And Then the Paradigm Shifted

What a path we’ve travelled in 2016.

Think back to the first few weeks of the year – the worst start in eight decades – to now.

We started with calls for a terrible year. The red ink flowed. Outlooks were dire across the board (except here).

I got the rose-coloured glasses comments, the "Mike, I am not sure you get it" suggestions.

In fact I jokingly said at the time that, "Historically speaking, it’s been a good sign for long-term investors during those time that I’ve been perceived as an idiot."

And Then?

The world did not end.

That’s said, as the costs of Obamacare and tax burdens to pay for social giveaways sucked more life out of the consumer it did not get much better either.

The masses have certainly felt it - working a lot more for a lot less.

That’s the inevitable outcome of extremely poor and misguided fiscal policy leadership.

Brexit arrived and shocked the audience into a 48-hour roller-coaster of market fear.

That’s not to say the market was a runaway train to the upside afterwards; just days before the election the SPY was trading nearly to the penny where it was back in early April of 2015!

We went nowhere for twenty months as of just three or four weeks ago.

And then the paradigm shifted.

Who'd a Thunk It?

Think back once more to early February of this year. Things were dark, headlines were bad, markets were down double-digits and the chants of a bear market looming were deafening.

We were even told that cheap oil was bad for us.

And if I’d grabbed you then (as we try to in these notes) and said, "Wait...there’s more to this...Listen, Generation Y is going to take us places we cannot imagine. And the demand building in the economy will surprise most everyone."

But the AAII sentiment polls told the story – the investor herd felt worse in February of 2016 than they did even in March of 2009; the lowest point of the recession before everything turned.

And Now?

In spite of the burdens placed on the economy since 2008-2009, and new record highs in GDP, forward earnings and major stock market indexes.

Heck, even oil has grown more expensive - and somehow we’ve come to believe this is a good thing.

Talk about spin.

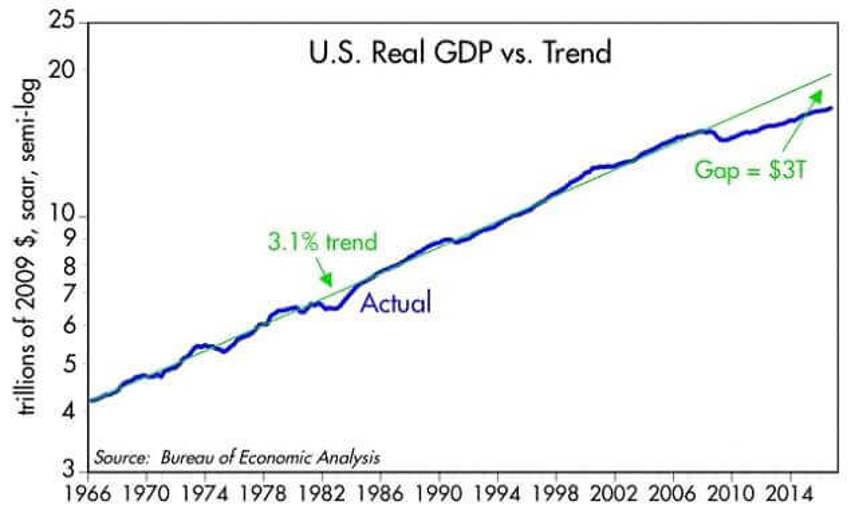

But here’s the key chart to focus on. It’s all about how much better we should have been for all the output and work we have generated.

The Chart Above

The chart above uses a semi-log scale on the y-axis to help you see that for roughly 40 years the US economy has followed a roughly 3.0% (3.1% to be exact) annualized real growth path.

More important - it bounced back nicely from every recession, except for the last one.

What was different? Why the constant lament from the media that, “Never before has the U.S. economy posted such a weak recovery and such a long period of sub-par growth.”

What we do know is this:

Business investment has been very weak, and

Record-setting profits have been met with ugly levels of productivity

What can explain that?

The social chickens are coming home to roost. A capital strike has been underway. There has been a lack of any excitement to build, a severe shortfall of confidence, and the constant presence of the need to avoid risk (as if there were some way to actually do that).

