A Distinct Lack of Any Market Euphoria

Forward earnings continue to notch new highs.

Now, obviously the press coverage of the Dow Jones has been highlighted.

But keep in mind that more than a few of these record highs have been around 14, 11, 21 and 9 points up.

And those figures measured against a base of over 20,000 makes these almost non-events.

So there are two thoughts to keep in mind about the "altitude sickness" many investors are suffering just now:

1) Pray for a correction

2) It remains our view that the game has just begun

A couple of points to note: In recent days in America we have seen four of the Federal districts report on their manufacturing activity for February (New York, Philadelphia, Kansas City, and Dallas), and all of them are showing solid rises in economic activity.

In fact, the composite average shot up from 15.3 to 25.1 in the latest data set, and it now stands in positive territory for the sixth straight month!

More Importantly…

The data is now at its highest readings collectively since December 2004.

This continues to support what we have often referenced here: That the setbacks in the energy sector were clouding the true improvements happening beneath that cloud of market angst for most of the last 18 months.

Inside the data we can see some even better things. The new orders index (22.3 from 16.2) accelerated for the seventh consecutive month, reaching its fastest pace since June 2006.

Meanwhile, Who Snuffed Out the Bulls?

With twelve straight record closes for the Dow Jones now (at the time of writing), what continues to be of fantastic benefit are sentiment levels. In short, there’s a distinct lack of any celebration going on.

And this is resoundingly positive news for long-term investors.

