a half.

And all these updates seem to follow the trend of being “the bad news we prepare for” that then arrives as "not nearly as bad as expected."

By example, there was Hurricane Matthew, which got more press than any hurricane in the last 15 years. These are truly terrible climate tragedies, but sadly not uncommon.

Here in Chicago "Special Reports" were interrupting broadcasts all evening. Any little trickle of news was enough for an update to keep everyone on guard, as pictures of miles of traffic fleeing the storm wallpapered our TV screens.

In short, it’s a poor media business model to keep your audience frightened and always on edge.

Over the last few weeks we’ve seen a bounce in rates as bonds have taken it on the chin along with anything else dividend-related. These scares are normal in cycles, even as the lighter jobs number rolled in this morning, which likely sets the stage for interest rates staying lower for longer.

By the way, we noted in the last jobs report that we should begin to expect smaller numbers ahead. The main problem is that we’re simply running out of trained candidates to fill the vast number of job openings.

Yet the US jobs market is a lot healthier than it’s being given credit for. The bad news bears will tell you jobs demand is falling. The reality is that we have never had this many job openings.

I suspect we need to see the same training transition we saw in the early 1980s, as our industrial heritage began the transformation to tech, IP and services. That was back when no one knew what software was, Microsoft Office I got blank stares and desktop computers with 30 MB hard drives that cost $6,000 to order from IBM.

At that time the jobs market demanded much higher output capacity for jobs opening up as the New Age of technology dawned. Re-training was needed just like it is today.

It will likely become clear over the coming years why Generation Y delayed moving out of their parents’ homes to instead get a solid degree for the future of business.

And we’ll thank them for the delay!

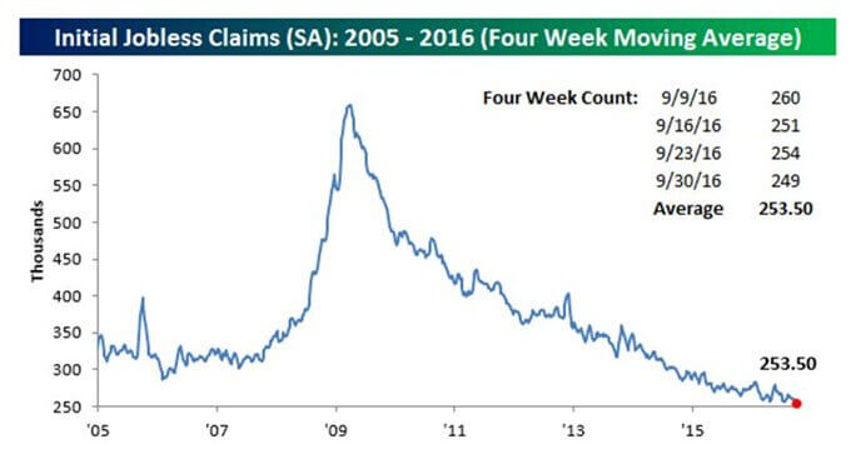

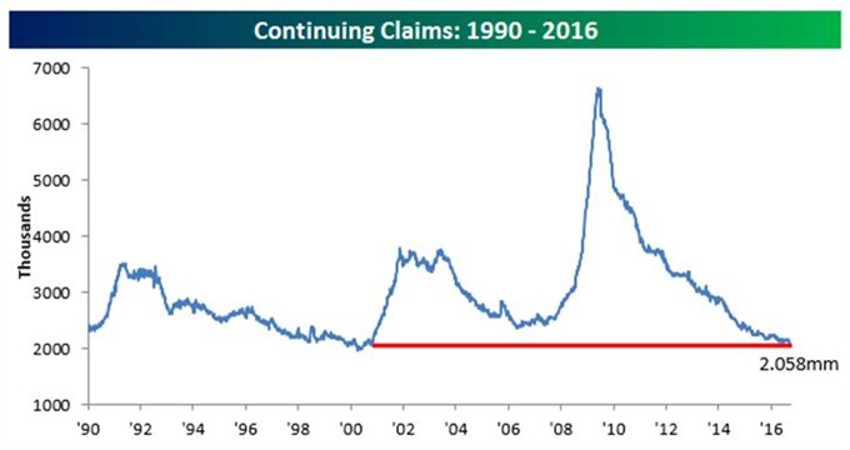

Jobless Claims?

Under the cloak of Hurricane Matthew, jobless claims showed continued strength in the marketplace.

Weekly jobless claims data released recently got little coverage, but dipped back below 250,000.

