All Money Doesn’t Go to Heaven

Things will likely get pretty hazy from here on out with that foggy feeling only thickening the closer we get to mid-December.

And the path ahead is still littered with tough steps.

From the long-term investor perspective things look very positive and are being pushed by major generational waves of change; the handing over of the economic baton from the Baby Boomer to the new largest age cohort ever – the Millennials of Generation Y.

But the short-term perspective suggests we cannot rule out continued chop and even a setback or two.

Like I always say, pray for a correction.

Improvement is Interesting

With the latest quarterly earnings parade now behind us, let's take a quick look at the improvement in the data.

And keep in mind that we may find months from now that some of the bounce we have seen post-election was because business has indeed gotten beyond the "energy depression" we were all told to fear.

Now, does everyone remember all of the Armageddon-like headlines we drowned in at the beginning of the year about this being the worst start for the market in eight decades?

Well, here’s the final tally on Q3 (focus on the bottom-up calendar year estimates for 2017 and 2018 that were both revised higher for the 2nd consecutive week):

Thomson Reuters' data by the numbers:

- Forward 4-quarter estimate: $128.56 versus last week's $128.47

- S&P 500 earnings yield: 5.81% versus last week's 5.89%

As has been experienced before, these estimates are still likely a bit light as changes are afoot. The negative tone in expectations has not burned off.

That noted, the year-over-year growth rate of the forward estimate was +4.03% versus last week's +3.80%. It is the highest growth rate since mid-January 2015, or 22 months ago.

Thomson Reuters also notes for us that (ex-Energy) S&P 500 earnings were up +7.9% in Q3 2016. FactSet's "Ex-Energy" growth is +6.5% for earnings and +4.5% for revenue.

Neither one of those final tallies is all that bad, and both are substantially better than what was projected by analysts before the season began.

While we can expect the same negative slant to earnings as Q4's end comes into view (only a little over a month away), the odds are high that those numbers will mean very little.

Instead, we can safely assume the vast majority of expectations are now being reset based on new policies and the goals of the new US political administration.

But let's look for corrective action as supremely advantageous for the long-term investor, even if the short-term has the normal hiccups along the way.

A focus on the Barbell Economy is important even as dividend growth headwinds are felt.

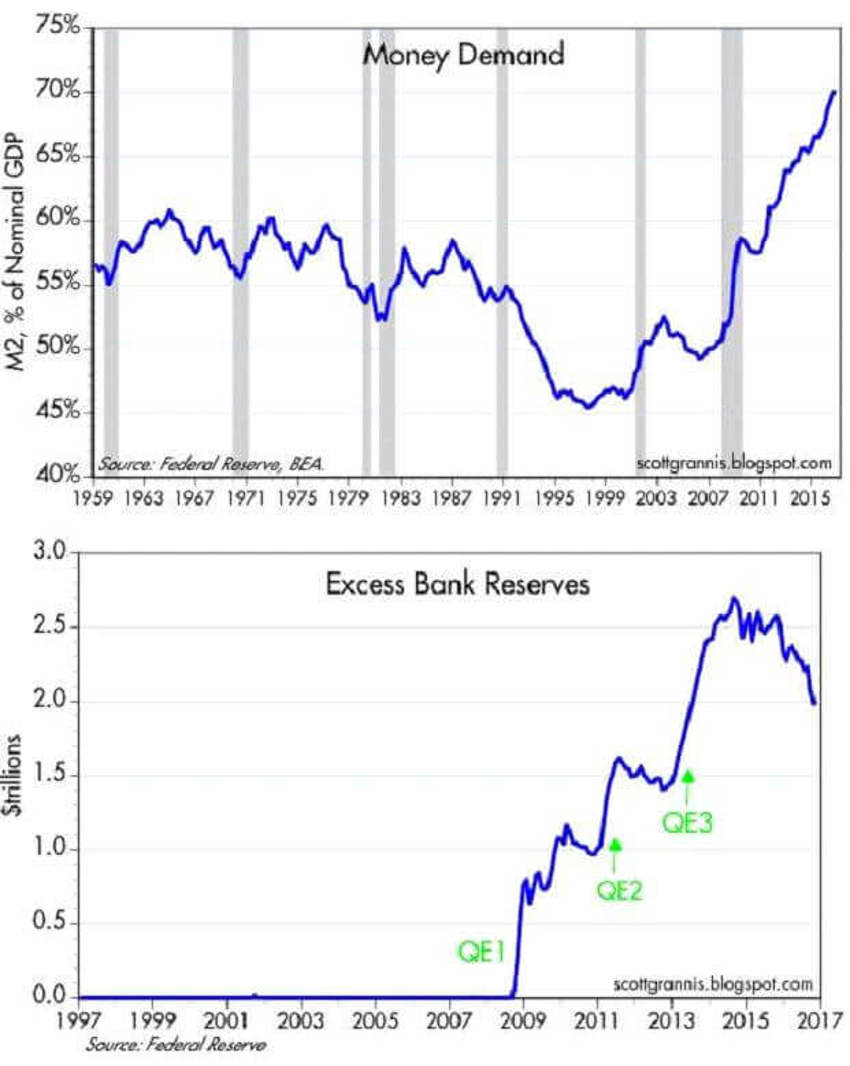

The Two Charts Above

The Calafia Beach Pundit team always has solid and insightful charts to view.

The top chart shows that cash demand remains at record highs. You can see from the slope of the curve that a dramatic increase in the demand for money has enveloped us over the past two decades.