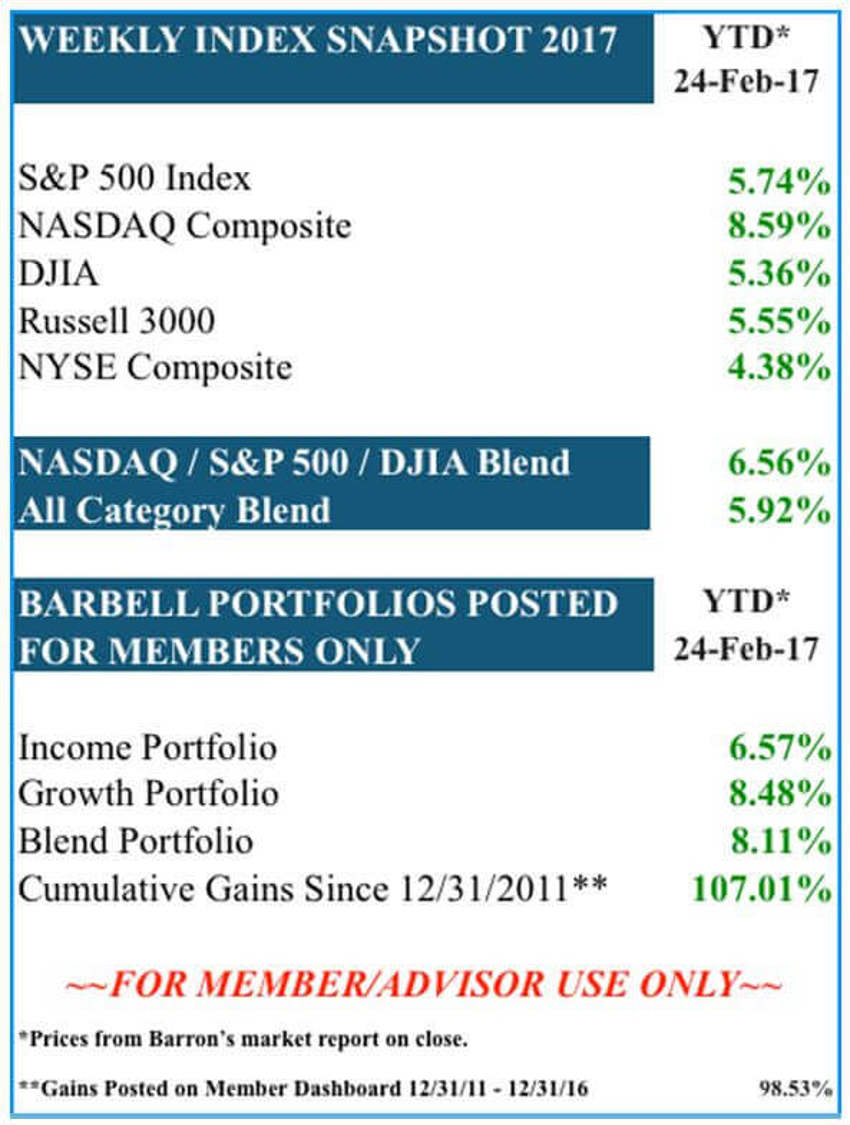

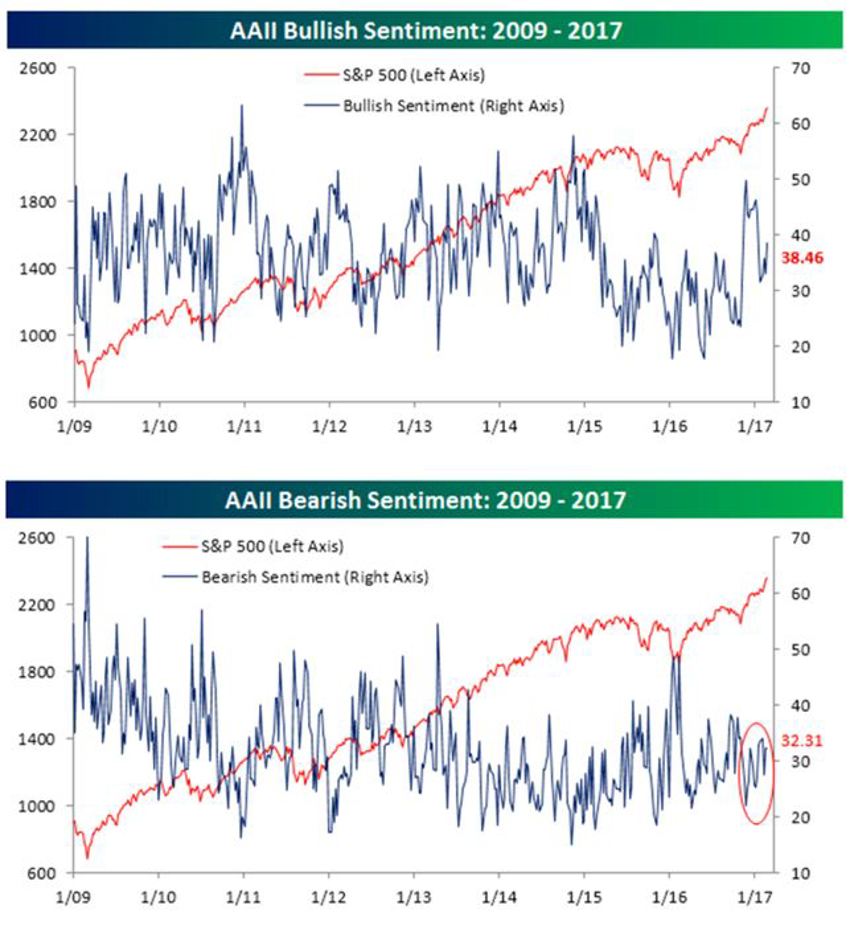

Note the two charts below. The latest market sentiment readings from the American Association of Individual Investors (AAII) show bullish sentiment rose by 5.4 percentage points to the ridiculously poor level of 38.46%.

This is the sixth straight week that bullish sentiment has come in below 40%. In fact, it’s set another record here as the 112th straight week where bullish sentiment is below 50%.

Is this overzealous? Misguided?

Well, just remember that there are still $9 Trillion reasons sitting in personal bank accounts to remind us what will happen once the investor herd tires of losing money or making very little on their investments, and euphoria finally comes back to town.

The second chart below shows that, beneath all of the noise out there, bearishness has actually been rising.

Now just wait until we get a week or two of stock market chop and setbacks, then grab some popcorn and watch how quickly the bulls run away to bearish country.

So Many Problems - So Little Time

So the problem is that too many investors, bearing the scars of 2008/09 (and some even those from 2000/02, are just waiting for the next shoe to drop.

Once again, tor those positive about the long-term future, this is a good thing. It opens up value opportunities when the herd bolts for the barn at the next sign of trouble.

Remember

Corrective action is a necessary and healthy part of market history.

And investors often glaze over when you mention this or that all-time high, by saying: “Yes, but look how high up we are and how far down we could fall…"

In fact, I used to hear that same line repeatedly back in the early 1980s, when the Dow Jones was at just 1,080.

Time may heal, but risk remains as the underlying reason any overall gain is available to the investor.

Trucks and Tonnage

Though it may be clear from the data above about manufacturing activity, more trucking shows tonnage movement at all-time highs.

And while this might support the latest Dow Jones buying signal theory, what’s happening is actually quite simple. American Trucking Association index data shows the amount of tonnage hauled around the U.S. economy by our massive fleet of trucks.

The bottom line here is that the economy is moving more goods today than ever before, and companies are worth more than ever before. This is not something to fear. Yet sometimes it’s the large numbers showing improvement that create panic based on now having more to lose.

In perspective, this is another good sign for long-term, patient and disciplined investors.

As Always - Think Demographics, Not Economics

Sure, sentiment has improved a tiny bit. But my hunch remains that these gains are paltry and weak, and that there is a caldera of fear just under the surface.

Give us all a two-week stock correction and I will show you a crowd of investors as afraid again as they were back in March of 2009.

This new demographic wave and "baton shift" of power has just begun between the Baby Boomers and the Millennials of Generation Y.

As much as it feels like we are in the late innings of this secular bull, as experts suggest, our view remains that the first batter is just stepping out of the batter's box and walking to the plate.