An Out-Of-Body Investor Experience

The “September is worse for markets than October” chatter has begun in earnest. And this time round it just might be, given the focus on the US presidential campaigns running to the finish line.

A severe hiccup is not out of the question (I hope!).

And so has the coverage of the number of US jobs in August. But before you drop into panic mode just remember that August is, after all, the end of summer vacation and the month of the year when a full 80% of jobs reports are revised upwards thereafter.

Case in point: Experts saw this month’s report as "short”…while July was revised up by 20,000.

The headline writers will of course play both sides once the revisions happen (often in the same publication and on the same day), like this:

"Jobs Number Takes Pressure off September Rate Hike"

"Revised August Numbers Suggest Fed is Behind Curve"

It would be hilarious if it weren’t for the impact it has on investors.

Just remain confident that, no matter the event, the headlines will always adjust. And it will lead too many, too often, in the wrong direction, because headlines and price drive our perception of fact.

And while the doldrums remain the popular investor reprise, the markets keep chopping around within a per cent or two of all-time highs.

In short, if things felt boring to you that’s because they were - August was nearly unchanged with the S&P ETF moving less than 40 cents from where it ended July.

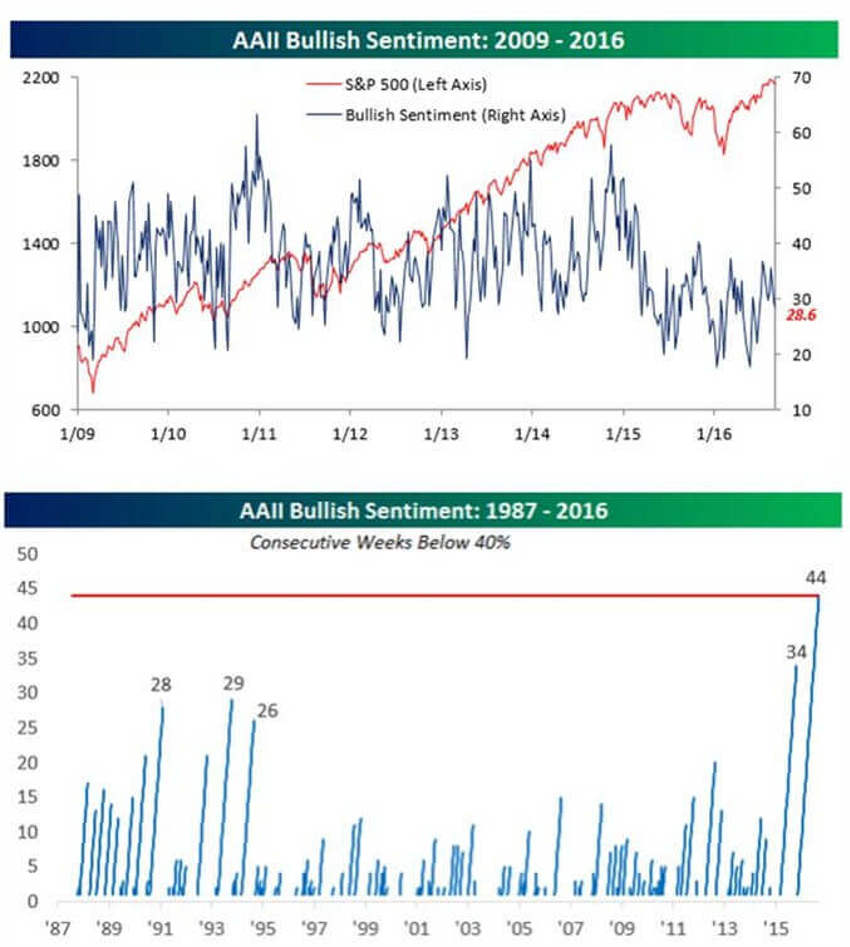

Here are the latest sentiment readings:

I cannot ever recall so many investors feeling so bad about markets during all-time highs. For me it’s like an out-of-body experience.

The first chart above is the updated view of the weekly AAII bullish sentiment survey. This week, as markets chopped into the end of August, bullish sentiment came in at 28.6%, falling another 0.82 points from last week's reading of 29.42%.

So, there are mountains of cash in banks and hoards of bond buyers running screaming from the stock market. Let’s just say stock sentiment is a far cry from optimistic.

In the second chart we’re seeing another record: this was the 44th consecutive week that bullish sentiment was below 40%. This is the longest streak of sub-40% weekly readings since 1987!

The mass audience of investors has been moving in a fog for years.

I’m also quite surprised that we have not corrected back into the previous breakout zone as most technicians would tell you is normal.

Even though it gets much tougher to do so as prices rise, stay focused on the long-term demographic aspects in place – as the Baby Boomers hand over the economic baton to the Millennials - rare as they are here in the US.

More Trade While Flat?

