An Odd Twist of Stock Market Fate

There are a few things to be aware of as the financial and economic positives build for 2018 and beyond.

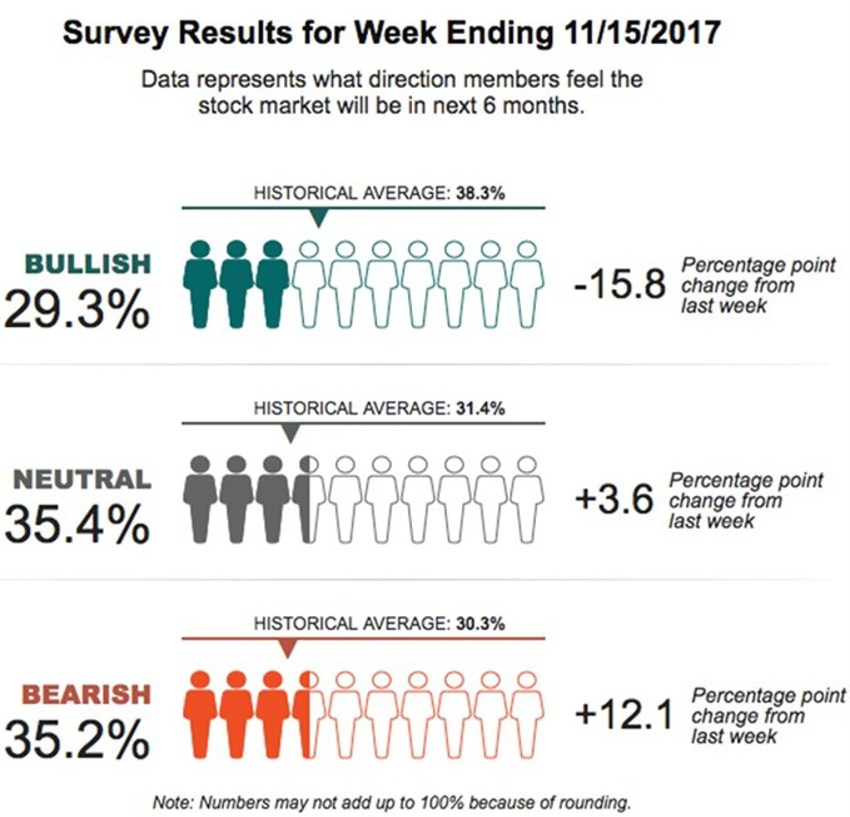

In the midst of all the recent new record setting highs across cash flows, net worth, market averages and earnings it appears much of this positive news continues to fall on deaf ears.

Maybe they’re suffering from a Thanksgiving-sized portion of disbelief, secure only in the knowledge that the proverbial end is always near.

Yet, in an odd twist of stock market fate, those not willing to believe the future is brighter than most fear, are supporting the building blocks of the upward movements ahead.

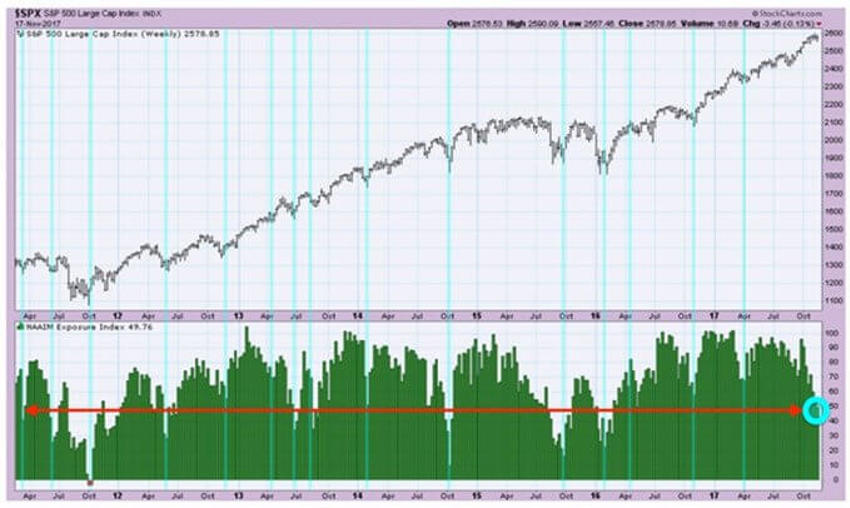

Have a look at the below chart and you’ll begin to see what I mean.

It shows active managers’ current exposure to markets. And, as you might expect, the lower the levels of exposure the less bullish investors collectively feel about the future.

As has been noted on the AAII sentiment runs for many years now, managers - like the individual audience of investors - are acting like a correction is either underway or has already unfolded:

The Index Stands at 49.76

What that means is that active managers have roughly half their clients’ assets "unexposed" to the markets.

I have circled the current levels in the blue highlight with a red line to give you an idea of what that means in context over time.

In simplest terms it shows the readings are low.

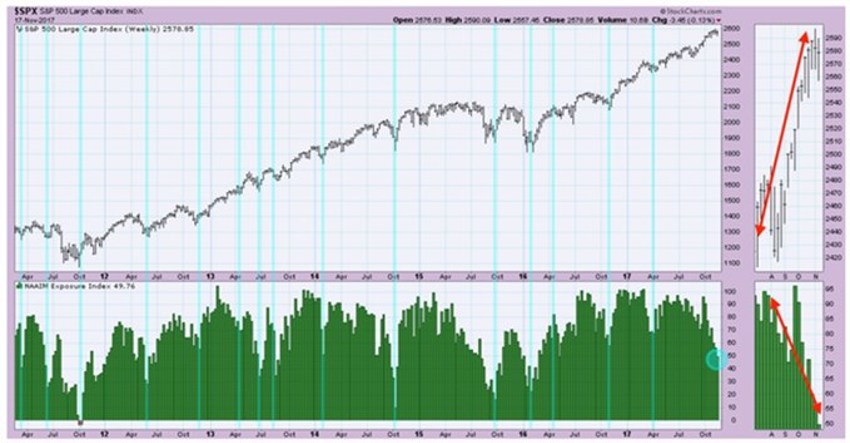

Now here’s that same chart, but this time with the right-hand side of the chart showing you a "close-up" of the last 6 months.

Notice how quickly sentiment readings have fallen off:

The Net Result?

Well, it’s pretty clear to me that fear is still the easier ride, and it’s the weak underbelly of all that "the crowd is too complacent" chatter that keeps too many guarded and focused on the wrong elements.

Make no mistake; there are many things that will be scary about all this change. It will be faster than any other change we have seen in history, and that speed will bring with it likely mistakes as things progress - just as all change has brought over time.

In Summary

Be prepared for all sorts of chatter about concerns that link today with 2018.

That will help keep sentiment levels low – and that’s a good thing for long-term investors.

Forget economics and think demographics.