A Little Investor Reality Break (Courtesy: History)

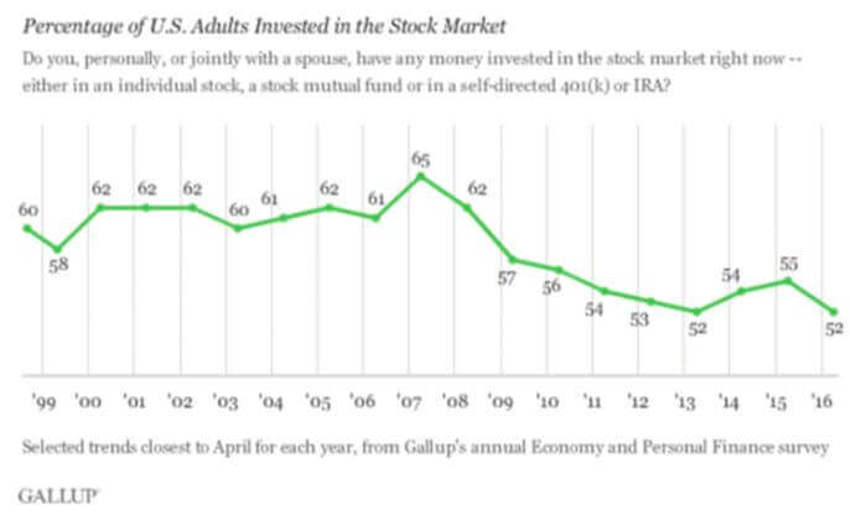

America has reached a new low in the percentage of households investing in the stock market.

And that's good news for long-term investors.

That’s particularly true as we meander towards the worst of the summer haze in August.

In fact, what should be a typically dull (and then suddenly volatile) holiday season, as most folks are sunning themselves away from the Wall Street pumps, we’ve seen two weeks of record setting global market activity.

But that hasn’t changed the negative sentiment one little bit.

It’s more like this now:

"Are you nuts? No way am I investing with prices this high. The correction is coming for sure, and it will be a big one after this run up in prices. I’ll wait and buy the dip."

To which I say, “Uhh, yea, right.”

So here’s is history a bit of history for all of you who might be thinking the same thing.

Think of it like a reality check of sorts:

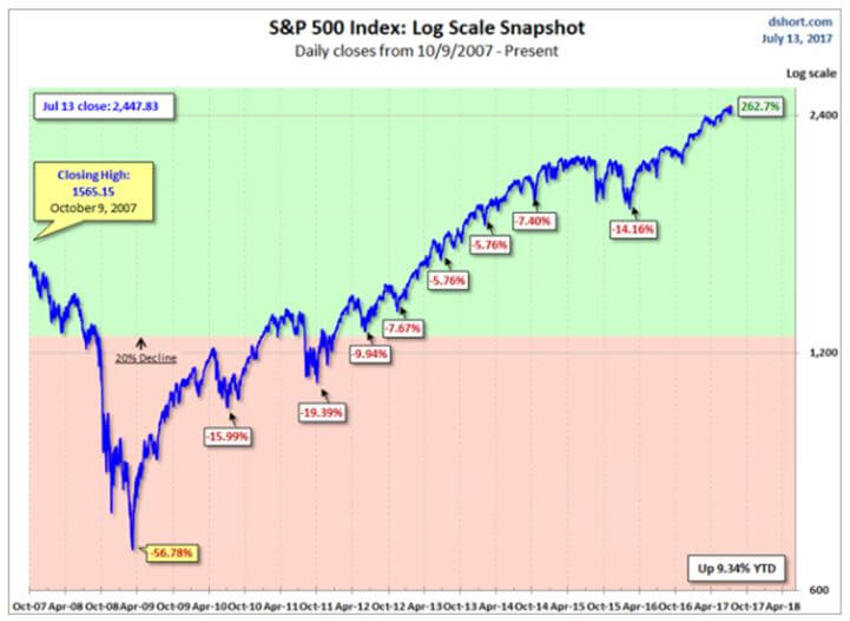

This is a great chart (above) from Doug Short because it shows all the corrections since the catastrophic lows of March 2009.

Notice the upward trend?

Still, despite all evidence to the contrary, there remains a kind of permanent fear model built into everyone’s psyche.