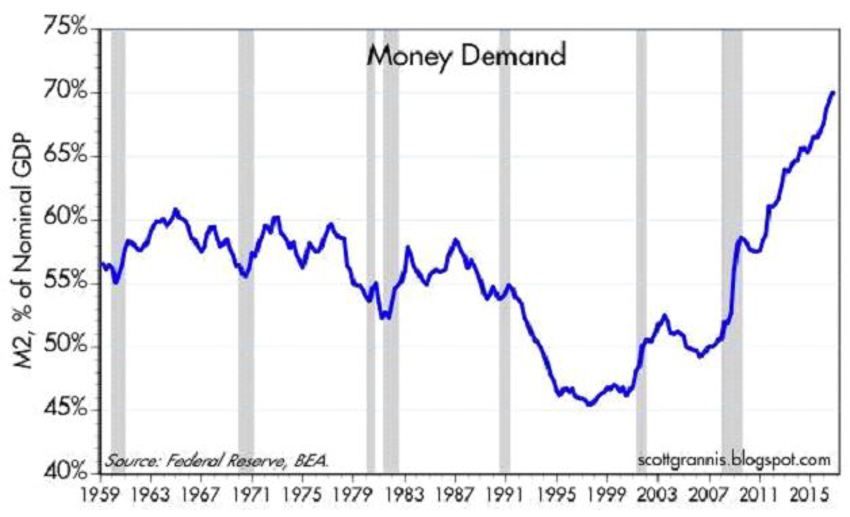

In short: People have simply been unwilling to work and invest more and they demanded a ton of cash (prime signs of the deep-seeded fear and capital strike).

We also know that, beginning in 2009, the economy has been heavily burdened by added costs which cannot be hidden in a spreadsheet in Washington DC. There has been:

- An unprecedented remaking of the entire healthcare industry (Obamacare), which in turn has impacted the lives and healthcare costs of nearly everyone

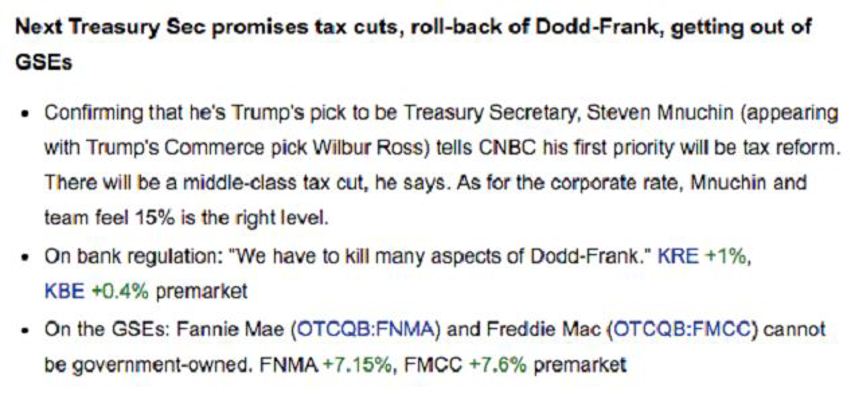

- Sweeping new regulatory burdens on the financial industry (e.g., Dodd-Frank)

- A very significant increase in government spending and transfer payments - the ARRA (This was then hidden from view in the deficit due to much higher marginal tax rates on income, dividends, and capital gains)

- A huge increase in the federal debt burden

The Gap

Check the first chart again; the gap is what we are now feeling.

Yes - it is stressful because it represents a monumental waste of capital and costs as well as - get this - a huge amount of lost income and jobs that were never created.

In essence, it means that while things are not completely bleak (after all, we are setting records) they could have been so much further ahead.

The Best News?

A look on the bright side tells us something else about that gap on the first chart: It’s a measure of the massive amount of untapped potential in the U.S. economy.

This suggests that if the Trump administration can succeed in rolling back the burdens heaped upon the economy in the past eight years, the future growth potential of the U.S. economy could be enormous.

And the mountain ahead is not a small one: It would take 5% real growth per year over the next eight years just to close the Obama Gap.

Here are some encouraging developments that suggest the market is in the very early stages of anticipating the unlocking of these shackles from the economy, as the new Administration begins to lay down the plan ahead:

The Biggest Lesson?

There will always be ugly periods and windows where markets do not do well.

Some of those will be painful, some excruciating.

And the investor herd will look like on these as if it’s never been this bad before. But by now, we should know better.

The rewards of the long-term investor are driven by patience and discipline, both very tough pathways at times.

But 2016 is yet another solid example of the lessons learned through fear. In short, it can be expensive.

Never lose faith in the strength of the US economy. It stalls, it sputters, it goes through painful jaunts but then it recovers.

Once we get the cloud of the oil collapse round-tripped and into our rearview mirrors (with Q3), we should see better numbers all around.

To that end GDP was upgraded this week - and this just in: here in Chicago our PMI read is on fire, beating consensus by more than 10%:

Maybe we should hope that 2017 starts off the same way 2016 did for the markets.

And will we have learned our lesson about fear?