Remember that as underlying fear increases the demand for cash in the bank does as well.

In this case the amount of money (as defined here by M2, which is the sum of currency in circulation, time deposits, checking accounts, retail money market funds, and bank savings deposits) relative to national income has never been so high.

Consumers in the US are holding a tad bit over $9 trillion in bank deposits these days, preferring their safety to the much higher yields available on riskier assets (read: Fear).

The second chart highlights the stealth moves already being made by the US Federal Reserve as it relates to bank reserves available for lending.

It’s likely that many experts are aware of this fact: Excess bank reserves have fallen over 25% from their high of a few years ago.

The Fed has been conducting a quiet yet sizable reduction in the amount of reserves that banks could use to exponentially increase their lending - and the money supply - if they chose to do so.

Let's note: This is an under-appreciated good development and slowly dismantles the fear that QE, "the printing of money" was going to light up inflation to levels never seen before.

QE remains the most misunderstood financial event of the last 25 years.

Now What?

A solid item to question is that might happen is the public ever wanted to reduce its holdings of so much money?

Bear in mind that wanting to hold less money doesn't mean that money just disappears. I can reduce my holdings of money, but only if someone else increases theirs.

Should the public on balance want to hold less money relative to incomes, the only way that can be accomplished is by increasing the nominal size of the economy.

There is no money heaven when money goes to die; it just moves.

Yes, there's a lot of money out there that could wind up bidding up the prices of goods and services if and when the public fully regains its confidence in the future.

That's sure is a good deal of potential inflationary pressure to worry about, but it only becomes a concern if confidence rises and the Fed fails to take offsetting measures (e.g., raising short-term interest rates by enough to keep the demand for bank deposits from declining).

See - I told you there would be something new to fret over as soon as we vanquished the current monsters.

Carrots and Sticks

As you may have guessed, I read a lot of comments over the weekend as half the country still despise the election results.

It’s ironic today as the very party doing the fretting is the same party who tried to scare the country into believing that Trump would contest the results if he lost.

Ah well, here are some key elements that may get missed in all the hype:

- Many have noted that "Trump supporters take him seriously, but not literally, while Trump detractors take him literally, but not seriously."

- There's a lot of truth in that observation, because the more we know about Trump the more we realize that his bark is worse than his bite. That should be deemed as good news. As suggested here earlier - the campaign rhetoric was more his way of negotiating.

- It’s already working two months before he becomes President. We will likely soon learn that he's not an inflexible ideologue; he's a businessman who wants to win. Maybe, just maybe, Trump is NOT going to start a trade war with tariffs (sticks); what if he wants instead to use carrots to boost trade and thus the economy?

- There was a sizable amount of negative media coverage of the New York Times spat and then interview with Trump last week. Yet, if you read the data some of it is quite revealing in this regard and very encouraging as to the real perspective we may want to focus upon.

Here's an important quote from Trump I read:

"I got a call from Tim Cook at Apple, and I said, 'Tim, you know one of the things that will be a real achievement for me is when I get Apple to build a big plant in the United States, or many big plants in the United States, where instead of going to China, and going to Vietnam, and going to the places that you go to, you're making your product right here.'

He said, 'I understand that.'

I said: 'I think we'll create the incentives for you, and I think you're going to do it. We're going for a very large tax cut for corporations, which you'll be happy about.' But we're going for big tax cuts, we have to get rid of regulations, regulations are making it impossible. Whether you're liberal or conservative, I mean I could sit down and show you regulations that anybody would agree are ridiculous. It's gotten to be a free-for-all. And companies can't, they can't even start up, they can't expand, they're choking."

The Difference?

Like it or not, if you run a business, Obama's approach to keeping jobs in the U.S. was to penalize corporations for doing inversions.

Trump's approach is to begin to define and think through the creation of incentives - lower taxes and reduced regulatory burdens - for corporations to relocate here, to bring jobs back.

One is the stick, the other a carrot.

Guess which one works better?

I don't want to bore you but this perspective runs the entire board: from capital controls, to regulatory burdens to taxes.

Trump is a businessman. You can take shots at him all day long, but he understands how businesses work.

The most important point for you and me: He understands that incentives are important.

Sadly, Obama never understood this and that's one big reason why the economy has been far weaker than it should have been for the past eight years.

In a nutshell, there is much change coming our way; on multiple levels. Some will be scary, some sloppy, some erratic and uneven to start, but all are reasons we can begin to feel much more optimistic about the future.

Consider This....

Yes, bear markets are coming. They last on average 11 months. In my career, I have lived through several. We made it out of every one of them before now.

Why do I always suggest we pray for a correction? Think about it - we are at record highs.

Meaning? Well, by nature every single correction and setback before now in the history of markets was an opportunity for the long-term, patient, disciplined investor.

Every single one.

Choice....

We can get lost in the small, short-term pictures under storms of media-driven, attention-getting monsters.

- or -

We can calmly recognize that with patience, a long-term view and disciplined planning the next 30 years are likely to look a lot like the last 30 years.

They will be driven by forces that are first derived from the direction of demographics.

They will be driven by people.

In Closing

Given that the US economy is at full employment, 4% growth will require much more productivity growth than the economy has delivered since the late 1990s.

Otherwise, there could be a significant increase in inflation.

Bond yields would continue to spike higher, and so would the dollar.

My vote? Pray for a correction.

We can be confident we will work collectively to find a solution for all.

After all, that is what got us here, right?