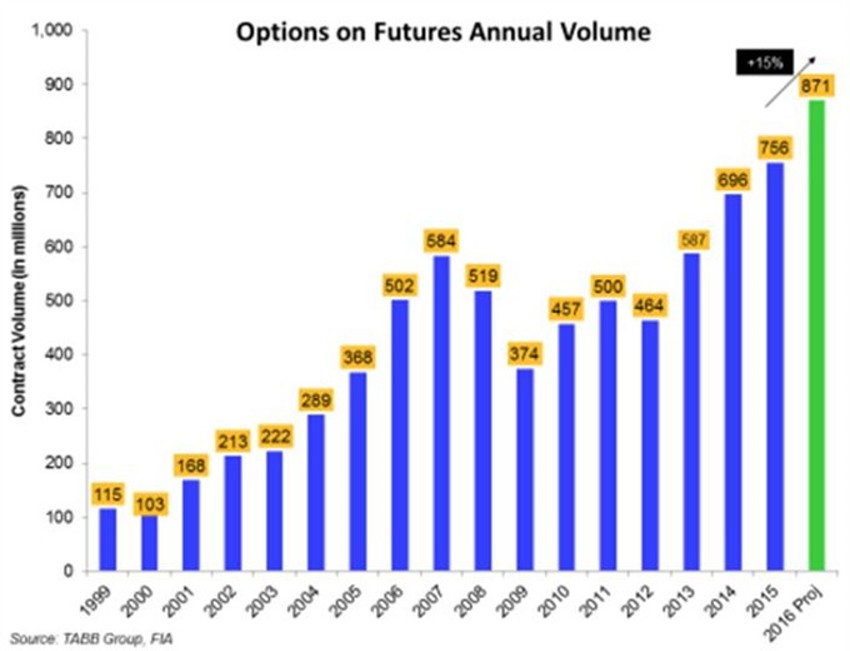

You have often heard me refer to a ton of noise in the markets over all the new-fangled options, futures, ETF and hedging tools that are continuously manufactured by Wall Street to, "hedge away risk" for investors.

That’s because those things look awfully foolish in a long bull market.

By example: The market was flat for the month of August, yet full of churn, chop and angst throughout. But the chart below also shows that it was a RECORD month in the futures world - setting the stage for all-time highs in trading those contracts this year.

So what’s all the shouting for?

In the "Out of Left Field" Category

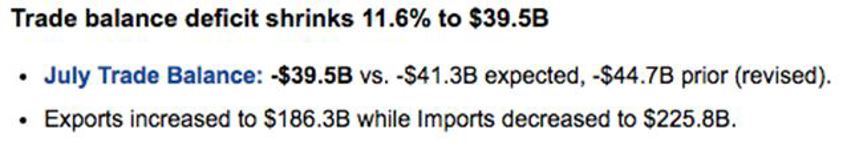

For decades we were told that our trade deficit was a horrible thing. That somehow it would eventually lead to the end of all things.

Yet, in amongst all the shouting in the futures pit, almost no one is talking about this:

A few things are happening here:

- Our exports continue to expand (just as we are told our production is dead)

- We spend a whole lot less on imported oil these days

- Companies are thinning their inventories even further, which normally sets the stage for a surge in new production in the future.

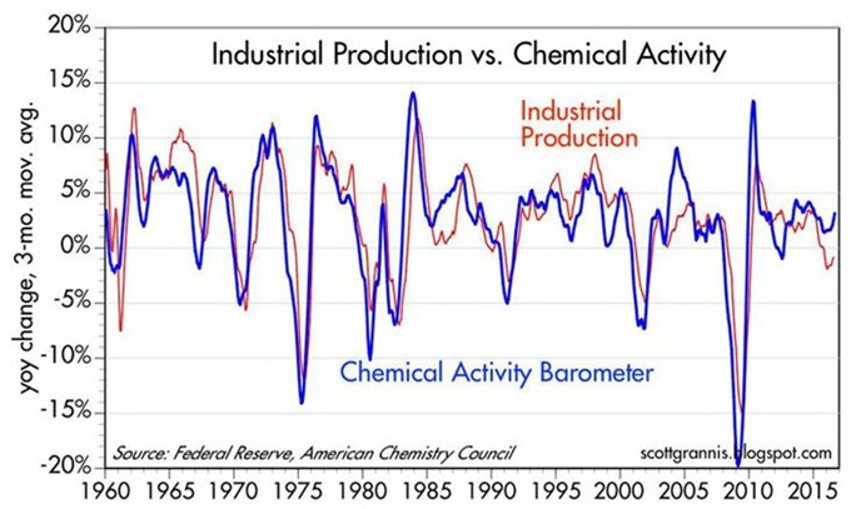

And this could further explain the news in the chemicals industry, almost always a harbinger of things to come.

Check the latest:

We recently noted the new all-time highs in the chemical industry's order book.

The chart above helps you to build more confidence in what that usually means for our future growth prospects.

You can see that an upturn in chemicals typically leads to an upturn in industrial production. This dovetails nicely with a solid surge in imports in the trade balance shrinkage.

Once we get done running down inventories here in the US (a drag on GDP), surprises to the upside on output will also be in the pipeline.

Remember, we’ve turned ourselves into a FedEx economy, folks.