Bad News? OK, What’s Next…?

Some of the smartest long-term investors have taught me that when bad news seems like very bad news indeed, there’s just one question you need to ask: "Yeah, but what's next?"

I’ve learned you can glean far more productive insights by asking "What's next?" whenever you hear something bad about some economic issue or company event.

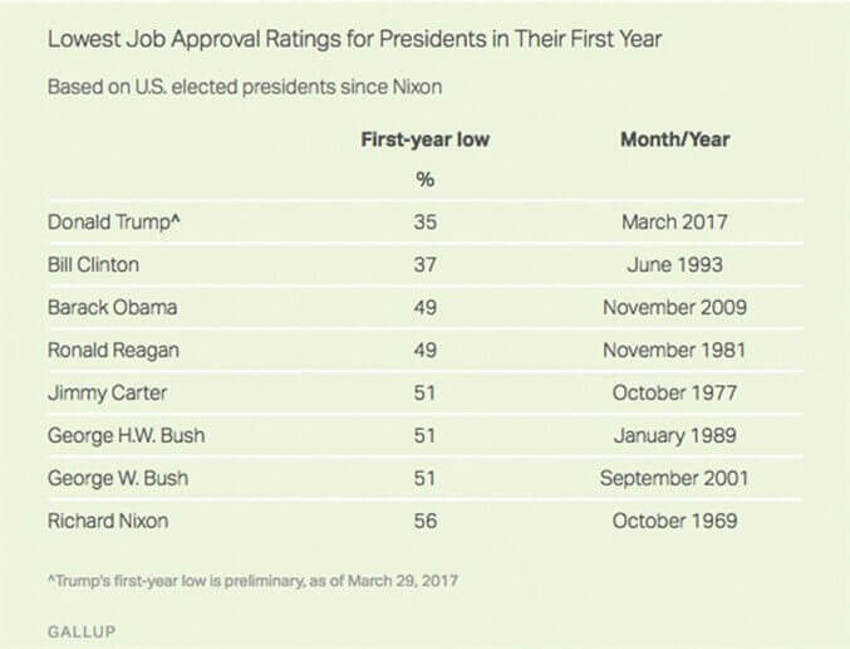

Case in point: We can be somewhat confident that we’re closing in on the lowest approval rating figure Trump is likely to obtain. It's ugly right? But it can only go to zero.

Is he setting records right now?

Yep, and all in the first 100 days or less:

Sure it’s ugly. But, "What's next?"

My Two Cents Worth?

It’s just a hunch, of course, but there’s probably another month or so ahead of perhaps even worse numbers.

I know of no one on this planet who could stand up under the withering media attacks in this first 80 days.

This guy was toast in the media before he was even sworn in.

But in the noise of it all we tend to forget that if you build big buildings in NYC, you often regularly deal with mob-riddled businesses.

And if you don't ever get another morning note from me then refer back to that last sentence to fill in the investigators.

Now, presuming I’m even marginally correct, do you really think that guy would be ruffled by a reporter with a sharp question? Nope. He strikes me as someone who doesn’t mind the fight.

And if we’re closing in on some number that will become the low in the approval ratings curve, then what would be next?

Well, I suppose it would be an improving approval rating.

Now say that 15 times real fast…

Now let’s take this a step further. Value investors with a long-term focus may find we’re closing in on a value play. Once he gets this all figured out and he wears out the press attacks, my hunch is that a rising approval rating would be coming on the back of Trump getting things done.

Then, yesterday's ghost from freak-outs past, about the worst day in 14 months will be like all the other “Apocalypse Now” events in recent years.

Fake news indeed.

Sentiment Works!

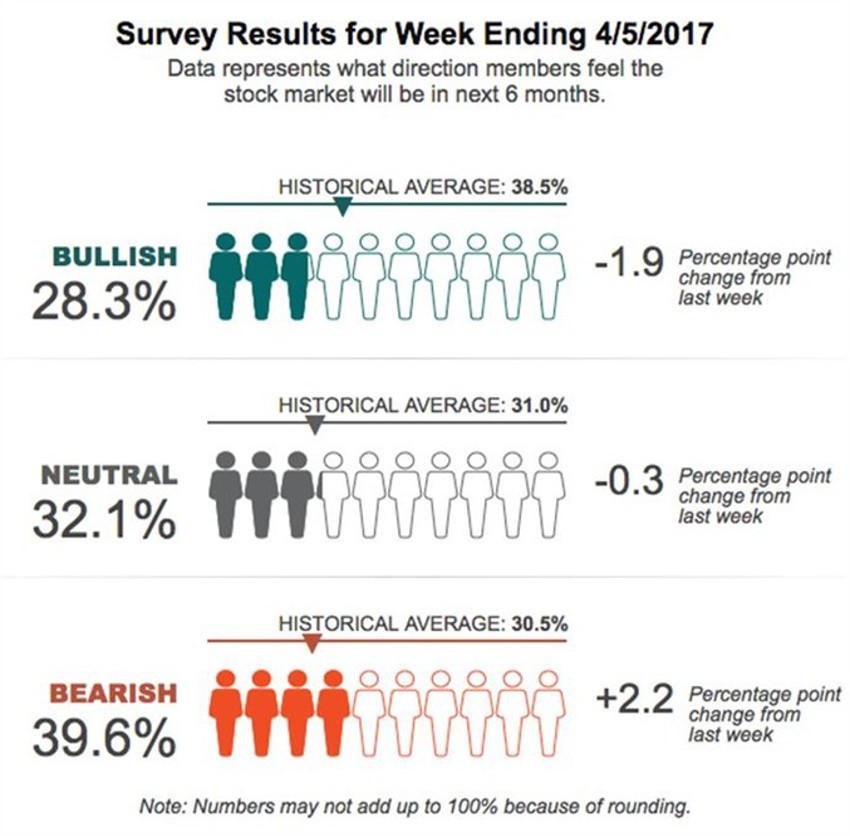

Last week’s sentiment stats for the AAII’s bulls and bears

What those figures show is that nearly 3 in 4 investors are once again afraid of the market.

Think back now to March 2009 – the stats were only a tick away then from where they are now, when 4 in 5 were afraid. And that was 14,000 Dow Jones points ago.

I suggest you simply hold your nose and pray for a correction.

And by the way if we can't see a correction over the next few months with all this noise, terrible Trump ratings and media reel-to-reel hype, then we should take heed of the idea that this market is far stronger than most realise.

Think demographics, not economics.