Nowadays we just call it: “Economic uncertainty.”

But if you have a look at the above again you’ll see that all the corrections came and went, and still the record highs arrived – despite all the fear.

Sure, these events all felt very scary at the time, but were they? Really?

Study them. There will be more. The future is always uncertain and now is no different.

Back to Reality

And when that big correction finally does come, the reaction will be the same as it has always been: They said they’ll buy the dip, and most never do.

That’s because those “brave” (Read: Clever) souls are thought to be “ignoring warnings” from indicators like gold and bonds.

The Bottom Line is Simple

The best news of all is that there is still way too much fear and bearishness embedded deeply into the investing audience.

Heck, even raging bulls are cautious, with an itchy trigger finger and plenty of hedging.

(To which I ask, "Hedging away what? Profits?")

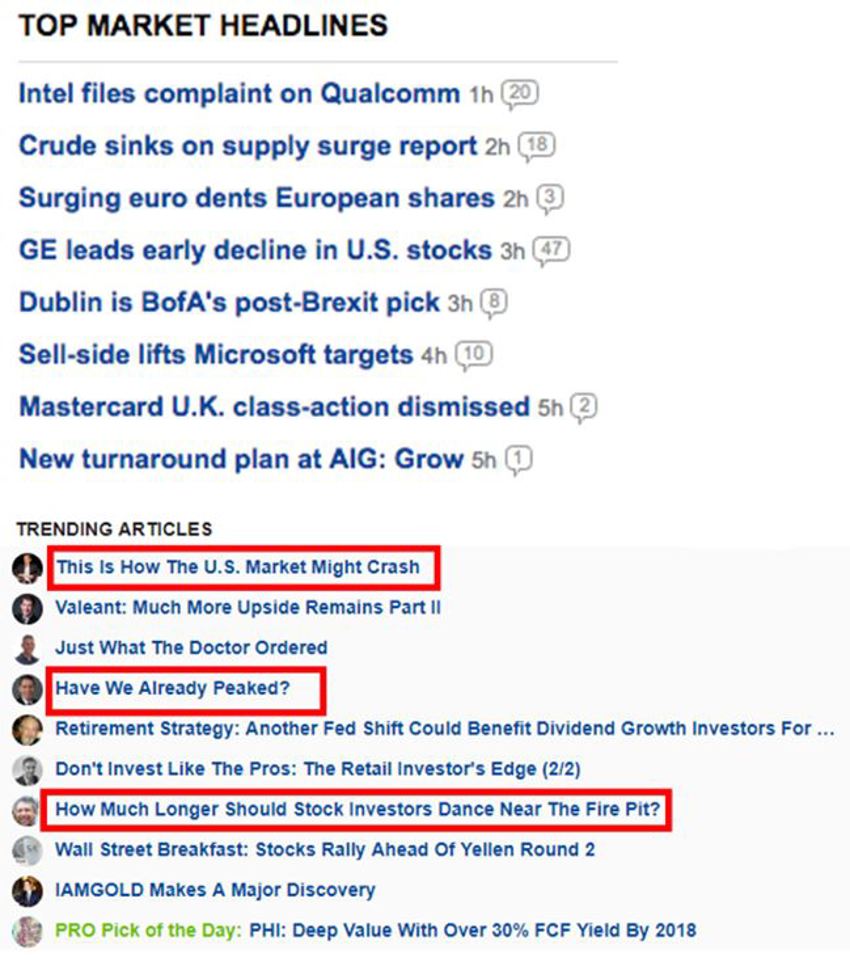

I’ll close with one more snapshot; one I literally took recently.

It’s a picture of the top headlines from a major financial website.

You can look down the list at almost any major site by the way and check the same thing; are they bullish or bearish?

I’m betting you’re going to have to look hard for a top headline about a good thing.

So, now we’re about to enter the last stage of the summer haze in August.

Warning: It's already a thin crowd. It will get thinner. Volume will fall more and choppiness could increase further.

Don't fret.

The Barbell Economy – where the Baby Boomers are handing over the economic reins to the Millennials of Generation Y - is working just fine, thanks, and the good news is that these driving forces are in place for decades to come.

I say bring on the correction that so many are afraid of.

Think demographics, not economics.