A Cure for Stock Market Altitude Sickness

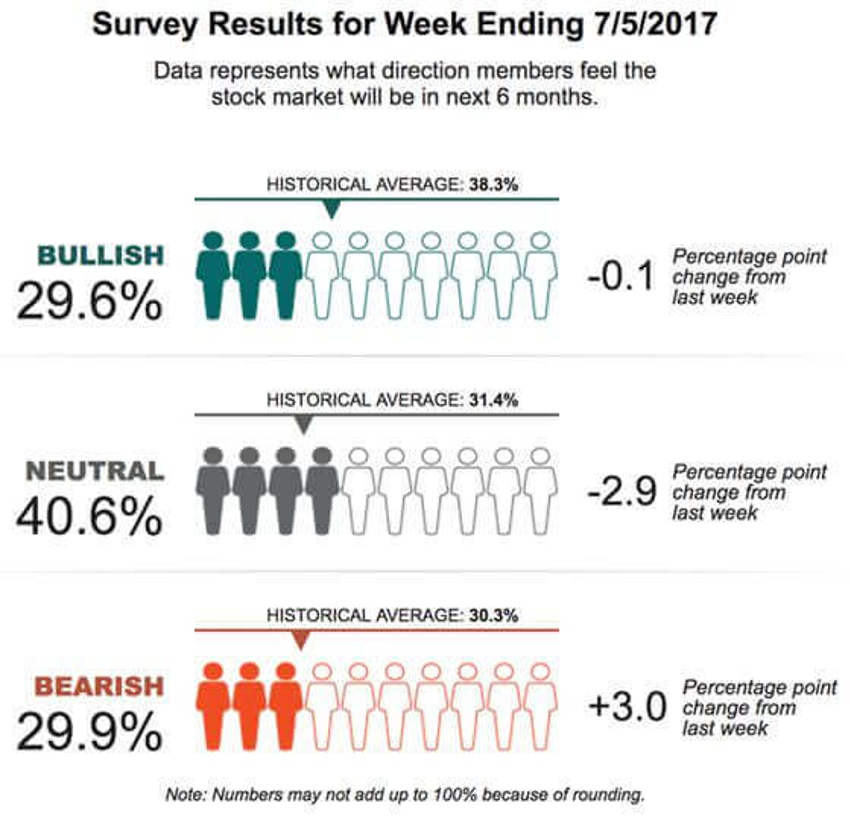

Have a look at the latest American Association of Individual Investors (AAII) stats from last week (below).

It shows the bears out there once again outnumber the bulls.

In fact, that level of negative investor sentiment has continued for a record 131 weeks, even as major indexes like the Dow Jones have ticked up thousands of points.

As suspected, that high number of neutral readings is now beginning to bleed off into the bear’s camp.

And if the summer stock market chop and churn continues, as is normal for this time of year, we should see that bear count rise even further.

That’s a good thing for long-term investors, as any media coverage that sounds like, "So, Jim is this finally the beginning of the summer swoon so many expect?" tends to uncork more negativity, more panic selling and more value opportunities.

That’s because as the markets continue to rise, investors are suffering more and more from a sort of altitude sickness. And that feeling grows as it seeps into the collective psyche of average investors – it’s so reminiscent to me of the early 1980s that it makes the hair on the back of my neck stand up; as if I were watching a replay of the confusion back then.

So how do you avoid that sickening feeling of light-headedness?

Folks, you need to focus on people – the growth of the Millennials as they take over the economic baton from the Baby Boomers, and all of the incredible changes that they are beginning to make on the world.

Meanwhile....

Fret if you will about US politics, but things are continuing to improve on several fronts.

