Are You Waiting for “Red Ink”?

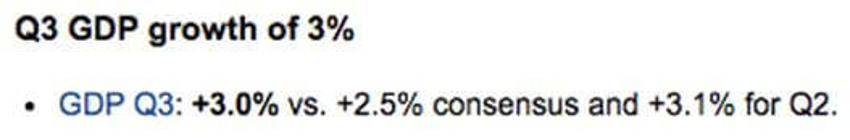

So, US GDP despite Mother Nature’s anger came in far better than expected.

There will likely be adjustments in the coming months, but historically speaking they tend to move things higher.

It’s a $20 Trillion economy moving at a 3% annual growth clip. Not too shabby.

And within it are the significant deflationary forces of Generation Y, permitting more and more energy to build into the foundation of our economy without the growth-killing domino effect of inflation.

Early indications for Q4 suggest better things to come.

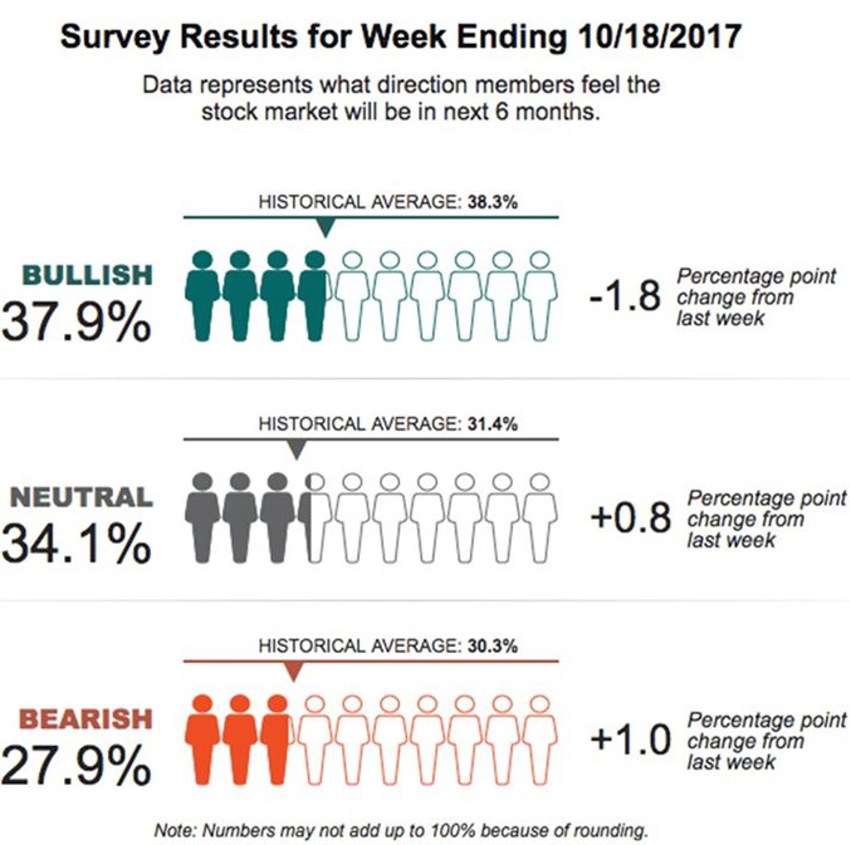

Yet even as tech's big names have literally knocked their numbers out of the park, sentiment remains tepid.

Another three weeks of this and we’ll have recorded three straight years of AAII bullish sentiment below 50%.

Hey, let’s pray for another three years:

The most notable part of the data above is watching how the numbers shift.

Almost four times as many left the neutral rank to turn bearish in this recording period.

True enough that bullish sentiment ticked higher, but bearish sentiment surged 5.1 percentage points to a seven-week high of 33.0%.

Now, 33% may not sound like much, and it’s certainly lower than the 39.6% bullish reading, but when you consider markets have been meandering around or hitting record highs on a sometimes daily basis it suggests a strong and deeply-seeded negative undercurrent.

The Investor herd seems to be standing by for the next splash of media red ink.

That’s good news for long-term investors.