This week's print of 249,000 is 1,000 above the cycle low of 248,000 printed in April of this year but the overall trend of extremely low claims has broadly persisted since that low.

Given the population and labour force back in the 1970s (the last time we saw these types of lows) were both dramatically smaller, it's probably fair to suggest that the current claims stats are the strongest on record.

Further, the 4-week moving average did set a new low this week! Its strength illustrates the continuing trend of a severe lack of layoffs from employers across the economy.

Heck even all the drillers found jobs quickly.

New lows in this moving average are a good sign that the current economic expansion is continuing forward.

Let's face this fact: Because Generation Y is just beginning to kick in with their respective economic impact (for decades ahead), this is not your Dad's jobs market anymore.

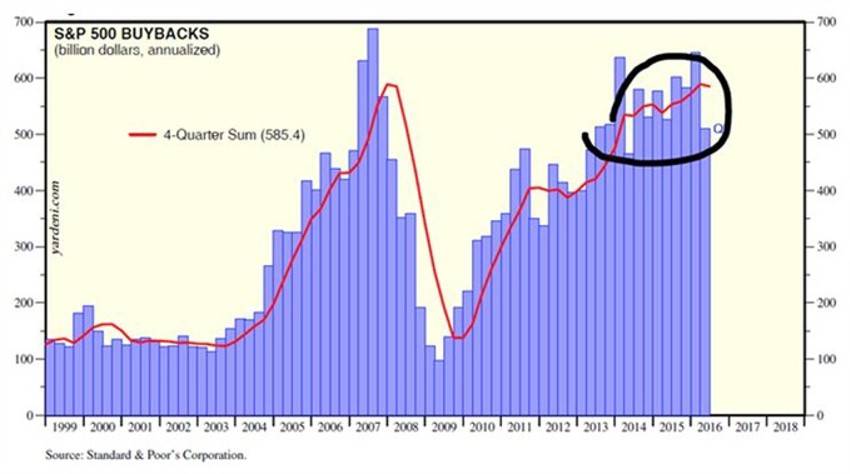

Corporate Buyback Support Steadies

Too many investors listen and believe the banter about how corporate buybacks are shams and how they distort reality.

That theme is French for: “I’m looking for the top every day and I was short the stock that just announced a buyback and popped it 4%."

Let's check the trend of buybacks. Like the markets they’ve been in a choppy holding pattern since the oil collapse capped major headway for the overall averages.

Now keep in mind that CFOs are doing what comes naturally when buybacks occur: They’re using cheap debt (driven by fear) for 10+ years to buy long-term undervalued stocks.

That low debt cost will stay on their balance sheets for a decade or more.

Then, as markets get out of this funk some years down the road the odds are that their stock rises. When, for example, debt comes due in about a decade, if rates are no longer low then they sell that same stock from a decade before back to the market. That move then raises cash at higher levels to pay off the debt.

Rather than complaining about buybacks a decade from now, my hunch is analysts will instead probably cheer on the corporate "debt pay-down" as balance sheet improvement.

Sentiment Nod

You can tell from the data, while watching equity funds bleed money, that bullish sentiment is nowhere near levels which would typically concern a long-term investor.

To be fair there was a bounce!

The chart above shows us that a few more bulls seeped into the picture. But the longer view only shows how that "bounce" rocketed the levels up to their 49th straight week of below average bullish sentiment!

Just look how close we are to the 2009 and 2003 investor sentiment lows for stocks.

Indeed, this is the 84th week in the last 85 where we have seen no bullish readings above 40%.

And while we still have twelve trade weeks left in 2016, this year is on pace to be the first in the history of the AAII survey when bullish sentiment never went above 40%.

The Bottom Line

Relax…and get your hands off my extra-large bottle of fruit-flavoured TUMS.

Don't expect anything but much to happen while we dance through the last month of this election show.

What I am confident about is that I years from now we’ll see the economic experiment perpetrated on our economy over the last eight years like white noise.

For now, market chop is your friend, and maybe even a week or two of correction. Following the election our view remains that there will be surprises to the upside.

And as a vast majority of the manager audience has done a woeful job this year on results, they will likely strive hard for a solid finish. An avalanche of money remains perched in back accounts and bonds.

So, if we stir all of this up, and mix in a little Holiday Season Blessing, you have the ingredients for a nice run to the finish line.

Focus on the Barbell Economy – and the handing of the economic baton from the Baby Boomers to the Millennials of Generation Y. We are in great shape with a solid future ahead.