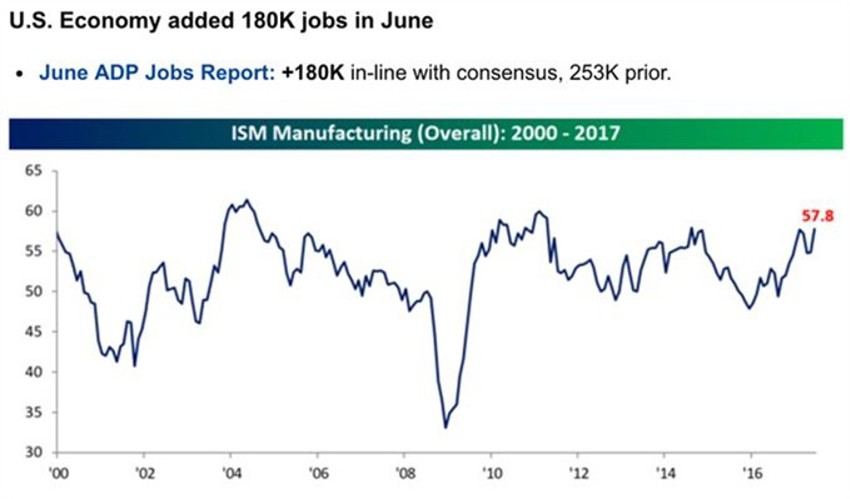

- American jobs are solid (see ADP)

- Manufacturing ISM is closing in on a 6-year high (see chart)

- Retail sales saw weekly gains of 2.7% on last Wednesday's data release (even better than the previous week) - and summer vacations are in full swing.

Even More?

Sure, the headline ISM index data was strong.

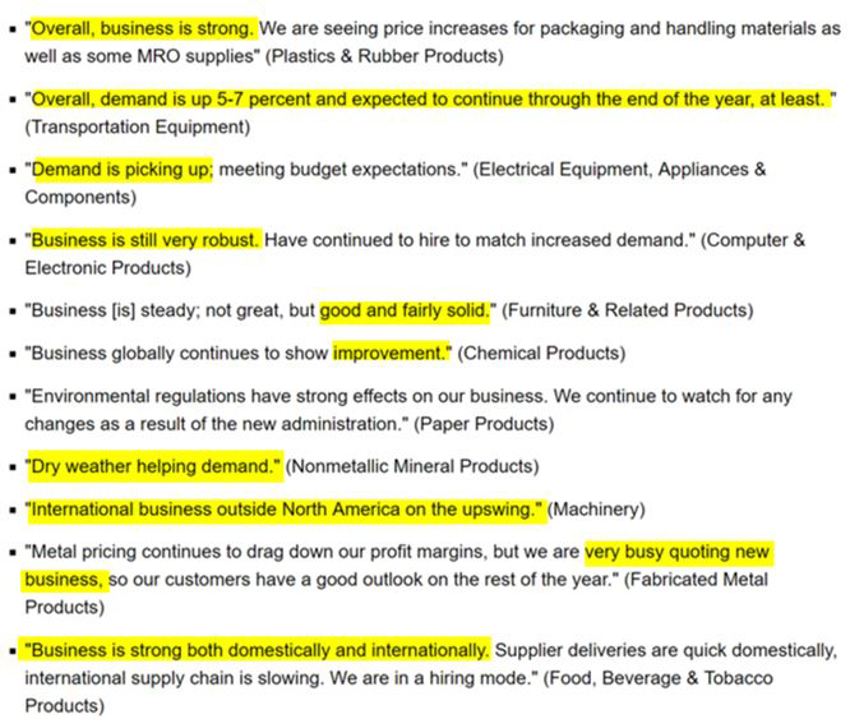

But the commentary that accompanied it, and that most never see or review, paints a picture of even more robust activity.

I’ve included a snapshot of some of that assessment from this month's report.

You can see that with the exception of the comment concerning environmental regulations, every other one suggests steady, solid, and or strong business activity. This tends to be a positive sign when we look at the months and quarters ahead.

Next?

Ok, I know I sound like a broken record at times, but it’s now summer. It's boring.

And there is a huge reach out there amongst the media at this time of year to make something out of what is often nothing.

But don't fret.

The scribblers will make much of the US Fed, Trump, North Korea (which is a China manufactured event), interest rates, upcoming earnings reports (which should be just fine) and anything else that might work to scare you a bit.

Long-term investors must look beyond all that and focus on the real driving forces of the economy.

The data makes it clear: There are significant growth waves ahead.

And they will surprise most investors, just as they did in the 1980s and 1990s.

That’s because lots and lots of people are becoming adults (Millennials).

And while we can disagree and worry about how others interpret that data, and get caught up in the minute-by-minute headlines, the Barbell Economy continues to do as it should - provide a solid cushion for investors to ride through the mess of the day-to-day hype.

Our focus remains the same; pray for a summer market swoon, and think demographics not economics.

We are in far better shape than the vast majority of investors realise.