A Traffic Jam of Common Sense

It should not be a surprise to see a sloppy market in October, and it’s never fun to watch.

And as we slowly dig our way through the last month of crowd disgust on the US election process we seem to be stuck in a sort of news recycle mode.

It’s all the same chatter, the same fears and the same so-called Armageddon triggers; like the media is simply shuffling the deck, dealing out the same few cards and taking turns spinning the same events.

Yep, the UK is deemed to be facing a hard Brexit, one sure to ruffle the feathers of every black swan hunter out there, yet the continent just announced near record auto sales.

We had the Wells Fargo saga and their CEO finally getting (shall we say) "bumpfed."

Earnings season is moving along with banks all pretty much beating back their respective monsters.

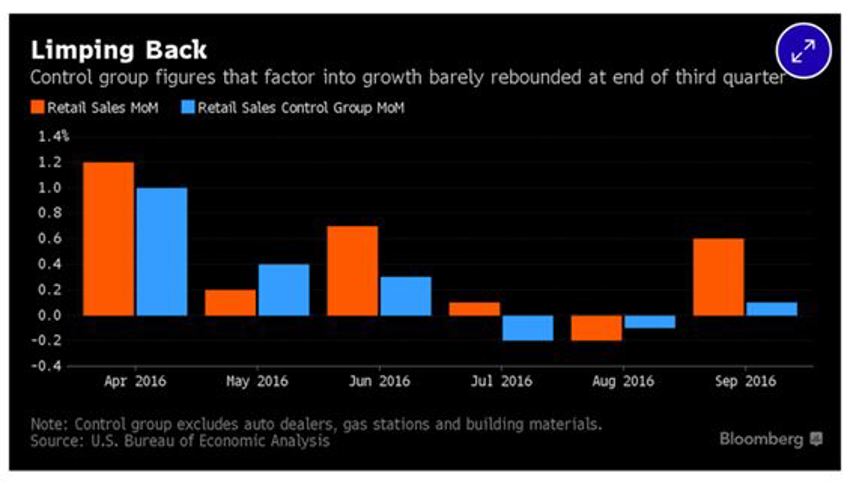

But the pall over the crowd says those stats are no longer good enough, even when we add in retail sales - which were solid - after a normally slow August.

Heck, even China released reports of them seeing a whiff - a tiny whiff - of (wait for it) inflation!

Let's make sure we remember this though; an ugly Octobers tends to set the stage for a solid finish for the year.

Now that would be a surprise.

A Funny Note on China

I was watching CNBC Asia week before last on an early Friday morning when most normal people were sleeping.

And I’m sharing this brief story because the interviewer made such a comical response to a good piece of news – it helps us to grasp how we just cannot seem to take good news as just good news anymore.

Here is how it went:

China Data Reporter: "Yes, the car sales and registrations are setting records in many parts of the country. We see this as a positive sign that the slow period may be bottoming out."

CNBC Moderator: "Well, Mr. Chin - I understand this may be some good news but can you tell me how this jives with the reports we are hearing that traffic jams are becoming more significant there in China? In fact, we are hearing that the local agencies are delaying the actual registrations of these new cars until they can find solutions to the increasing traffic problems. Can you give me some sense of how this will impact the future car sales and whether or not this is just a one-time piece of good news essentially?"

I am not kidding, by the way. The interviewer turned a positive data point into a concern because of traffic jams.

Excuse me while I laugh my ass off.

Just the Facts, Ma'am

A few weeks ago a full 93% of all AAII Bullish sentiment readings were higher than where we are now.

This is happening while the market is just 3-4% off its most recent highs.

And while markets had broken out from a near two-year trade range after the panic over Brexit and the following bounce, we’ve now basically sat just above that range for the better part of two more months.

It would be perfectly normal to now work through a test of those same breakout ranges.

If you work it out, the last several weeks have been doing just that, with likely a bit more to go.

The Net Effect?

We are where we were when summer began as this latest test proceeds.

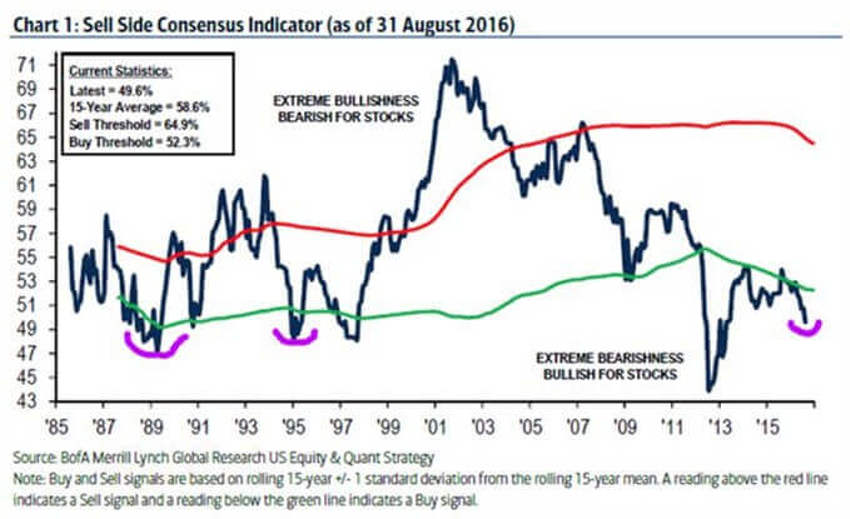

Here are a couple of charts that should help support what I’ve noted above:

To suggest that the general audience of investors has felt pretty unexcited about stocks for a very long time now is (I know) repetitive.

However, the first chart above shows you that the "experts" also feel terrible, and this has historically been a compellingly good sign for long-term investors.

And while the data is a month old the picture is still clear. See how sell-side sentiment is now lower than it was after the 2008-2009 sell-off, and it has been falling (for the most part) since the 2009 lows. All the while the market has been basically rallying despite everything that’s been thrown at it since.

The crowd is now at best broadly apprehensive while Wall Street remains extremely defensive.

In short, the Wall of Worry couldn’t be much higher.

Finally, I highlight for you that current levels on sell-side sentiment are closing in on lows seen in the late 1980s and mid-1990s.

The second chart above gives us a feel for the retail sales improvement noted for September.

Beyond the Near-Term Hurdles

There is some more good news about the near-term market chop and this testing period.

It’s these periods in that set the stage for the "relief rally" when everyone finally realises that the world does not and did not end. Yes, dividend players have been roughed up while fretting over interest rates. And I’m pretty confident we’ll find that the fretting will have all been for naught.

The Point?

Long-term investing results have these types of resets throughout history.

They’re required for progress and instead of fretting over them long-term investors they should see them for what they are.

The Wall Street and so-called experts' banter are just pitches in the dirt. Swinging at them makes for a losing effort over the long-term.

We are Paid to be Patient

I stand by what has been stated for a few weeks now; knowing in advance it is never fun, so don't expect much while we dance through the US election event.

It could even get uglier as far too many investors, managers and commentators are likely to also overlook the good in earnings results and focus instead on the bad.

After the election our view remains that surprises are to the upside.

Given the rather poor results most fund managers have seen this year the last few weeks have only made it worse. As such, I have a hunch they will work hard for a solid finish.

That’s while an avalanche of money remains perched in back accounts and bonds.

Long-term investors must focus instead beyond this latest bout of altitude sickness. As your video review link above will show, the markets are generally acting pretty normal given the circumstances.

Be patient and stay focused and on your plan.